Weekly ChartBook

Week of June 28, 2021

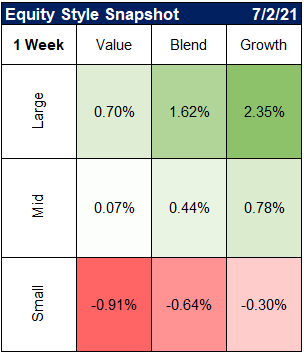

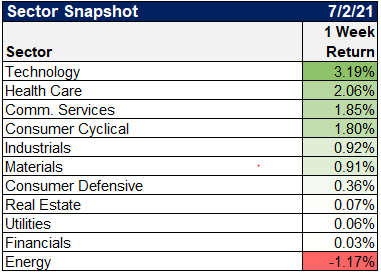

Market Performance For The Week

Source: YCharts

Disclaimer: Past performance is no guarantee of future performance

The Good News

Revenue and earnings expectations continue to rise

$SPX is projected to report its largest Y/Y revenue growth in Q2 2021 (19.6%) since FactSet began tracking this metric in 2008. https://t.co/LVGochDGY0 pic.twitter.com/TzCrVDeXiH

— FactSet (@FactSet) July 4, 2021

Earnings for Q2 are almost upon us. After a blockbuster Q1, which produced a 53% growth rate (30 percentage points from the start of the season), the Q2 season will start with a 63% estimated growth rate. Q3 and Q4 so far look more normal by comparison. pic.twitter.com/Zbk1yXXeXk

— Jurrien Timmer (@TimmerFidelity) July 2, 2021

S&P 500 EPS estimates inched higher again overnight. $SPY pic.twitter.com/Hddxx1JuRn

— The Earnings Scout (@EarningsScout) June 30, 2021

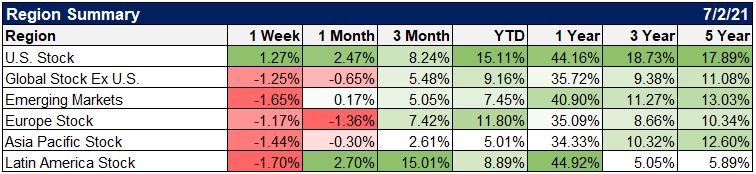

The jobs report released on Friday showed the economy continues to make strong strides

ECONOMY WATCH: U.S. adds 850,000 new jobs in June – well above 706,000 MarketWatch forecast. Unemployment rate rises to 5.9% from 5.8%. Hiring strongest in leisure and hospitality and govt. Good report. Economy clawing back from pandemic and growing strongly.

— MarketWatch Economy (@MKTWeconomics) July 2, 2021

BREAKING: The US economy added 850,000 jobs in June, a strong number that shows workers are starting to return as they feel safe and ready.

Unemployment rate: 5.9%

**Overall, ~70% of jobs lost are back. There are at least 6.8 million jobs to go **

— Heather Long (@byHeatherLong) July 2, 2021

Unemployment rate’s uptick to 5.9% was higher than 5.6% est. & 5.8% in prior month, but not sinister when compared to earlier levels pic.twitter.com/gRskIEsjnl

— Liz Ann Sonders (@LizAnnSonders) July 2, 2021

Getting better, but still not good. Nonfarm payrolls beat in June; however, the total shortfall when compared to the February 2020 peak is 6.764 million. About half the gap is in two areas: leisure & hospitality and state & local governments. pic.twitter.com/nVpO8NIQds

— RenMac: Renaissance Macro Research (@RenMacLLC) July 2, 2021

To put the jobs recovery in perspective..

The Bad News

Supply chains across the globe continue to be pressured

Wow! The price gauge of the ISM manufacturing index just soared to a more than 40-year high.

Bear in mind, however, that this is a measure of the number of companies experiencing pricing pressure, as opposed to absolute prices themselves. Still though.https://t.co/Qoqqo4V4r1 pic.twitter.com/AxEuNiloB4

— Joe Weisenthal (@TheStalwart) July 1, 2021

The State Of The Market

The market is humming along

The S&P 500 today will close its 2nd best first-half of the year since 1998.

