August 17, 2021

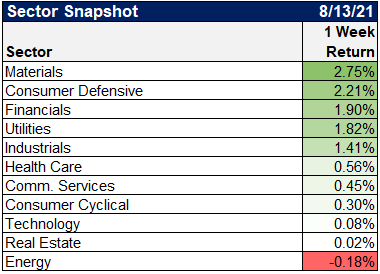

Market Performance For The Prior Week

Source: YCharts

Disclaimer: Past performance is no guarantee of future performance

The Good News

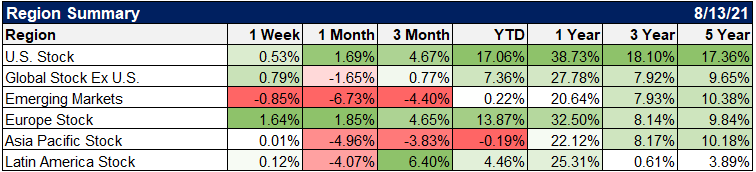

2Q earnings keep pouring in above estimates

Source: Factset

For more info and charts about Q2 earnings, please visit past posts.

The Mixed News

What companies are saying

In the past week, a number of companies have addressed questions regarding the spike since the beginning of the third quarter.

- Southwest Airlines warned of a sharp deterioration in business in recent weeks, a challenge that is affecting all airlines.

- Airbnb, however, said, “in the last few weeks, we had our biggest night ever in the U.S. and our biggest night globally since the pandemic began.”

- Aramark, which provides on-site food services, says the disruption is “really limited mostly to companies and their return-to-work strategies.” Though executives don’t think it’ll impact colleges, sporting arenas and entertainment venues.

- Foodservice competitor Sysco shared that sentiment, noting it did not experience any impact in July tied to Delta. However, CEO Kevin Hourican cautioned that they couldn’t predict whether the government might step in with new restrictions.

- Casper Sleep president Emilie Arel said Tuesday that people were still out shopping, saying, “To date, we are seeing week-over-week improvements on foot traffic.”

- Bumble has experienced no slowdown in activity on its dating app. “When COVID accelerates and loneliness climbs, people turn to us for connections,” Bumble CEO Whitney Wolfe Herd said on Wednesday.”

Source: Sam Ro (Axios)

The Bad News

Covid refuses to go away

US Covid-19 Update (*7-day Avg):

-New Cases*: 121k (highest since Feb 5)

-% Positive*: 10.8% (highest since Jan 17)

-Hospitalizations: 78k (highest since Feb 9)

-Deaths*: 537 (highest since May 22) pic.twitter.com/Mp9hAXsiP9— Charlie Bilello (@charliebilello) August 16, 2021

And many continue to worry about the Delta variant

DELTA is Coming For Your Economic Recovery https://t.co/xOvqVbgsJ2 pic.twitter.com/vnBJBqCLpI

— Barry Ritholtz (@ritholtz) August 13, 2021

Which is partly to blame for the weak retail sales numbers this week

July retail sales much weaker at -1.1% vs. -0.3% est. & +0.7% in prior month (rev up from +0.6%); sales took hit from autos, but ex-autos weak at -0.4% vs. +0.2% est. & +1.6% in prior month (rev up from +1.3%)…control group -1% vs. -0.2% est. & +1.4% prior (rev up from +1.1%) pic.twitter.com/peBOvQMkDU

— Liz Ann Sonders (@LizAnnSonders) August 17, 2021

JPMORGAN: “Retail spending outcomes have fallen short of our .. model in recent months. Our US card data reinforces this note of caution, showing a loss of momentum for airline spending and leveling off for restaurant spending this quarter.” $XAL pic.twitter.com/Tgt1VU0pLF

— Carl Quintanilla (@carlquintanilla) August 10, 2021

It’s not just demand, though. Supply chains continue to be a problem.

Shipping bottlenecks and resulting supply-chain disruptions are "the single biggest threat the economy faces at the moment…Imagine if oil went up from $20 per barrel to $200 per barrel, then that would be tantamount to what’s happening now." https://t.co/ixdKx9Jor0 pic.twitter.com/8O46VV55LN

— Lisa Abramowicz (@lisaabramowicz1) August 16, 2021

“Thirty-seven ships were anchored awaiting berth space outside the twin ports of Los Angeles and Long Beach, California, as of late Sunday, the most since early February.”

