August 11, 2021

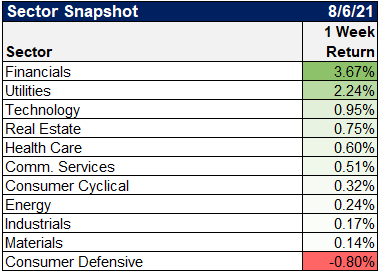

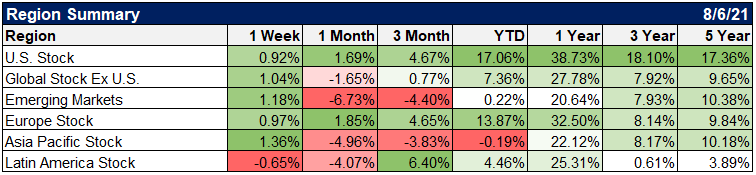

Market Performance For The Prior Week

Source: YCharts

Disclaimer: Past performance is no guarantee of future performance

The Good News

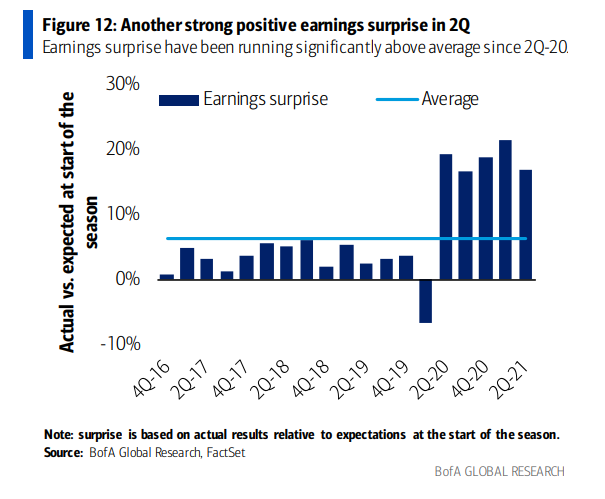

2Q earnings are astonishingly good

what a round trip pic.twitter.com/zKMUxwETmM

— Sam Ro 📈 (@SamRo) August 6, 2021

The share of S&P 500 companies beating 2Q earnings estimates is set for a recordhttps://t.co/EdKigK7Elx pic.twitter.com/InyG591Zfp

— Sarah Ponczek (@SarahPonczek) August 9, 2021

The beat rate for top-line sales continues to break all prior records. 78.66% of companies have beaten consensus sales estimates over the last 3 months. (Chart from: https://t.co/aOlg67yOJG) pic.twitter.com/mIywrpJJOV

— Bespoke (@bespokeinvest) August 9, 2021

Following the last busy earnings week, 444 S&P 500 companies (90% of index earnings) have reported. 2Q EPS is now tracking $52.29

Wild chart. pic.twitter.com/vUjCQJXhwb

— Mike Zaccardi, CFA, CMT (@MikeZaccardi) August 8, 2021

And we had a very strong jobs report last week

Jobs report was prettay dang good

– Added 943,000 jobs in July

– Large upward revisions for May and June

– Median duration unemployment down from 19 to 15 weeksStill, a lot of sectors way below pre-pandemic employment rates (Leisure and hospitality -2.2 million from Feb 2020)

— Morning Brew ☕️ (@MorningBrew) August 6, 2021

Leisure and Hospitality continues to be the driver of jobs gains. #JobsReport pic.twitter.com/TKN4AS3QeL

— Kathy Jones (@KathyJones) August 6, 2021

And wages are following

Wage growth still looking incredibly strong in leisure/hospitality as sector continues to add jobs … 3m annualized gain in wages (for nonsupervisory workers) at 21.7% pic.twitter.com/tgGt1qr9FD

— Liz Ann Sonders (@LizAnnSonders) August 9, 2021

$15 an hour is suddenly the rule, not the exception, for U.S. workers. It’s a major shift from pre-pandemic norms.https://t.co/lpqm11Wxys pic.twitter.com/quilyO7lEu

— Catherine Rampell (@crampell) August 8, 2021

The Bad News

But many must be waiting for even higher wages

Wild: https://t.co/eF9Mtfwj6a

— Morgan Housel (@morganhousel) August 9, 2021

There are currently 1.75 jobs for every person unemployed.

