April 12, 2023

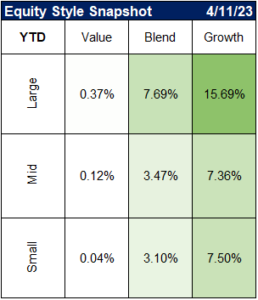

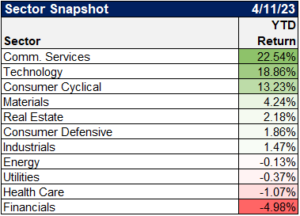

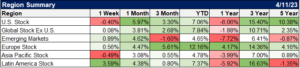

Market Performance (YTD)

Source: YCharts

Disclaimer: Past performance is no guarantee of future performance

Jobless claims rose by 228K last week, but the big news is the upward revision to the previous week’s numbers by 48K and an upward revision of 128K in continuing claims. pic.twitter.com/dwhZTAGtQ8

— Kathy Jones (@KathyJones) April 6, 2023

Jobs day charts thread:

1/ Solid NFP number in March, marginally above pre-COVID trend. To some extent just offsets the outsized January strength, 3 month average steady just shy of 350K (which is very high, but a lot lower than a year ago) pic.twitter.com/wrBtCg9iqg

— Guy Berger (@EconBerger) April 7, 2023

3/ Average hourly earnings continue to decelerate. We're really not that far above the pre-COVID growth rate at this point. Not sure how that affects your inflation takes. pic.twitter.com/rCV1sxXg1u

— Guy Berger (@EconBerger) April 7, 2023

Why do some think the labor market is cooling w/ still robust gains in payrolls? Triangulating across data sources & looking at leading indicators–hiring has narrowed as sectors hit by policy slow, hiring rates/turnover are falling & layoffs are rising & hit payrolls w/ a lag pic.twitter.com/2X2YjRiVjU

— Julia Coronado (@jc_econ) April 10, 2023

So much for "nobody wants to work anymore": 80.7% of prime-age (25-54) Americans were working in March, the highest rate since May 2001. pic.twitter.com/W858TSe2G0

— Ben Casselman (@bencasselman) April 7, 2023

APOLLO: “The credit crunch has started. .. A survey of 71 banks in the Dallas Fed district done after SVB went under shows a dramatic reversal in loan volumes, .. from March 21 to 29.” [Slok]$KRE $XLF pic.twitter.com/tTtev6Zwkd

— Carl Quintanilla (@carlquintanilla) April 6, 2023

US bank lending contracted by the most on record in the last two weeks of March, dropping nearly $105 billion in the two weeks ended March 29: Fed data. The more than $45 billion drop in the latest week was primarily due to a a drop in loans by small banks. @atanzi @TheTerminal

— Lisa Abramowicz (@lisaabramowicz1) April 7, 2023

According to Goldman, all those "the credit crunch has officially arrived" tweets were wrong. pic.twitter.com/U1cNmIN7yQ

— Joe Weisenthal (@TheStalwart) April 12, 2023

The Senior Loan Officers Opinion Survey gave plenty of reason to stick with the view that a 'Hard Landing' is more likely than a 'Soft Landing', or 'No Landing'. Maybe it will be different this time, but for 30 years the SLOOS has signalled where Unemployment is heading! pic.twitter.com/vWmmY617EM

— Ian Harnett (@IanRHarnett) February 12, 2023

⚠️ March saw biggest tightening in US Small Business Credit Availability since 2002 (joint 2nd biggest on record). NFIB confirms credit tightening happening as a result of bank failures. 1st clear sign for Fed to digest. Hard to see this as temporary at this stage of cycle $USD pic.twitter.com/U89HVQMzPu

— Viraj Patel (@VPatelFX) April 11, 2023

Headline CPI in March

3-month annualized change: +3.8%

6-month annualized change: +3.6%Core CPI in March

3-month annualized change: +5.1%

6-month annualized change: +4.7% https://t.co/nx9Te9qL9f pic.twitter.com/PtzrXAsnlz— Nick Timiraos (@NickTimiraos) April 12, 2023

New CPI numbers: Lots of things shifting, but core inflation is still moving sideways.

You can see two levels here:

– high one from Oct 2021 to Sep 2022

– a lower, but still elevated, one during the past 5-6 months.What could break us out of the lower level? Let's dig in. /1 pic.twitter.com/wGMJPu4Udo

— Mike Konczal (@mtkonczal) April 12, 2023

After a strong first quarter, the stock market’s momentum will hinge in part on earnings. Q1 earnings season is coming up in two weeks, and the consensus estimate is for an 8% contraction in the growth rate, followed by a 6% contraction in Q2. pic.twitter.com/ZS4JYYokE3

— Jurrien Timmer (@TimmerFidelity) April 5, 2023

Heading into the year, analysts expected earnings *growth* for Q1. Now they're expecting almost a 6% decline for the quarter pic.twitter.com/Pusy1QotIm

— Gunjan Banerji (@GunjanJS) April 6, 2023

'As of Wednesday, the average extra yield, or spread, above U.S. Treasurys that investors were demanding to hold CMBS with a triple-B rating was 9.52 percentage points, approaching the 10.8 percentage point level reached in March 2020.' https://t.co/m4XY62lOGI ht @GunjanJS pic.twitter.com/Hz67njPNXw

— Jesse Felder (@jessefelder) April 7, 2023

The US stock market has been in a sideways trading range for 10 months now. 🧵 pic.twitter.com/TyO8Y2RC7w

— Jurrien Timmer (@TimmerFidelity) April 10, 2023

2/4

Activity components by country show:√ 36% of countries stay in expansion of which 15% are slowing down and 21% are accelerating, Hungary & India have the highest PMIs

√ 30% are recovering, including the US & Europe marginally

√ 33% deteriorating, Canada the most pic.twitter.com/v1jPHJiM09— Patrick Zweifel (@PkZweifel) April 5, 2023

Disclosure

Clear Rock Advisors, LLC is registered with the SEC as a registered investment advisor with offices in Texas. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy (including the investments and/or investment strategies recommended and/or undertaken by Clear Rock Advisors, LLC) or any investment-related or financial planning consulting services will be profitable, equal any corresponding indicated historical performance level(s), or prove successful. It remains the client’s responsibility to advise Clear Rock Advisors, LLC, in writing, if there are any changes in the client’s personal/financial situation or investment objectives for the purpose of reviewing, evaluating or revising Clear Rock Advisors, LLC’s previous recommendations and/or services, or if the client would like to impose, add to, or modify any reasonable restrictions to Clear Rock Advisors, LLC’s services. A copy of Clear Rock Advisors, LLC’s current written disclosure statement discussing its advisory services and fees are available upon request.