February 15, 2022

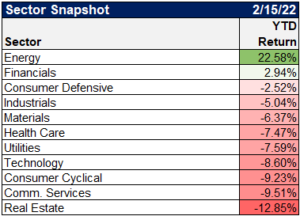

Market Performance (YTD)

Source: YCharts

Disclaimer: Past performance is no guarantee of future performance

What happened over the past week?

GDP forecasts continue to go lower

Forecasts for 1Q22 real GDP growth are getting slashed … @Bloomberg consensus now at +1.65% q/q a.r. (down from nearly +4.5% a couple months ago) pic.twitter.com/2S5bRcvkS5

— Liz Ann Sonders (@LizAnnSonders) February 15, 2022

Earnings are still good, though not as good as the past few quarters

“…the percentage of S&P 500 companies with NTM EPS growth above that of the index has climbed to 56%” – BMO pic.twitter.com/hygp1iUpn4

— Sam Ro 📈 (@SamRo) February 13, 2022

60% of companies beat on both sales and EPS, well above the historical average of 39% pic.twitter.com/SHjjITg8tz

— Mike Zaccardi, CFA, CMT (@MikeZaccardi) February 14, 2022

“Company guidance for the first-quarter earnings season is tumbling, reversing the bullish trend of the previous five quarters and eating away at analyst forecasts:" Bloomberg Intelligence's @GinaMartinAdams @cw_soong pic.twitter.com/VfVJmPo4Yr

— Lisa Abramowicz (@lisaabramowicz1) February 15, 2022

Inflation remains higher than expected and consumer sentiment continues to plunge

'U.S. consumer sentiment declined further in early February to a fresh decade low as views about personal finances deteriorated due to intensifying inflation concerns.' https://t.co/i3giBuA8o0 pic.twitter.com/AoMoCl31TJ

— Jesse Felder (@jessefelder) February 11, 2022

Here’s the break down for the CPI numbers last week

Services and Goods added 2.4% each, Food added 1.0%, and Energy added 1.7%. Inflationary pressure is broad. pic.twitter.com/5q56gaTurT

— Liz Young (@LizYoungStrat) February 10, 2022

The largest sub-components driving U.S. CPI MoM%: {ECAN} pic.twitter.com/EnRjpDIgtN

— Michael McDonough (@M_McDonough) February 10, 2022

And rent continues to be underreported

Shelter is the single biggest component of CPI (33% of Index) and is still being wildly understated (@ +4.4% YoY) with rents up 18% over the last year and home prices up 19%. Actual inflation rate is much higher than 7.5%. pic.twitter.com/aiTq8eDwHf

— Charlie Bilello (@charliebilello) February 10, 2022

(Not) Living the American Dream

“Rental prices for single-family homes grew an average of 7.8% in 2021, an all-time high, according to the most recent data available from CoreLogic Inc. In December, U.S. home rents jumped 12% year over year,” pic.twitter.com/Eju3114jHY

— Danielle DiMartino Booth (@DiMartinoBooth) February 15, 2022

So how are analysts and investors reacting?

… and now nearly 7 hikes by the end of the year pic.twitter.com/9LpcUC16bU

— Liz Ann Sonders (@LizAnnSonders) February 11, 2022

Massive numbers from Mark Cabana of BofA just now on @BloombergTV

-7 hikes this year

-50bps in March possible

-Terminal rate 2.75-3%

-$1trln bs reduction this year

-$1trln bs reduction next year— Jonathan Ferro (@FerroTV) February 11, 2022

"…we are raising our Fed forecast to include seven consecutive 25bp rate hikes at each of the remaining FOMC meetings in 2022.. We continue to expect the FOMC to hike three more times at a gradual once-per-quarter pace in 2023Q1-Q3"

Goldman Sachs moves to seven hikes for 2022

— Jonathan Ferro (@FerroTV) February 11, 2022

“In light of this morning’s CPI data – particularly the nature of the beat showing a broadening of price pressures and acceleration in more persistent services items – we updated our Fed call. We now expect a 50bp move in March and 175bps total for this year”

DB says 50bps

— Jonathan Ferro (@FerroTV) February 10, 2022

“Details of January core CPI point to sustained inflation running around 6% and spreading more broadly… We now expect the Fed to raise rates 50bp in March followed by four 25bp hikes in May, June, September and December (150bp of total hikes in 2022)”

Citi joins the 50bp club

— Jonathan Ferro (@FerroTV) February 10, 2022

"We now expect five 25bp rate hikes this year, including hikes in March, May, and June. We expect a deceleration in inflationary pressures to open the door for a more gradual pace… We expect the hiking cycle to conclude in mid-2023 at a target range of 1.75-2.0%"

Barclays

— Jonathan Ferro (@FerroTV) February 11, 2022

Banks, energy, and materials stocks are the highest allocation in fund managers' portfolios ever!

