September 7, 2022

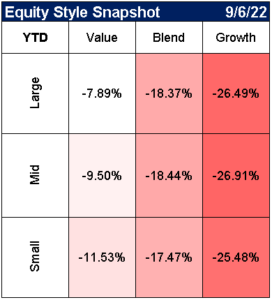

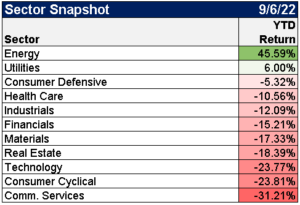

Market Performance (YTD)

Source: YCharts

Disclaimer: Past performance is no guarantee of future performance

The 60/40 portfolio is running a 14% loss YTD. One of the main goals of adding bonds to a portfolio is to reduce the risk of major drawdowns in equities. The 60/40 has prevented deeper losses from equities alone, but it's a tough chart to look at when both are down. pic.twitter.com/ieB1ju3UJg

— Liz Young (@LizYoungStrat) September 6, 2022

Two-year yields surge to new highs in US, UK and Europe as markets build in expectations of even more central bank tightening due to inflation pressures. pic.twitter.com/5rbKUcrBWD

— Kathy Jones (@KathyJones) September 6, 2022

In August, the two-year yields for nine of the world's 10 largest sovereign issuers climbed more than 10%. No such broad and extreme rate shock has occurred over the past 20 years, via @GinaMartinAdams @TheTerminal

— Lisa Abramowicz (@lisaabramowicz1) September 6, 2022

Actual vs. Estimates:

NFP: est. ~300k, act. 315k

Unemplyment rate: est. 3.5%, act. 3.7%

Avg. Hourly Earnings: est. 0.4%, act. 0.3%

Weekly Hours: est. 34.6, act. 34.5

Labor Force Participation: est. 62.2%, act. 62.4%— Bespoke (@bespokeinvest) September 2, 2022

These just don’t look recessionary

ISM Manufacturing 52.8, Exp. 51.9

New Orders 51.3, Exp. 48.0

Employment 54.2, Exp. 49.5

Prices Paid 52.5, Exp. 55.3

— Michael Antonelli (@BullandBaird) September 1, 2022

Was high inflation transitory after all? pic.twitter.com/HSbN0KJxdu

— MacroMarketsDaily (@macro_daily) September 1, 2022

Gasoline prices have fallen over 25% over the past 85 days helping lift consumer sentiment and lower inflation expectations

Chart via @SoberLook pic.twitter.com/betCSWv9Jj

— Gregory Daco (@GregDaco) September 7, 2022

Rough print for August @SPGlobal U.S. Services PMI … final read came in at 43.7 vs. initial print of 44.1 & 47.3 in prior month … companies recorded solid decline in new business, with new orders falling for 2nd time in 3 months (contraction among fastest on record) pic.twitter.com/Y0iNF7uJWW

— Liz Ann Sonders (@LizAnnSonders) September 6, 2022

That escalated quickly pic.twitter.com/QRcYKJ7T4Z

— Jeffrey Kleintop (@JeffreyKleintop) September 6, 2022

Here's a way to see how YoY CPI looks going forward based on constant MoM moves ranging from flat to +0.4%.

With a constant MoM move of 0.2%, YoY CPI is down to 3.4% by May '23 and 2.2% YoY by June '23. Fed Fund Futures pricing has the Fed Funds Rate at 3.9% at that point. pic.twitter.com/YkXmML13f7

— Bespoke (@bespokeinvest) September 1, 2022

🇺🇸 #Housing #Recession | #Mortgage purchase applications index fell for the 5th straight week, reaching the lowest since April 2020 ⚠

*Link: https://t.co/9yqBdwNm1f pic.twitter.com/scz5iH8IZe— Christophe Barraud🛢🐳 (@C_Barraud) September 7, 2022

🚨 The average 30-year fixed mortgage rate jumps to 6.23%. pic.twitter.com/7LflBUkVxp

— Lance Lambert (@NewsLambert) September 1, 2022

'Over the last century, housing has helped define the swings in the economic cycle, being a key driver of investment, employment, and consumption (especially white goods). In short, housing IS the business cycle.' https://t.co/dZ3oiNh20J by @IanRHarnett pic.twitter.com/D29ozYnsDv

— Jesse Felder (@jessefelder) September 1, 2022

Earnings estimates continue to be revised lower for Q3 and Q4. 👀@ayeshatariq pic.twitter.com/7n2zpgb0Jt

— Markets & Mayhem (@Mayhem4Markets) August 31, 2022

Can #Fed #ECB cope with current #inflation shock? #CPI decomposition shows limited effect of monetary policy. Sure, takes some time for tightening to unfold. But only 30% in #US and 15% in #Eurozone demand driven. In mid term monetary policy is not only determinant for inflation. pic.twitter.com/ObjXOacQ3B

— Patrick Krizan 🇺🇦🏳️🌈 (@PatrickKrizan) September 1, 2022

Goldman's Jan Hatzius:

The good news: The hit to real incomes in the US is slowing as energy prices fall.

The bad news: The hit to housing as interest rates rise is just getting started. pic.twitter.com/Dk9tvpQchk

— Tracy Alloway (@tracyalloway) September 7, 2022

The economic shock of ~6% mortgage rates in 2022 is hitting a lot harder than ~5% rates did in 2018. pic.twitter.com/JFSKpH3e6j

— Lance Lambert (@NewsLambert) August 31, 2022

U.S. life expectancy fell by nearly a year in 2021 to 76.1, lowest since 1996 … first 2-year drop since early 1960s and largest since 1921-1923 period pic.twitter.com/C7Du4LfRcQ

— Liz Ann Sonders (@LizAnnSonders) September 1, 2022

Visualizing the top economies of the world from 1960 through 2021.

Some of the growth is nothing short of remarkable. pic.twitter.com/WKmWqWQrya

— Traderade (@TraderadeTweets) September 5, 2022

Disclosure

Clear Rock Advisors, LLC is registered with the SEC as a registered investment advisor with offices in Texas. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy (including the investments and/or investment strategies recommended and/or undertaken by Clear Rock Advisors, LLC) or any investment-related or financial planning consulting services will be profitable, equal any corresponding indicated historical performance level(s), or prove successful. It remains the client’s responsibility to advise Clear Rock Advisors, LLC, in writing, if there are any changes in the client’s personal/financial situation or investment objectives for the purpose of reviewing, evaluating or revising Clear Rock Advisors, LLC’s previous recommendations and/or services, or if the client would like to impose, add to, or modify any reasonable restrictions to Clear Rock Advisors, LLC’s services. A copy of Clear Rock Advisors, LLC’s current written disclosure statement discussing its advisory services and fees are available upon request.