— Teddy Vallee (@TeddyVallee) August 9, 2021

And inflation continues to be a concern for many

The Citi US Inflation Surprise Index hit another record high in July. pic.twitter.com/AjOx1S3QuB

— (((The Daily Shot))) (@SoberLook) August 3, 2021

U.S. consumers’ expectations for inflation over the medium term rose to an eight-year high in July: Fed data https://t.co/FCUekwFout

— Lisa Abramowicz (@lisaabramowicz1) August 9, 2021

Inflation forecasts rise all over the world… except where inflation is already too high. pic.twitter.com/AWMFR2p1vg

— Daniel Lacalle (@dlacalle_IA) August 7, 2021

The State Of The Market

The traditional inflation hedge might not be just that anymore

Worst of all, #gold makes a three year low versus the S&P 500. pic.twitter.com/iVu5KTL10t

— Charlie Morris (@AtlasPulse) August 6, 2021

Ratio of Gold ETF to the S&P 500 hits a new low. $GLD $SPY

Charting via @ycharts pic.twitter.com/KF2sjIBa9P

— Charlie Bilello (@charliebilello) August 9, 2021

Emerging markets continue to struggle

Emerging Markets to S&P 500 index approaching 20-year lows. Will be interesting to see what #cathartic event occurs this time.

h/t @ISABELNET_SA pic.twitter.com/W3V6xA28zo— Lance Roberts (@LanceRoberts) August 9, 2021

For a lot of reasons, but vaccination rates are a big reason

.@bopinion re dispersion in #Covid vaccination:

Comparing shares in global population to shares in global vaccination for the 50 wealthiest and least wealthy countries.

Needless to say, such dispersion has notable health, economic, social, political and institutional implications pic.twitter.com/EIKdovRr1q— Mohamed A. El-Erian (@elerianm) August 7, 2021

This scatterplot shows manufacturing PMIs (business activity) vs. vaccination rates.

Source: @OurWorldInData; @WilliamsonChris pic.twitter.com/UpYxLr06v8

— (((The Daily Shot))) (@SoberLook) August 5, 2021

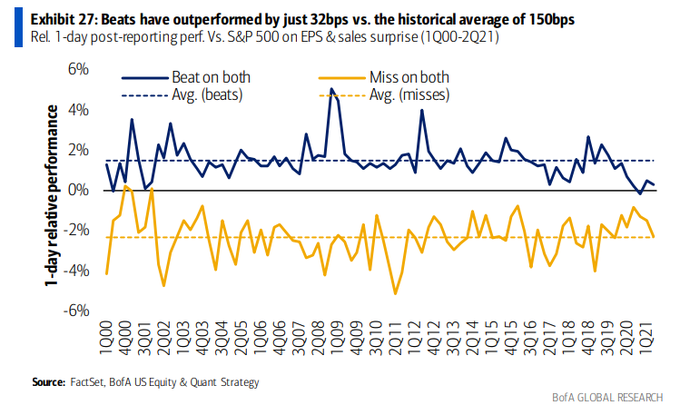

The strong earnings haven’t been necessarily correlating due to high expectations

