Diversified Portfolios

The biggest market challenge today is extremely low interest rates that have persisted for the better part of a decade. These low rates have pushed bond and stock prices higher over the past few years resulting in lower expected returns going forward. Bond holders are watching their high coupon bonds issued 10+ years ago mature. New bonds entering portfolios generate a fraction of the income, creating stress on cash flow and retirement planning. Stock prices have also been affected by low interest rates as investors have shifted away from bonds toward stocks, pushing their valuations to the high end of their historical range.

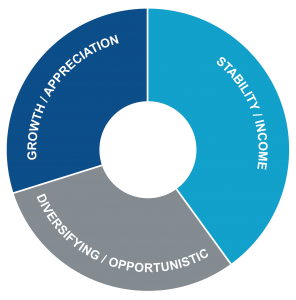

The need for diversification in this environment is more important than ever and something we take very seriously at Clear Rock. Naively investing in what worked in the past is unlikely to generate similar returns in the future. At Clear Rock, portfolios are balanced by investments that fit in three categories: (1) stability and income, (2) growth and appreciation, and (3) diversifying and opportunistic. This approach is similar to those used at endowments, but with a focus on tax efficiency and liquidity.

Stability / Income

This portion of the portfolio is designed to deliver stable value and attractive income primarily through municipal and high-grade bonds. Higher yielding segments of the fixed income market may be included, such as US corporate high yield, bank loans, and non-US debt, when risk/return ratios are attractive.

Growth / Appreciation

Exposure to equity investments offers the potential for capital appreciation far above inflation over long time periods, although at higher risk. Our focus is on strategies that can deliver superior, risk-adjusted returns over market cycles and may include large, mid and small cap as well as US, international, and emerging markets stock portfolios.

Diversifying / Opportunistic

Investments in this category seek to deliver alternative sources of return and lower correlation to traditional long-only stock and bond portfolios. We may use a combination of multi-strategy, equity long short, and other investments that are held through both mutual funds, ETF’s, and L.P.’s.

Despite today’s difficult environment, we see many compelling investment opportunities in each of these three categories – and most importantly – believe our goal of protecting our clients’ wealth, capturing opportunities, and providing attractive risk-adjusted returns after inflation, taxes, and fees is achievable.