March 2, 2022

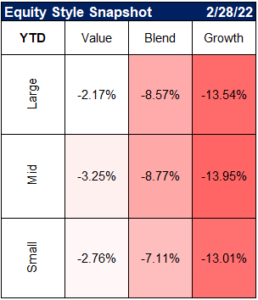

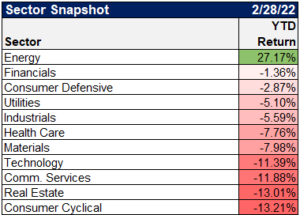

Market Performance (YTD)

Source: YCharts

Disclaimer: Past performance is no guarantee of future performance

What might an optimist say right now?

The economy remains relatively strong

16 #economic releases this morning. Only 3 worse than expected and 10 positively surprised. Not exactly the sign of an imminent #recession. pic.twitter.com/fYKUhLffrf

— Richard Bernstein (@RBAdvisors) February 25, 2022

With 92% of companies reported, S&P 500 earnings are on pace to hit a record high for the 4th consecutive quarter.

GAAP EPS are up 63% year-over-year and Operating EPS are up 41%.$SPX pic.twitter.com/lXYS36w0ag

— Charlie Bilello (@charliebilello) February 28, 2022

Jobless #Claims (LEADING indicator) improve. Absolutely no sign of pending #recession here. pic.twitter.com/N9IWwruq5z

— Richard Bernstein (@RBAdvisors) February 24, 2022

Bearish sentiment may have reached its bottom

We’re getting close to something big…

Bears have been in control but the balance of power could be shifting.

Sentiment is very bearish.

II Bull-Bear lowest since April 2020.

Historically, these kind of extremes have resulted in strong rallies.

Stay nimble, stay open minded. pic.twitter.com/dfp9mAJ27D

— Julien Bittel, CFA (@BittelJulien) February 23, 2022

What Could Go Right? That was the title of our report this morning. It's been purely a P/E-led sell off due to fear of rates, the Fed, oil, and slower growth. Any one or more of these issues needs to ease for stocks to begin to recover. Too soon to know if today was the "low." pic.twitter.com/DJ3L0RLxQ5

— Michael Kantrowitz, CFA (@MichaelKantro) February 24, 2022

Only 19% of S&P 500 Tech members trading above their 200d moving average … lowest since 2020 bear market pic.twitter.com/psKdhPjYeD

— Liz Ann Sonders (@LizAnnSonders) February 24, 2022

“.. the decline for the Nasdaq is now close to the average decline of 19.5% seen for all Nasdaq corrections in its history going back to 1970.” – @bespokeinvest pic.twitter.com/3gPJ58n0Hn

— Carl Quintanilla (@carlquintanilla) February 24, 2022

Sentiment washout still upon us? Number of @AAIISentiment bulls has fallen to lowest since summer 2016 pic.twitter.com/Ncdt0llt2L

— Liz Ann Sonders (@LizAnnSonders) February 18, 2022

"This is the 25th pullback of more than 5% that we have seen since the March 2009 low… once stocks found their low, the average rebound over the next five months was 19.8%.” @TruistNews pic.twitter.com/791r2ZNkG3

— Sam Ro 📈 (@SamRo) March 1, 2022

War Impacts Stocks Less than You Think https://t.co/iufaGcRrtH pic.twitter.com/ftJdZoJVK9

— Barry Ritholtz (@ritholtz) March 2, 2022

And valuations have come down

S&P Index Forward PEs

Large Caps 19.1

Mid Caps 14.5

Small Caps 13.7 pic.twitter.com/KtTmMQM0w6— Mike Zaccardi, CFA, CMT (@MikeZaccardi) March 1, 2022

Global valuations pretty decent pic.twitter.com/ItnXwRpxgB

— Mike Zaccardi, CFA, CMT (@MikeZaccardi) March 1, 2022

And global conflict is expected to make the fed less hawkish than already priced in

Fed's meeting in 15 days. Market expectations around the size of the coming hike have dropped and are currently BELOW a full 25-bps move. pic.twitter.com/X5bOvfpvtq

— David Ingles (@DavidInglesTV) March 1, 2022

Rates traders are now pricing in less than five rate hikes this year, from about seven just days ago. pic.twitter.com/SNgPM5VV60

— Lisa Abramowicz (@lisaabramowicz1) March 1, 2022

There have been 5 first hikes since 1990 and each one started with a 25bps hike.

