January 18, 2023

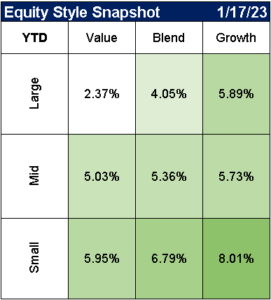

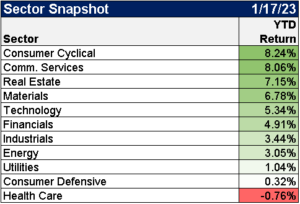

Market Performance (YTD)

Source: YCharts

Disclaimer: Past performance is no guarantee of future performance

World Bank Cuts 2023 Forecasts and Warns of Global Recession https://t.co/1fFuyva5LH pic.twitter.com/gzCkrX0NAX

— Gregory Daco (@GregDaco) January 10, 2023

Year-on-year CPI inflation in the US is now fundamentally a story of two categories—Food and Core Services (which includes housing)

The year-on-year contribution from energy and core goods is rapidly dwindling and likely to turn negative soon. pic.twitter.com/2EVbKt8SuT

— Joey Politano 🏳️🌈 (@JosephPolitano) January 12, 2023

All 3 months have featured the 3 things that Powell has said he wanted – goods in deflation, housing leveled off, and the rest of core services disinflating. Across the board good news.

Now comes what the hawks will argue: that this level is still too high for 2% inflation. /3 pic.twitter.com/Dyj5GVj76c

— Mike Konczal (@mtkonczal) January 12, 2023

Here is the crucial "Core Services ex-Shelter CPI YOY" measure https://t.co/kEku1fYIR7 via @M_McDonough pic.twitter.com/huJhfJRqTj

— Joe Weisenthal (@TheStalwart) January 12, 2023

December CPI, three month annualized rates:

Core goods: -4.8%

Shelter: +9.2%

Services less shelter: 1.2% pic.twitter.com/A8FQeRATjH— Nick Timiraos (@NickTimiraos) January 12, 2023

US headline CPI is back below 7% YoY for the first time since November 2021. Today's -0.1% MoM print pulled the YoY number down to 6.45%. Unless MoM prints above 0.5% for the next couple months, YoY CPI is projected to be below the Fed Funds Rate when March CPI is released. pic.twitter.com/Fro2SYk5Th

— Bespoke (@bespokeinvest) January 12, 2023

Can wage inflation come down without unemployment going up? pic.twitter.com/gsmsB0atki

— Nick Reece (@nicholastreece) January 13, 2023

Q4 earnings season kicks off tomorrow!

In terms of '23 outlook, bottom-up analyst estimates looking for #SPX500 EPS flat in 1H & then a boom in 2H, for +4.8% overall. Interesting, cyclical sectors forecasted to see the highest earnings growth. 🤔#Recession not consensus here. pic.twitter.com/auOJCTF4ry

— Matthew Miskin, CFA (@matthew_miskin) January 12, 2023

Earnings season is around the corner, and much is riding on it in terms of stock-market momentum. So far, all the incoming waves of estimates are heading lower. pic.twitter.com/vOnB4R3sFC

— Jurrien Timmer (@TimmerFidelity) January 12, 2023

Expectations for global EPS growth in 2023 have declined significantly from 16 weeks ago — and the trend doesn't appear to be reversing anytime soon. pic.twitter.com/JrJCGQXC5P

— Gina Martin Adams (@GinaMartinAdams) January 17, 2023

‘EPS appears to be far above its long-term trend, and due to revert down toward the mean. This chart from the Bloomberg terminal shows that any sensible trend line suggests that recent earnings are unsustainable.’ https://t.co/HSOYm6ml7y by @johnauthers pic.twitter.com/k7OCBkMvA5

— Jesse Felder (@jessefelder) January 10, 2023

"Asset allocators are the most underweight US stocks since Oct 2005" – BofA pic.twitter.com/Ej2lbwLCJp

— Sam Ro 📈 (@SamRo) January 17, 2023

Recession Watch Update:

87% of yield curves are now inverted pic.twitter.com/8H9K065jdA— Jeffrey Kleintop (@JeffreyKleintop) January 16, 2023

APOLLO: “.. households across the income distribution continue to have a higher level of cash available than before the pandemic, and the speed with which households are running down their cash balances in recent quarters has been very slow. .. a powerful tailwind in place ..” pic.twitter.com/YpNcbi9N8G

— Carl Quintanilla (@carlquintanilla) January 13, 2023

2022 was a record year for earnings call swearinghttps://t.co/gWyx89YOiJ pic.twitter.com/qTtNt8HTBT

— Jim Bianco biancoresearch.eth (@biancoresearch) January 13, 2023

⚠️@NewYorkFed Empire State Manufacturing Survey:

▶️General business conditions -22pts to -32.9 (worst since pandemic)

▶️New orders & shipments declined substantially

▶️Employment growth stalled

▶️Input price increases slowed considerably

▶️Firms expect little improvement over 6mo pic.twitter.com/E5vjvajTse— Gregory Daco (@GregDaco) January 17, 2023

Disclosure

Clear Rock Advisors, LLC is registered with the SEC as a registered investment advisor with offices in Texas. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy (including the investments and/or investment strategies recommended and/or undertaken by Clear Rock Advisors, LLC) or any investment-related or financial planning consulting services will be profitable, equal any corresponding indicated historical performance level(s), or prove successful. It remains the client’s responsibility to advise Clear Rock Advisors, LLC, in writing, if there are any changes in the client’s personal/financial situation or investment objectives for the purpose of reviewing, evaluating or revising Clear Rock Advisors, LLC’s previous recommendations and/or services, or if the client would like to impose, add to, or modify any reasonable restrictions to Clear Rock Advisors, LLC’s services. A copy of Clear Rock Advisors, LLC’s current written disclosure statement discussing its advisory services and fees are available upon request.