(via @peterschack) @CNBC pic.twitter.com/WZEORjdE0G

— Carl Quintanilla (@carlquintanilla) June 30, 2021

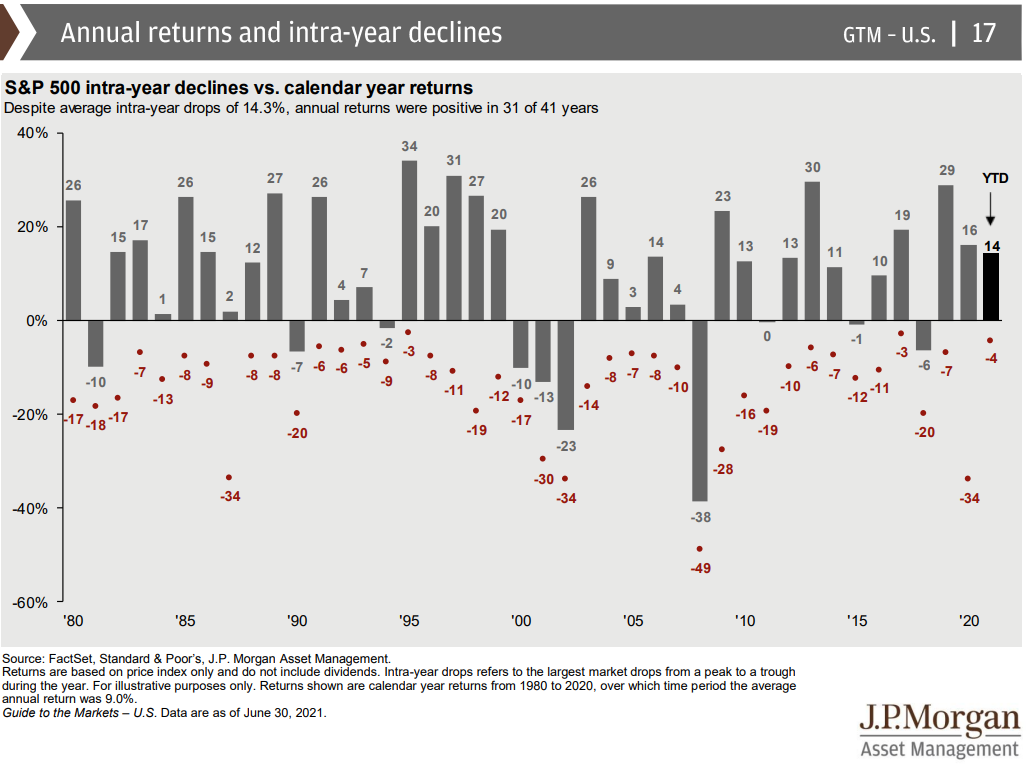

With very little hiccups, so far

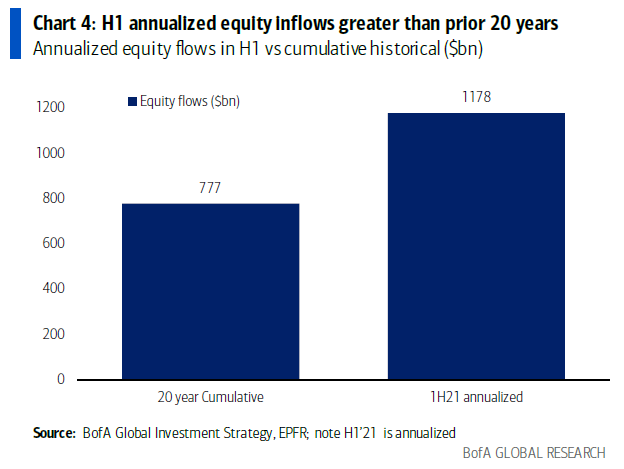