Not to mention overall stock returns after that first hike historically did quite well. pic.twitter.com/KlgBxElLGB

— Ryan Detrick, CMT (@RyanDetrick) February 27, 2022

JPM: Six reasons the worst might be behind us for risk assets pic.twitter.com/RjeK0kMgYD

— Sam Ro 📈 (@SamRo) March 1, 2022

What might a pessimist say right now?

Earnings and the economy were already showing signs of slowing

Morgan Stanley:

🛑 Evidence is now building that earnings forecasts are

increasingly at risk

🛑 The negative-to-positive guidance ratio during 4Q

earnings spiked to 3.6x—highest since 1Q16,

when we were mired in a global manufacturing

recession $SPY $QQQ pic.twitter.com/uXfL5mGGd7— Seth Golden (@SethCL) March 1, 2022

🇺🇸 Big drop in the Chicago PMI.

56.3 vs. Exp. 62.3 (Prior 65.2)

Largest 1 month drop since April 2020.

All eyes on the ISM tomorrow… pic.twitter.com/SCkxPKxVMs

— Julien Bittel, CFA (@BittelJulien) February 28, 2022

Global EPS growth is slowing down

From BofA: pic.twitter.com/aJbKIQAYFO

— Srivatsan Prakash (@SrivatsPrakash) February 26, 2022

And stagflation arguments are gaining steam

BMO says stagflation:

`Higher prices with the backdrop of heightened geopolitical uncertainty will ultimately be stagflationary. An energy crisis is the most direct path to stagflation; and an unfortunately familiar one.'

— Katie Greifeld (@kgreifeld) February 24, 2022

“It is getting increasingly hard to be a disinflationist,” says @yardeni. The end of the Cold War “was very disinflationary,” but ‘Cold War 2’ brings less “cheap labor .. disrupted supply chains,” while gov’t stimulus boosts aggregate demand. “The result is rising inflation.” pic.twitter.com/oLOPysAV8w

— Carl Quintanilla (@carlquintanilla) March 1, 2022

Economists surveyed by @Bloomberg haven’t yet matched @AtlantaFed GDPNow model, which is penciling in 0% growth in 1Q2022, but estimates have been cut significantly over past few weeks pic.twitter.com/3s8tYLTNQJ

— Liz Ann Sonders (@LizAnnSonders) March 2, 2022

Invasion of Ukraine expected to hit Russian economy harder than Eurozone, UK, US, and rest of world; but deterioration in GDP still expected everywhere nonetheless per @OxfordEconomics

@FT pic.twitter.com/BzLuOkcCet— Liz Ann Sonders (@LizAnnSonders) February 28, 2022

Comprehensive graphic

“Reluctance to crack down on source of much of Russia’s wealth reflects fear that doing so would send energy prices surging even higher, transmitting stagflationary mix of faster inflation & slower growth around an already fragile world economy.”@business pic.twitter.com/4yHneSTjSJ

— Danielle DiMartino Booth (@DiMartinoBooth) February 27, 2022

Here we go…

Weaker growth and higher inflation.

Don't be surprised if estimates continue to move the wrong way.

Estimates by JPM pic.twitter.com/5MhQUIwZqN

— Daniel Lacalle (@dlacalle_IA) February 26, 2022

Here’s the other next global issue we need to start talking more about.