Interesting to take note of this potential positioning extreme. pic.twitter.com/4Vq5VpdXXS

— Markets & Mayhem (@Mayhem4Markets) February 13, 2022

And how did the bond market react and what might it be telling us?

Massive Bond Move. Red-hot inflation pressures and hawkish Fed rhetoric caused the 2-year Treasury yield to spike 22 basis points yesterday. This marked the largest one-day move in 2-Year Bond yields since 2009! pic.twitter.com/wtgxmU8Sfn

— Larry Adam (@LarryAdamRJ) February 11, 2022

I challenge you to find a more amazing chart than the 2-year Treasury yield over the past two years. pic.twitter.com/PJ4ZTx3g2B

— Brian Chappatta (@BChappatta) February 10, 2022

I know trends may change, but the 2yr/10yr spread has on average been flattening ~10 bps a month since the peak 3/31/21. If this trend continues, with a starting point of ~60 bps now, we are looking at inversion in roughly 6 months. @FactSet chart pic.twitter.com/rZqMLefcaz

— Matthew Miskin, CFA (@matthew_miskin) February 9, 2022

Check this out. Rate cuts now getting priced in as soon as 2024. This is the consequence of front loading hikes. The bond market is now signaling a slowdown/recession may not be far off, perhaps as a result of a policy mistake? Will the Fed overdo it?

H/T @DavidInglesTV pic.twitter.com/4SZXJXALtl

— Kriti Gupta (@KritiGuptaNews) February 11, 2022

Tweets/Charts Of The Week

Today I learned that the iPhone caused chewing gum sales to plummet. People became distracted on their phones in grocery store checkout lines and made fewer impulse purchases. pic.twitter.com/7q90P4kqPm

— Rex Woodbury (@rex_woodbury) February 14, 2022

The only times in the past 40 years when both the Bloomberg US Aggregate Bond Total Return Index and the S&P 500 Total Return Index both showed 5% drawdowns from their 12-month highs:

• June 1994

• Today— SentimenTrader (@sentimentrader) February 11, 2022

It’s true that higher food, energy and rent prices hurt most for those with the lowest incomes. For the Fed to have any effect here, it primarily runs thru constraining their access to labor income. https://t.co/wXACBMCE5R https://t.co/OvtlKH0l8S pic.twitter.com/sbkbndCiz4

— Skanda Amarnath ( Neoliberal Sellout ) (@IrvingSwisher) February 14, 2022

BREAKING: $23.7 million just paid (highest price ever) for this CryptoPunk NFT.

Maybe the Fed should really hike 7 times and do proper QT in 2022. pic.twitter.com/WEC9ngthxr

— Alf (@MacroAlf) February 13, 2022

High inflation is rapidly eroding US wages. pic.twitter.com/qxfATSrDlO

— (((The Daily Shot))) (@SoberLook) February 14, 2022

"Looking at the last eight major rate cycles in the US, we find that the equity market always peaked well after the yield curve inverted (10 months, on average), never before, & was then followed by a recession 4 months later." @Barclays

Add duration when the curve inverts. 😉 pic.twitter.com/5wDbVKZ9a7

— Matthew Miskin, CFA (@matthew_miskin) February 9, 2022

Good chart from IHS Markit on the current economic softening combined with rising prices (which is stagflationary; uncommon over the past few decades).https://t.co/ZCKEb6OC2u pic.twitter.com/uDLk8jKZqv

— Lyn Alden (@LynAldenContact) February 8, 2022

The #Fed is just one of many central banks expected to tighten aggressively this year. Market expectations for global tightening have move up sharply with #inflation. pic.twitter.com/ckr9ZX0rd0

— Kathy Jones (@KathyJones) February 8, 2022

As mortgage rates move up, will the housing market cool off? Housing's share of GDP stood at about 17% in 2021. pic.twitter.com/tBtN9j5t5c

— Kathy Jones (@KathyJones) February 8, 2022

Disclosure

Clear Rock Advisors, LLC is registered with the SEC as a registered investment advisor with offices in Texas. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy (including the investments and/or investment strategies recommended and/or undertaken by Clear Rock Advisors, LLC) or any investment-related or financial planning consulting services will be profitable, equal any corresponding indicated historical performance level(s), or prove successful. It remains the client’s responsibility to advise Clear Rock Advisors, LLC, in writing, if there are any changes in the client’s personal/financial situation or investment objectives for the purpose of reviewing, evaluating or revising Clear Rock Advisors, LLC’s previous recommendations and/or services, or if the client would like to impose, add to, or modify any reasonable restrictions to Clear Rock Advisors, LLC’s services. A copy of Clear Rock Advisors, LLC’s current written disclosure statement discussing its advisory services and fees are available upon request.