December 28, 2022

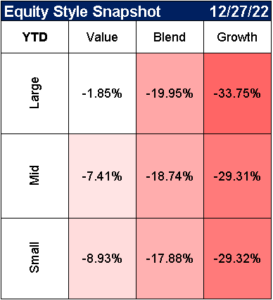

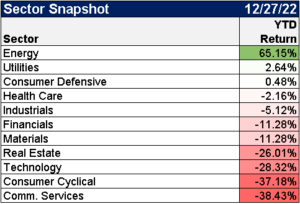

Market Performance (YTD)

Source: YCharts

Disclaimer: Past performance is no guarantee of future performance

#Stocks tend to bottom when leading economic indicators (LEI) bottom.

The @Conferenceboard LEI -4.46% YoY in November, at the current trend they have 6 months before hitting past troughs of -10%. Of course trends can change & '08 was worse than -10% YoY.@Factset @MichaelKantro pic.twitter.com/75Ajf0cEsx

— Matthew Miskin, CFA (@matthew_miskin) December 22, 2022

PCE inflation figures continue to show deceleration. With mo/mo numbers slowing, the overall trajectory is lower. pic.twitter.com/L33h8W0diC

— Kathy Jones (@KathyJones) December 23, 2022

We can break PCE inflation into the three categories that Powell and other Fed officials are watching: goods in deflation, housing peaked, and the rest of services slowing. We see all; notably in services, which has a much different balance of items than CPI. /3 pic.twitter.com/sm7aWodoEn

— Mike Konczal (@mtkonczal) December 23, 2022

This looks very different in nominal dollars, of course. Goods spending is still WAY above trend in nominal terms. pic.twitter.com/5nlyOT0Mxu

— Ben Casselman (@bencasselman) December 23, 2022

Significant HH stat dump this morning suggests continued moderate demand and disinflation for Oct & Nov.

– wages and salaries at 6-7pct ann nominal.

– spending at 6pct ann nominal.

– PCE deflator ex food energy at 2-3pct ann— Bob Elliott (@BobEUnlimited) December 23, 2022

Reposting with a better image of the chart. pic.twitter.com/UxIQ6BhYOD

— Kathy Jones (@KathyJones) December 22, 2022

2007, 2008, 2009, and 2022.

^ years that have seen U.S. home prices, as measured by Case-Shiller, decline by +2% in a 4-month window. pic.twitter.com/Sri12FDws8

— Lance Lambert (@NewsLambert) December 27, 2022

Since peaking in June 2022, U.S. home prices have fallen 2.4%. That puts us just below April 2022 levels

IF U.S. home prices fall 10% peak-to-trough, it'd take prices back to Oct. 2021 levels

IF U.S. home prices fall 20% peak-to-trough, it'd take prices back to Feb. 2021 levels pic.twitter.com/uAp9LgHLYV

— Lance Lambert (@NewsLambert) December 27, 2022

20 million households priced out of homeownership in a matter of months. Imagine being a home builder or home flipper intending to sell $400k homes in January. https://t.co/rEtnplLt2Z

— John Burns (@johnburnsjbrec) December 23, 2022

2022: worst year for the western US since… pic.twitter.com/TXm40SkmqM

— Conor Sen (@conorsen) December 27, 2022

The #USD is no longer surging (it was up >15%) but it hasn’t weakened enough to start benefitting earnings. pic.twitter.com/AlbaqLkxou

— Richard Bernstein Advisors (@RBAdvisors) December 22, 2022

Disclosure

Clear Rock Advisors, LLC is registered with the SEC as a registered investment advisor with offices in Texas. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy (including the investments and/or investment strategies recommended and/or undertaken by Clear Rock Advisors, LLC) or any investment-related or financial planning consulting services will be profitable, equal any corresponding indicated historical performance level(s), or prove successful. It remains the client’s responsibility to advise Clear Rock Advisors, LLC, in writing, if there are any changes in the client’s personal/financial situation or investment objectives for the purpose of reviewing, evaluating or revising Clear Rock Advisors, LLC’s previous recommendations and/or services, or if the client would like to impose, add to, or modify any reasonable restrictions to Clear Rock Advisors, LLC’s services. A copy of Clear Rock Advisors, LLC’s current written disclosure statement discussing its advisory services and fees are available upon request.