Unsurprisingly, equity inflows this year have been very, very strong

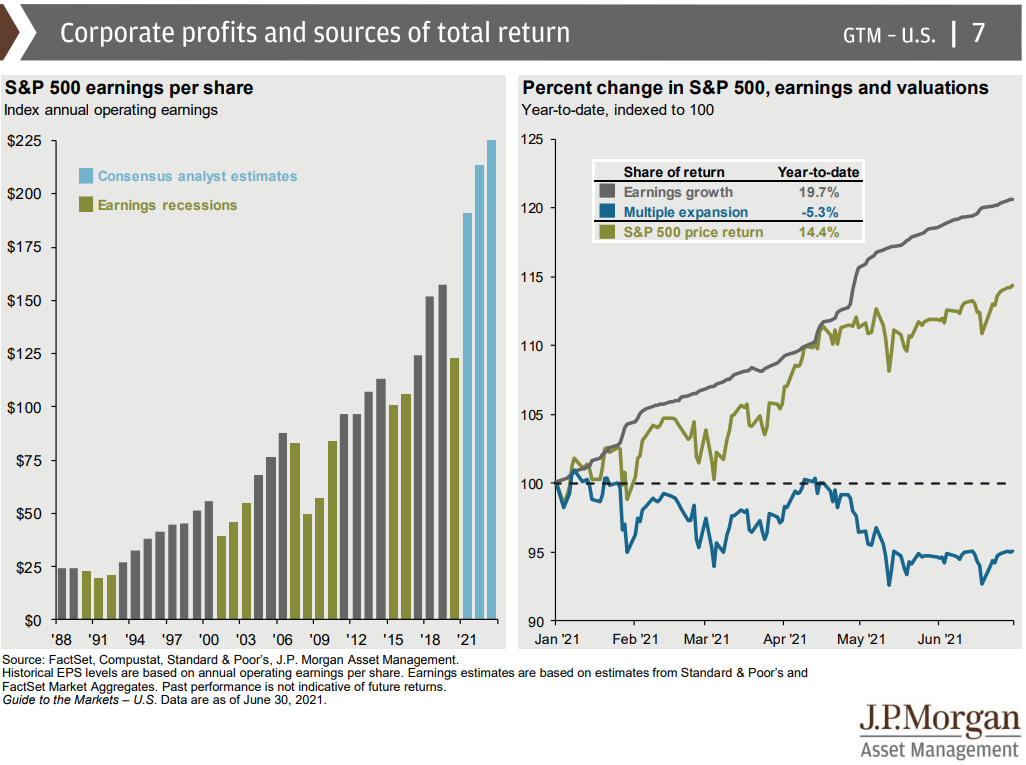

The gains in the market this year have been led by earnings growth, not multiple expansion