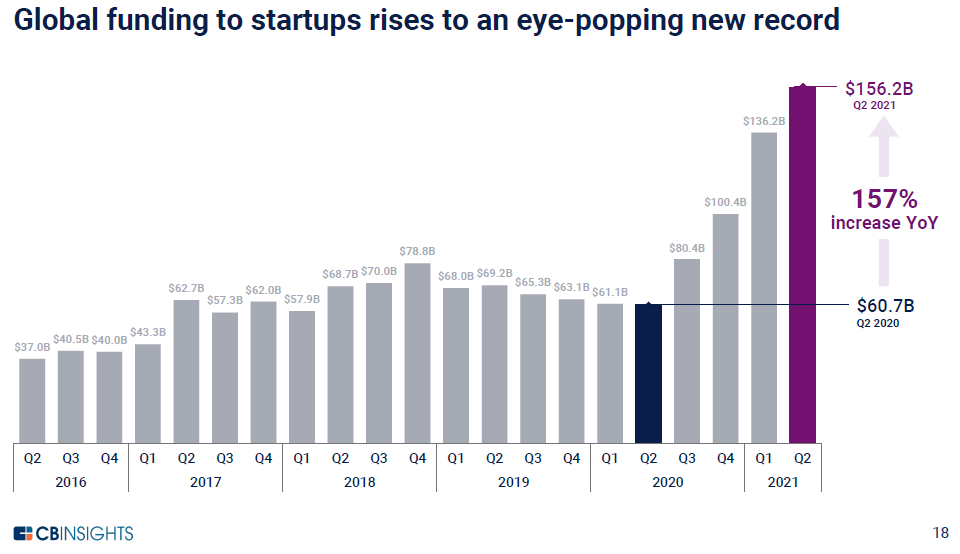

Private markets also have very high expectations going forward

You get what you pay (#fees); LASIK/ Laser eye surgery discount “fees” STRATEGY could be detrimental to one’s portfolio?@BainInsights midyear report: #PrivateEquity industry continued to supersize in 2021 and is on track to post its best year by farhttps://t.co/BNalukVE3q #lbo https://t.co/27DtImmIkM pic.twitter.com/rKfwR3fjq6

— Mo Hossain (@MoHossain) August 7, 2021

The World is Awash in Capital https://t.co/v7dQgirBpc pic.twitter.com/dseNKuGbeb

— Barry Ritholtz (@ritholtz) August 9, 2021

Charts Of The Week

So basically $HOOD is up 107% since ARK bought it? Oh man lol pic.twitter.com/2jYPSlAhDH

— Eric Balchunas (@EricBalchunas) August 4, 2021

Beyond social, "Cathie Wood" has also gotten more media mentions than "Warren Buffet" every single month this year. Unreal. New Era. pic.twitter.com/fgqBV0zg37

— Eric Balchunas (@EricBalchunas) August 7, 2021

World’s 🌎 100

Biggest Companies pic.twitter.com/tgeO3P2njr— Win Smart, CFA (@WinfieldSmart) August 9, 2021

SPACs are holding companies designed to bypass traditional IPO regulations, historically associated with rampant criminality.

The amount of fraud that will soon come to light will make 2000 and 2008 seem minor by comparison. pic.twitter.com/lQ9yBPQpjg

— Mac10 (@SuburbanDrone) August 8, 2021

How Dominant is the U.S. Dollar? 💵https://t.co/Bw0cnJpYJs pic.twitter.com/MLOF5raKy8

— Visual Capitalist (@VisualCap) August 6, 2021

Visualizing the World’s Population by Age Group 🌎https://t.co/FJCClEf7Kw pic.twitter.com/gZvdn72onU

— Visual Capitalist (@VisualCap) August 7, 2021

And this is how our our manufacturing base got hollowed out pic.twitter.com/afriXbSI8O

— Max (@1478397vw) August 6, 2021

The market is going to crash. I’ve been doing research for more than 100 years. See chart below pic.twitter.com/OSp6lxOmhH

— Jerome Powell (@alifarhat79) August 4, 2021

Disclosure

Clear Rock Advisors, LLC is registered with the SEC as a registered investment advisor with offices in Texas. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy (including the investments and/or investment strategies recommended and/or undertaken by Clear Rock Advisors, LLC) or any investment-related or financial planning consulting services will be profitable, equal any corresponding indicated historical performance level(s), or prove successful. It remains the client’s responsibility to advise Clear Rock Advisors, LLC, in writing, if there are any changes in the client’s personal/financial situation or investment objectives for the purpose of reviewing, evaluating or revising Clear Rock Advisors, LLC’s previous recommendations and/or services, or if the client would like to impose, add to, or modify any reasonable restrictions to Clear Rock Advisors, LLC’s services. A copy of Clear Rock Advisors, LLC’s current written disclosure statement discussing its advisory services and fees are available upon request.