Food prices are soaring. Wheat prices this week rose back to 2008 highs pic.twitter.com/ieUh3bvotR

— David Ingles (@DavidInglesTV) February 25, 2022

Charts/Tweets of the Week

Russia's current account surplus (black) in 2021 was the largest EVER: $120 bn. This is all energy exports (blue) & is hard currency that now pays for war. Spiking energy prices – perversely – mean Russia is reaping a windfall from its invasion of Ukraine. That has to stop ASAP! pic.twitter.com/djydxFeDp5

— Robin Brooks (@RobinBrooksIIF) February 27, 2022

With just announced sanctions Russia's banking/private sector will take the brunt of being cut off from Western financing. But with oil at $90-$100 Russia runs a budget surplus and doesn't need financing. pic.twitter.com/uLbAyUXIqK

— Anastasia Amoroso (@AAmoroso_1) February 24, 2022

You only have to take a glimpse at Russia's export basket to realise that a sanctions regime excluding the energy sector runs into severe effectiveness limits. pic.twitter.com/CG8b8k7T3o

— Philipp Heimberger (@heimbergecon) February 25, 2022

If accurate that Switzerland will join the economic sanctions tomorrow that is a serious blow to Moscow's dwindling economic lifelines. The move could freeze action at the Bank for International Settlements where Russia likely holds close to $25 billion in reserve assets. pic.twitter.com/WuJMcYY8fa

— Josh Lipsky (@joshualipsky) February 27, 2022

This is how much Russia has managed to exclude itself from the dollar-based economy since the occupation of Crimea in 2014. It now has more reserves in gold than in USD. h/t @IIF pic.twitter.com/MMfNfz2pUQ

— John Authers (@johnauthers) February 24, 2022

Russia Exports Share by Country: pic.twitter.com/aCIMzi8zZa

— Michael McDonough (@M_McDonough) February 24, 2022

Russ Import Share by Country: pic.twitter.com/ilqimoAobt

— Michael McDonough (@M_McDonough) February 24, 2022

Banks' exposure to Russia pic.twitter.com/vyh2XSG8fG

— Daniel Lacalle (@dlacalle_IA) February 27, 2022

#Brutal #Ruble@biancoresearch pic.twitter.com/ThxqrOcaB2

— Liz Ann Sonders (@LizAnnSonders) February 27, 2022

Going Much Further Back in Time $RUB (Russian Ruble) pic.twitter.com/znSt1NR3vB

— Michael McDonough (@M_McDonough) February 28, 2022

“I’ve stood in lines for an hour, but foreign currency is gone everywhere, just rubles. .. I got a late start because I didn’t think this was possible. I’m in shock.”

(via @business) #Russia https://t.co/EO5xjV6TV9

— Carl Quintanilla (@carlquintanilla) February 27, 2022

Classic chart of the Russian stock market, which closed for several years during WWI. Folks briefly bought the open, right before it all went to zero https://t.co/7u7iWjcmgm pic.twitter.com/DyvixnG47h

— Joe Weisenthal (@TheStalwart) February 27, 2022

Worry about this, not that. pic.twitter.com/qovDoE0DfA

— Tarun Raju (@btarunr) February 24, 2022

Here's a summary of the most important Russian + Ukranian exports.

Obviously, oil + gas are a large part of the discussion, but there are other markets equally if not more important for global supply chains where these countries are far more dominant. pic.twitter.com/m23QtqJ7qa

— Maroon_Macro (@Maroon_Macro) February 27, 2022

A GDP comparison someone mentioned, and I found surprising.

So I made a bar chart. pic.twitter.com/56gkpHx11H

— ʎllǝuuop ʇuǝɹq (@donnelly_brent) February 25, 2022

California exodus visualized by State pic.twitter.com/FiybeHVZrC

— Terrance (@thisisterrance) February 23, 2022

Disclosure

Clear Rock Advisors, LLC is registered with the SEC as a registered investment advisor with offices in Texas. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy (including the investments and/or investment strategies recommended and/or undertaken by Clear Rock Advisors, LLC) or any investment-related or financial planning consulting services will be profitable, equal any corresponding indicated historical performance level(s), or prove successful. It remains the client’s responsibility to advise Clear Rock Advisors, LLC, in writing, if there are any changes in the client’s personal/financial situation or investment objectives for the purpose of reviewing, evaluating or revising Clear Rock Advisors, LLC’s previous recommendations and/or services, or if the client would like to impose, add to, or modify any reasonable restrictions to Clear Rock Advisors, LLC’s services. A copy of Clear Rock Advisors, LLC’s current written disclosure statement discussing its advisory services and fees are available upon request.