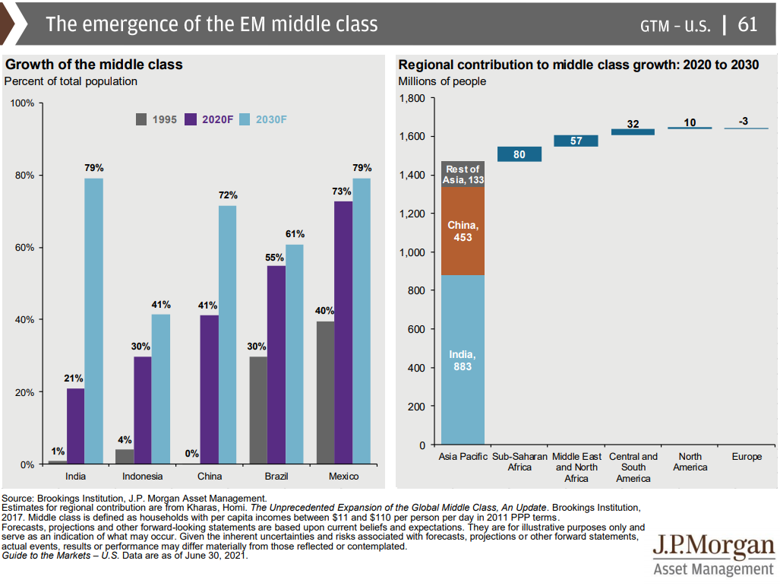

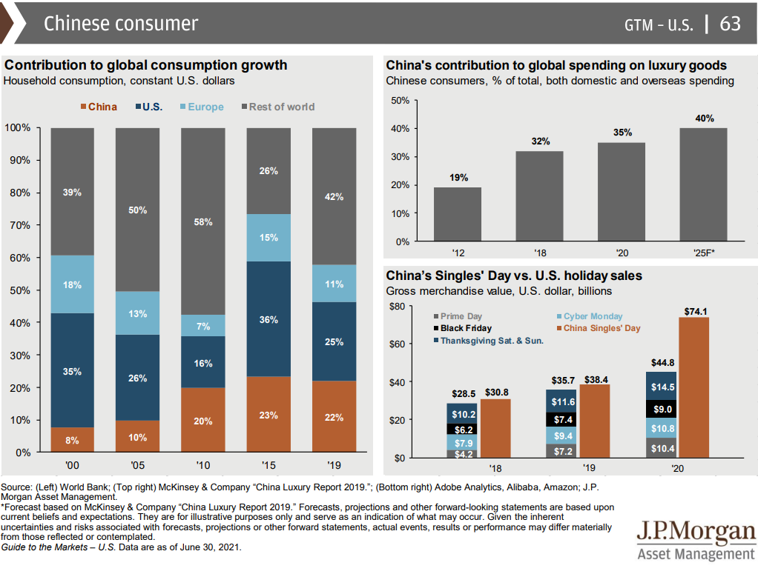

Speaking of growth, emerging markets are poised for strong economic growth going forward

More specifically, China

And we are starting to see some progress internationally..

Starbucks CEO Kevin Johnson:

Every market around the world is going to see exactly what the United States has experienced here over the last 90 days.$SBUX pic.twitter.com/aMWQxHADhq

— The Transcript (@TheTranscript_) July 2, 2021

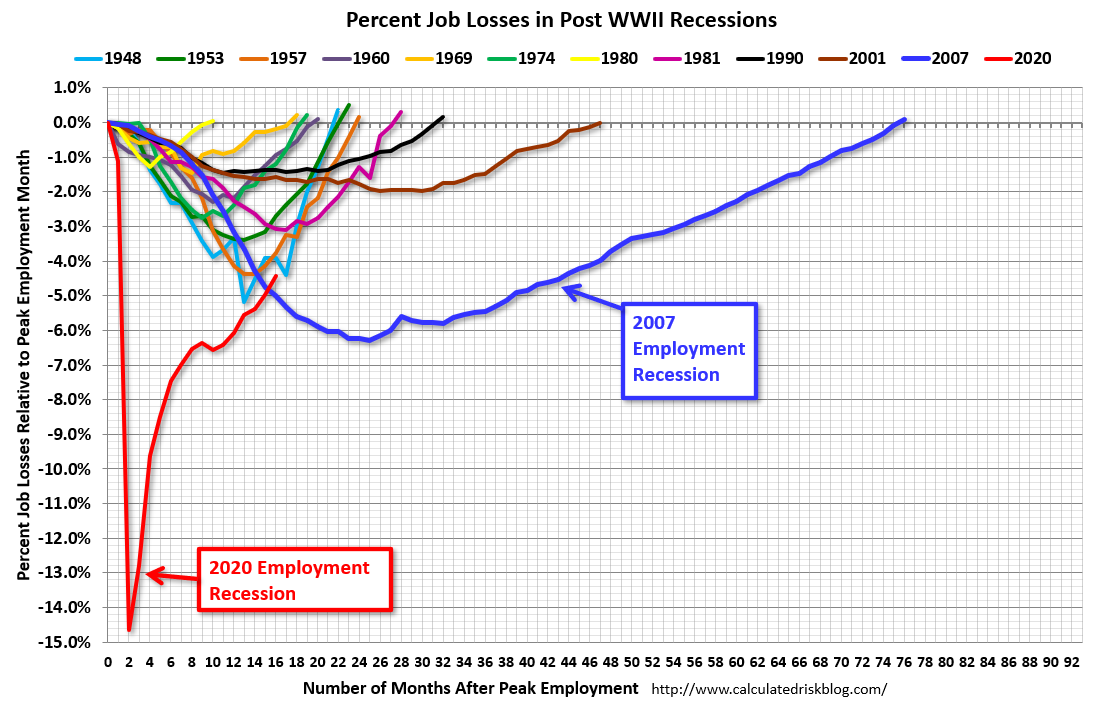

Charts Of The Week

— Peter Mallouk (@PeterMallouk) July 2, 2021

The Russell 1000 Value Index has trailed its growth counterpart by roughly 8 percentage points this month, the most since 2000.@business pic.twitter.com/MYaFEoFq49