U.S. Container-Ship Bottleneck Lurches Near Its February Record https://t.co/RLyLDnXbEd pic.twitter.com/v6XkHeZy7p

— Danielle DiMartino Booth (@DiMartinoBooth) August 17, 2021

🌎 Global Supply Chains Are Being Battered by Fresh Covid Surges – Bloomberg

*Link: https://t.co/PcabQWmn9D pic.twitter.com/idb1OZLiQf— Christophe Barraud🛢 (@C_Barraud) August 15, 2021

Resulting in consumers and manufacturers feeling less optimistic

“On we go to US housing starts and retail sales, after the softness of U-Mich and Empire State. Retail sales are volatile, but they are a real measure of spending, and so more important than activity surveys.” @kitjuckes pic.twitter.com/QciBoE8zkb

— Sam Ro 📈 (@SamRo) August 17, 2021

The State Of The Market

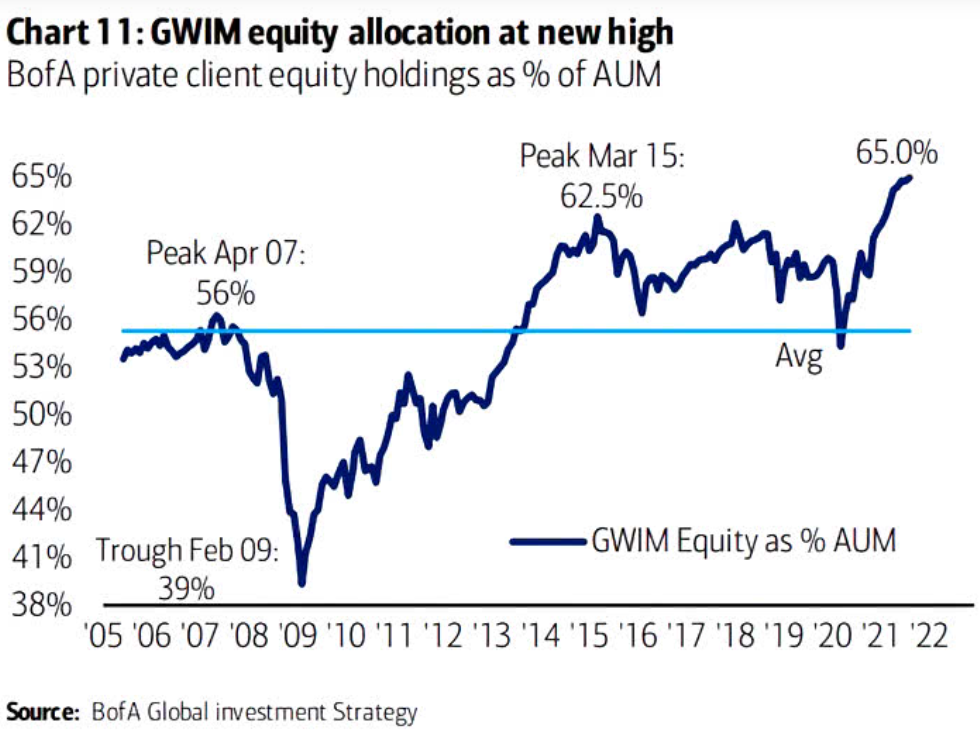

Yet investor sentiment remains high

4. Investor Confidence vs Consumer Confidence

h/t @takis2910 $SPX $SPY pic.twitter.com/tqTYY9ylGB

— Callum Thomas (@Callum_Thomas) August 14, 2021

Probably because corporations have been able to pass along price increases effectively

corporate profit margins are still expanding @FactSet https://t.co/Iw6LSLEsXg pic.twitter.com/LH3wHMmAIw

— Sam Ro 📈 (@SamRo) August 14, 2021

And liquidity remains elevated

As is always the case, when looking at any ratio involving disposable personal incomes (#DPI) the measures are skewed by the top 10%.

Good example from @soberlook is liquid assets to DPI as shown below. pic.twitter.com/7GPmdPVG0T— Lance Roberts (@LanceRoberts) August 10, 2021

Companies Are Hoarding Record Cash Amid Delta Fears https://t.co/kIvb8v41vC pic.twitter.com/yuiv6SZRso

— Barry Ritholtz (@ritholtz) August 16, 2021

Ultimately cultivating in this impressive run

Market milestone: The S&P 500 just doubled its level from its pandemic low close, marking the fastest bull-market doubling off a bottom since World War II 📈

w/ @YunLi626: https://t.co/gMhph6Yf7G pic.twitter.com/QgNZcbKdo6

— Nate Rattner (@naterattner) August 16, 2021

Quite stunning … as of end of last week, S&P 500 has gone 200 days with > 75% of its members trading above their 200d moving average … takes out prior record set in 2013 and is best stretch since 2004

[Past performance is no guarantee of future results] pic.twitter.com/4d0UakhlQE— Liz Ann Sonders (@LizAnnSonders) August 17, 2021

The average intra-year drawdown of the S&P 500 Index is 14%. This year we had two drawdowns of 4%. If it stays like this in 2021, only two calendar years since 1980, 1995 and 2017, would have seen smaller intra-year drawdowns. pic.twitter.com/YeCGCPAwSA

