December 21, 2022

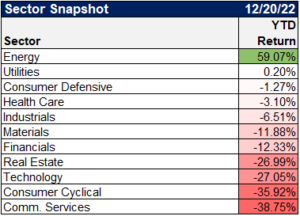

Market Performance (YTD)

Source: YCharts

Disclaimer: Past performance is no guarantee of future performance

Key Fed Takeaways:

– Fed slows rate increase, as expected

– But emphasizes that it will do more to restrain the economy

– Rates to 5.1% next year, up from 4.6% prev forecast

– Unemployment expected to jump (4.6%)

– Growth will pull back sharply (0.5%)— Jeanna Smialek (@jeannasmialek) December 14, 2022

Dot plot points to 5.125% median terminal rate!

~ three more hikes to come pic.twitter.com/xVgvsK1Y3w— jeroen blokland (@jsblokland) December 14, 2022

The #Fed is forecasting a growth recession as a necessary evil to bring down #inflation

The rose-colored glasses are coming off with the unemployment rate seen rising to:

▶️3.7% in Q4 2022

▶️4.6% in Q4 2023 (was 4.4%)

▶️4.6% in Q4 2024 (was 4.4%) pic.twitter.com/tRZOZJzv4S— Gregory Daco (@GregDaco) December 14, 2022

Upward revisions to #inflation projections indicate the Fed is worried about inflation persistence

Why?

Higher projections despite more aggressive policy stance & weaker growth.Core PCE:

▶️4.8% in Q4 2022 (was 4.5%)

▶️3.5% in Q4 2023 (was 3.1%)

▶️2.5% in Q4 2024 (was 2.3%) pic.twitter.com/Xu2WCWkQew— Gregory Daco (@GregDaco) December 14, 2022

Weakness was seen in online purchases, building materials and furniture/appliances. pic.twitter.com/EVac903P0f

— Kathy Jones (@KathyJones) December 15, 2022

🇪🇺 Striking features of the new @ecb staff projections:

– recession to relatively short-lived and shallow, with 2023 annual GDP of +0.5% still

– large upward revisions to inflation including core

– 2025 inflation way above target (2.3% headline and 2.4% core!) pic.twitter.com/SSAPnI1LHL— Frederik Ducrozet (@fwred) December 15, 2022

I simply can't remember when Lagarde tried to manage market expectations to a degree she is doing today. https://t.co/rMHBJrNAgR

— Piet Haines Christiansen (@pietphc) December 15, 2022

#ECB terminal rate (measured by fwd ECB depo rate) jumps by 10bps to 2.91% after hawkish guidance following upward revision to inflation. pic.twitter.com/FkgWNz2fVL

— Holger Zschaepitz (@Schuldensuehner) December 15, 2022

Until now, the Bank of Japan has been an outlier among central banks, most of which have rapidly tightened policy.

The BOJ widened its YCC range to allow borrowing costs to rise above the previous limit, surprising expectations of on change at its policy meeting. pic.twitter.com/nbM2uwD9QQ— Jeffrey Kleintop (@JeffreyKleintop) December 20, 2022

Fed model now says recession is inevitable, if we aren’t already in one. pic.twitter.com/xwOcmONWQL

— Gina Martin Adams (@GinaMartinAdams) December 21, 2022

As of this morning the US stock market had lost $11.7 trillion in market cap from its 1/3/22 high. https://t.co/SqrQ8NFukT pic.twitter.com/jeBn3F1vnI

— Bespoke (@bespokeinvest) December 20, 2022

Disclosure

Clear Rock Advisors, LLC is registered with the SEC as a registered investment advisor with offices in Texas. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy (including the investments and/or investment strategies recommended and/or undertaken by Clear Rock Advisors, LLC) or any investment-related or financial planning consulting services will be profitable, equal any corresponding indicated historical performance level(s), or prove successful. It remains the client’s responsibility to advise Clear Rock Advisors, LLC, in writing, if there are any changes in the client’s personal/financial situation or investment objectives for the purpose of reviewing, evaluating or revising Clear Rock Advisors, LLC’s previous recommendations and/or services, or if the client would like to impose, add to, or modify any reasonable restrictions to Clear Rock Advisors, LLC’s services. A copy of Clear Rock Advisors, LLC’s current written disclosure statement discussing its advisory services and fees are available upon request.