November 9, 2022

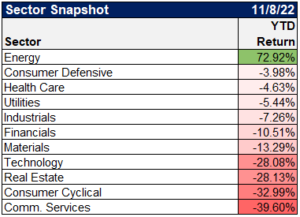

Market Performance (YTD)

Source: YCharts

Disclaimer: Past performance is no guarantee of future performance

How much did markets dislike Powell's presser today? It was the worst last 90 minutes of a Fed Day for the S&P (-3.2%) since 1994 (when the Fed began announcing policy decisions on the day of the meeting).

Read our full analysis in tonight's Closer: https://t.co/MKhmUCp8DC pic.twitter.com/H5uouP2yqz

— Bespoke (@bespokeinvest) November 2, 2022

And I see why. The Fed added this entire section to its statement basically justifying a slowdown in rate increases. Yay stocks!!! pic.twitter.com/h4BSk2IYSZ

— Dion Rabouin 🇺🇸 (@DionRabouin) November 2, 2022

Chair Powell takeaways:

– Big rate increases could slow in Dec or shortly after

– But rates will go higher than prior forecast

– And stay there

– His message was blunt: "I would want people to understand our commitment to getting this done."

– Upshot: This was not a pivot.— Jeanna Smialek (@jeannasmialek) November 2, 2022

Fascinating moment in the presser. A journalist wrongly misleads Powell into thinking the market was still rallying and we're all getting real time insight into what he thinks about that… He's leaning hard against it.

— Jonathan Ferro (@FerroTV) November 2, 2022

The economy gained a surprisingly strong 261,000 new jobs in October, underscoring the persistent strength of a labor market that the Federal Reserve worries will exacerbate high inflation. https://t.co/a7r8QWLhns pic.twitter.com/uFrtXHzOcb

— MarketWatch Economy (@MKTWeconomics) November 4, 2022

JUST IN: The US economy added 261k jobs in October, higher than expected.

Stay tuned for analysis from @jasonfurman. pic.twitter.com/4YB7R5Cmht

— Peterson Institute (@PIIE) November 4, 2022

On a year-over-year basis, average hourly earnings growth has cooled markedly — up 4.7% in October, vs 5.6% in March. A lot of that slowdown came earlier this year, however — more recently, growth has been bouncing along at an annual rate of around 4%. pic.twitter.com/nkqLOGhxm0

— Ben Casselman (@bencasselman) November 4, 2022

“.. eight of 10 chief human resources officer said they’re cutting or freezing hiring,” says a @PwCUS survey.

(via @business @JohnSpall247) #NFP pic.twitter.com/Mfv0KV8tgJ

— Carl Quintanilla (@carlquintanilla) November 2, 2022

Layoffs announced in the last day:

– Lyft 13% of workers

– Opendoor 18%

– Stripe 14%

– Chime 12%

– Twitter 50%

– Morgan Stanley (% unknown)— Genevieve Roch-Decter, CFA (@GRDecter) November 3, 2022

Here are the updated 3Q22 through 2Q23 S&P 500 EPS growth expectations w/ and w/out the Energy sector.

1H23 EPS growth ests are clearly negative and going lower.

$SPY $XLE pic.twitter.com/8z9ULs7MG7— The Earnings Scout (@EarningsScout) November 8, 2022

U.S. #municipal #bonds are yielding the most in over 10 yrs. at 4.18%. Using the highest federal tax bracket of 37%, the tax equivalent yield is ~7%.

To find a ~7% yield right now, you would be looking at BBB/BB corporates bonds.

High quality bond #income 👍 @Factset pic.twitter.com/nL5ny2IdkC

— Matthew Miskin, CFA (@matthew_miskin) November 7, 2022

Miss one or the other but not both: pic.twitter.com/3srpke6Syl

— The Transcript (@TheTranscript_) November 7, 2022

Disclosure

Clear Rock Advisors, LLC is registered with the SEC as a registered investment advisor with offices in Texas. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy (including the investments and/or investment strategies recommended and/or undertaken by Clear Rock Advisors, LLC) or any investment-related or financial planning consulting services will be profitable, equal any corresponding indicated historical performance level(s), or prove successful. It remains the client’s responsibility to advise Clear Rock Advisors, LLC, in writing, if there are any changes in the client’s personal/financial situation or investment objectives for the purpose of reviewing, evaluating or revising Clear Rock Advisors, LLC’s previous recommendations and/or services, or if the client would like to impose, add to, or modify any reasonable restrictions to Clear Rock Advisors, LLC’s services. A copy of Clear Rock Advisors, LLC’s current written disclosure statement discussing its advisory services and fees are available upon request.