— jeroen blokland (@jsblokland) August 16, 2021

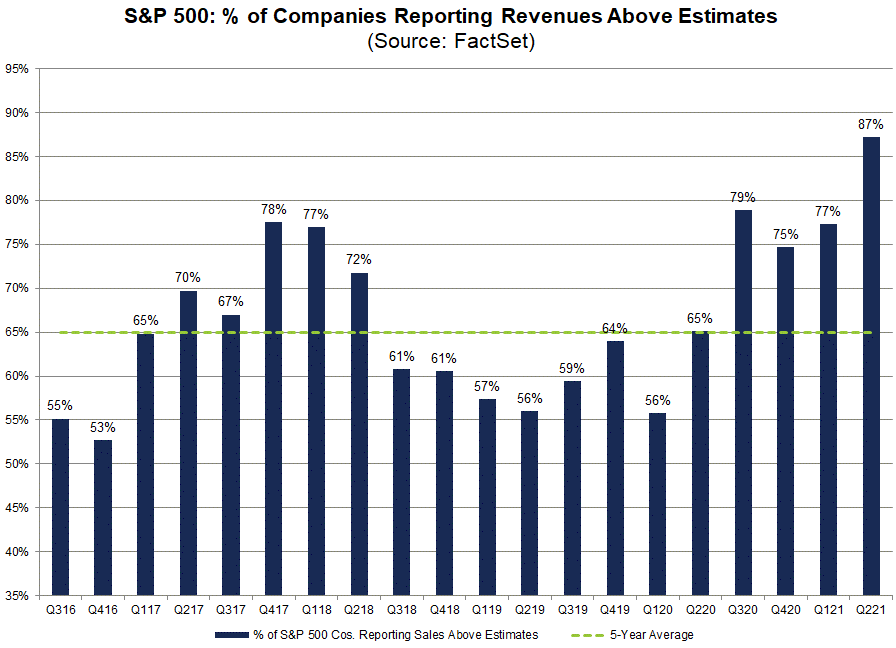

And, fortunately, many are taking advantage. But also a little worrisome.

In the first 6 months of the year, US equities experienced $267 billion of inflows. To put that in context, that’s $72 billion more than was achieved in the whole of 2013, the previous record year.

via @ManGroup pic.twitter.com/MLKxM342Bw— Andrew Thrasher, CMT (@AndrewThrasher) August 16, 2021

Charts Of The Week

"High frequency data suggests a hot rental market…" BofA pic.twitter.com/rbPAjtFL8R

— Sam Ro 📈 (@SamRo) August 15, 2021

GOLDMAN: “Companies have authorized $683 bn in buybacks through July, the largest total on record at this point in the year outside of 2018, in the wake of tax cuts. We therefore see some upside risk to our baseline S&P 500 buyback forecast of $726 bn this year.” [Kostin] pic.twitter.com/S6xG7fSUWI

— Carl Quintanilla (@carlquintanilla) August 15, 2021

Which Countries Have the Most Internet Users? 💻https://t.co/vpTvAlcoXF pic.twitter.com/tDdOGEjjZD

— Visual Capitalist (@VisualCap) August 14, 2021

Global 🌎 Covid deaths pic.twitter.com/6NkZIaeNsA

— Win Smart, CFA (@WinfieldSmart) August 10, 2021

Technology margins are 2x the broader S&P 500 – GS pic.twitter.com/azvqTsxvUe

— Sam Ro 📈 (@SamRo) August 12, 2021

The World’s Most Searched Consumer Brands 🔍https://t.co/RGZYMllMwB pic.twitter.com/5FTV8lOzpM

— Visual Capitalist (@VisualCap) August 12, 2021

Stories Of The Week

Internet pet rocks are selling for $100,000: https://decrypt.co/78097/ethereum-pet-rock-nfts-selling-more-than-100000

32% of people admit to trading while drunk: https://www.magnifymoney.com/blog/news/emotional-investing-survey/

Crypto hackers stole $600 million, then generously gave some back: https://www.wsj.com/articles/poly-network-hackers-steal-more-than-600-million-in-cryptocurrency-11628691400

Disclosure

Clear Rock Advisors, LLC is registered with the SEC as a registered investment advisor with offices in Texas. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy (including the investments and/or investment strategies recommended and/or undertaken by Clear Rock Advisors, LLC) or any investment-related or financial planning consulting services will be profitable, equal any corresponding indicated historical performance level(s), or prove successful. It remains the client’s responsibility to advise Clear Rock Advisors, LLC, in writing, if there are any changes in the client’s personal/financial situation or investment objectives for the purpose of reviewing, evaluating or revising Clear Rock Advisors, LLC’s previous recommendations and/or services, or if the client would like to impose, add to, or modify any reasonable restrictions to Clear Rock Advisors, LLC’s services. A copy of Clear Rock Advisors, LLC’s current written disclosure statement discussing its advisory services and fees are available upon request.