— Mo Hossain (@MoHossain) July 1, 2021

Story Of The Week

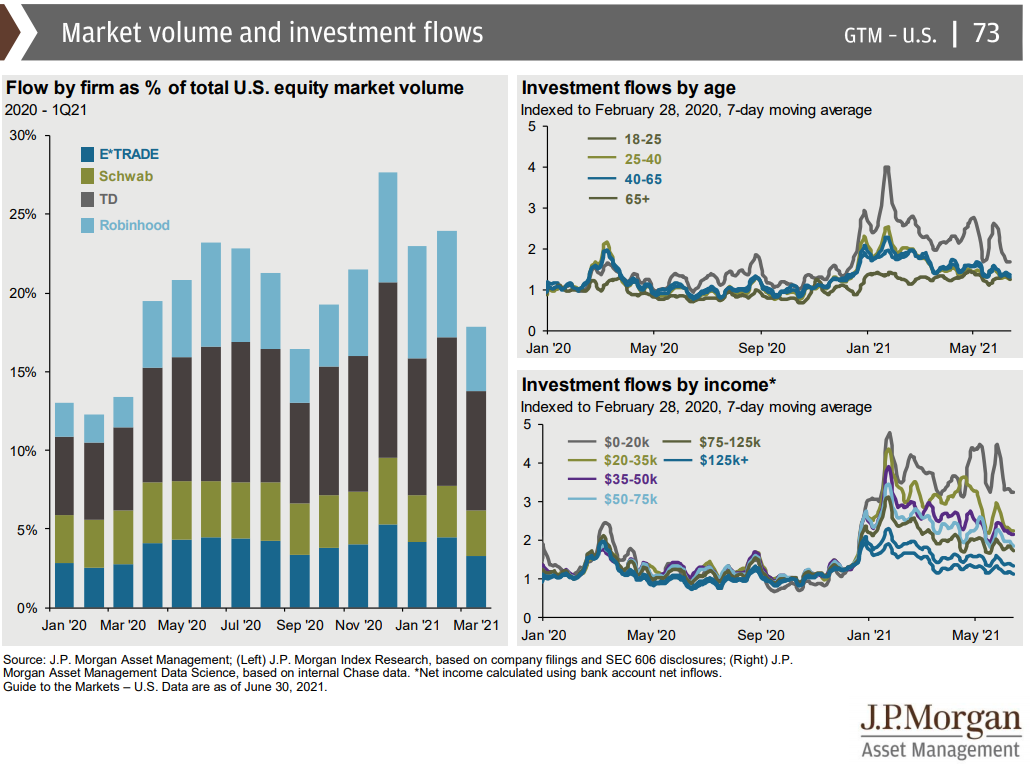

Robinhood is preparing to go public and receives the largest ever FINRA fine: Revealed: How Robinhood harmed millions of its customers – Axios

This is unfreakinbelievable:

Robinhood did $277 million in revenue in 2019 and $958 million in 2020. https://t.co/O67fanC5DK

— Michael Batnick (@michaelbatnick) July 1, 2021

Disclosure

Clear Rock Advisors, LLC is registered with the SEC as a registered investment advisor with offices in Texas. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy (including the investments and/or investment strategies recommended and/or undertaken by Clear Rock Advisors, LLC) or any investment-related or financial planning consulting services will be profitable, equal any corresponding indicated historical performance level(s), or prove successful. It remains the client’s responsibility to advise Clear Rock Advisors, LLC, in writing, if there are any changes in the client’s personal/financial situation or investment objectives for the purpose of reviewing, evaluating or revising Clear Rock Advisors, LLC’s previous recommendations and/or services, or if the client would like to impose, add to, or modify any reasonable restrictions to Clear Rock Advisors, LLC’s services. A copy of Clear Rock Advisors, LLC’s current written disclosure statement discussing its advisory services and fees are available upon request.