November 1, 2022

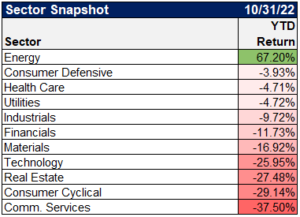

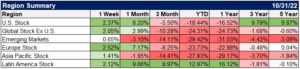

Market Performance (YTD)

Source: YCharts

Disclaimer: Past performance is no guarantee of future performance

52% of SPX cos have reported Q3 results @FactSet:

71% EPS beat rate

68% rev beat rate

Blended earnings growth: +2.2%, lowest since 3Q20

2:1 negative:positive guidance (28 to 14)Ex-Energy, SPX reporting a -5.1% EPS growth rate pic.twitter.com/HPZGnrfW5u

— Mike Zaccardi, CFA, CMT (@MikeZaccardi) October 28, 2022

We are halfway through the earnings season with 52% of the companies in the S&P 500 having reported calendar Q3 results.@DataTrekMB, using @FactSet data, gives us a snapshot of how the earnings season is going: pic.twitter.com/llu817OTXy

— The Transcript (@TheTranscript_) October 31, 2022

Pretty amazing that the mega-caps averaged a one-day decline of 8.99% on their earnings reaction days this season yet $SPY is up 6.75% since earnings season began on 10/10.https://t.co/FAnaUZGmvc pic.twitter.com/1WmBkKbpzN

— Bespoke (@bespokeinvest) October 31, 2022

Earnings "misses are getting punished, underperforming the S&P 500 by 667bps the next day, the largest in history" -bofa pic.twitter.com/xhlWcr7Uiv

— Gunjan Banerji (@GunjanJS) October 31, 2022

INFLATION WATCH: U.S. inflation rises 0.3% in September, PCE shows. Matches Wall Street forecast. Increase in past 12 months unchanged at 6.2%. Core CPI rises 0.5%, pushing yearly increase to 5.1%. Inflation coming off a boil, but still running hot.

— MarketWatch Economy (@MKTWeconomics) October 28, 2022

Lots of measures telling roughly the same story of 5% underlying inflation. pic.twitter.com/DHmPKDPO7l

— Jason Furman (@jasonfurman) October 28, 2022

Excluding incentive-paid occupations quarterly wage growth sits at 5% annualized (not seasonally adjusted) and year-on-year growth is still 5.5%. pic.twitter.com/mw9PAVhfna

— Joey Politano 🏳️🌈 (@JosephPolitano) October 28, 2022

Job openings edged back up in September, which isn't a big surprise given the huge drop in August. (Aug. also revised up, but only slightly.)

Basic story seems unchanged: Openings are falling, but from a *very* high level. pic.twitter.com/uy3ZfkrH4H— Ben Casselman (@bencasselman) November 1, 2022

Employment Cost Index vs. Quits Rate: pic.twitter.com/kOGKohZqq0

— Michael McDonough (@M_McDonough) October 28, 2022

That also means people are saving less–the savings rate hit 3.1% in Sep. Lowest since the 2005-2008 period and one of the lowest readings since 1959. pic.twitter.com/8hxBV5Y5gL

— Liz Young (@LizYoungStrat) October 28, 2022

“.. People are still drawing down their excess pandemic savings – by about $90B in September – but they still have some $1.3T left.”

– @PantheonMacro pic.twitter.com/TGeeLdCXYw

— Carl Quintanilla (@carlquintanilla) October 28, 2022

Luckily, very little debt is set to mature (and possibly be refinanced) in Q4 ($1.3bn) & 2023 ($10bn) while rates are at this level. The bigger maturity walls start in 2025 and 2026. pic.twitter.com/tvyebPHLYl

— Liz Young (@LizYoungStrat) October 31, 2022

Just the fifth double-digit m/m decline in Pending Home Sales since 2001:

November 2009: -13.25%

May 2010: -30.35%

March 2020: -18.79%

April 2020: -21.49%

September 2022: -10.17%— Bespoke (@bespokeinvest) October 28, 2022

From @ApartmentList: “this October’s record-setting decline marks a rapid cooldown which may signal that we’re entering a new phase of the rental market rollercoaster” https://t.co/rBRUvhapfJ pic.twitter.com/4CAV31Prfd

— Conor Sen (@conorsen) October 31, 2022

Rent delinquency rates among US small businesses increased significantly this month. About 37% of small businesses, which between them employ almost half of all Americans working in the private sector, were unable to pay their rent in full in Oct.: report https://t.co/jSS5RMnea5.

— Lisa Abramowicz (@lisaabramowicz1) October 31, 2022

Energy is the biggest driver of Euro inflation at +41.9%% YoY: https://t.co/PtbBHpA94P pic.twitter.com/aTj7syGvTB

— The Transcript (@TheTranscript_) October 31, 2022

Are equities attractive now? If you adjust stocks for the rise in interest rates, developed market equity prices are now higher (!) than at the beginning of the year. Earnings estimates have on aggregate not adjusted. Makes zero sense imo.

Chart: Bridgewater (h/t @momchev12) pic.twitter.com/7SSHputWSn

— Patrick Saner (@patrick_saner) October 31, 2022

MSCI China has delivered a 0% return in the nearly 30 years since inception

Oh my word pic.twitter.com/2lU5i0PUr8

— Duncan Lamont (@DuncanLamont2) October 28, 2022

At 13.6%, this would be the 12th biggest monthly gain for the Dow since 1915 and its best since January 1987. The index needs another 240 points to eclipse Jan. '87, Jan. '75, and Jan. '76 and move up to the #9 spot, which would be the biggest monthly gain since June 1938. pic.twitter.com/wnidDA3pny

— Bespoke (@bespokeinvest) October 28, 2022

Disclosure

Clear Rock Advisors, LLC is registered with the SEC as a registered investment advisor with offices in Texas. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy (including the investments and/or investment strategies recommended and/or undertaken by Clear Rock Advisors, LLC) or any investment-related or financial planning consulting services will be profitable, equal any corresponding indicated historical performance level(s), or prove successful. It remains the client’s responsibility to advise Clear Rock Advisors, LLC, in writing, if there are any changes in the client’s personal/financial situation or investment objectives for the purpose of reviewing, evaluating or revising Clear Rock Advisors, LLC’s previous recommendations and/or services, or if the client would like to impose, add to, or modify any reasonable restrictions to Clear Rock Advisors, LLC’s services. A copy of Clear Rock Advisors, LLC’s current written disclosure statement discussing its advisory services and fees are available upon request.