September 21, 2021

Market Performance For The Prior Week

Source: YCharts

Disclaimer: Past performance is no guarantee of future performance

The Good News

People are continuing to spend

BofA: signs that the Delta-lull is passing and a mini-reopening cycle is starting pic.twitter.com/NOQF69scma

— Mike Zaccardi, CFA, CMT (@MikeZaccardi) September 16, 2021

And there’s some hope we’ll start seeing lower peaks in Covid cases

“Lower peaks ..”

(via JPMorgan) pic.twitter.com/EnMhC2fDH5

— Carl Quintanilla (@carlquintanilla) September 15, 2021

And there’s still a lot of money and spending out there

US Retail Sales are down slightly from their peak in April but still 19% above pre-covid levels and up 13% year-over-year. The stimulus money is still driving above-trend consumer spending.

Charting via @ycharts pic.twitter.com/LSs6QvwCsy

— Charlie Bilello (@charliebilello) September 16, 2021

The Mixed News

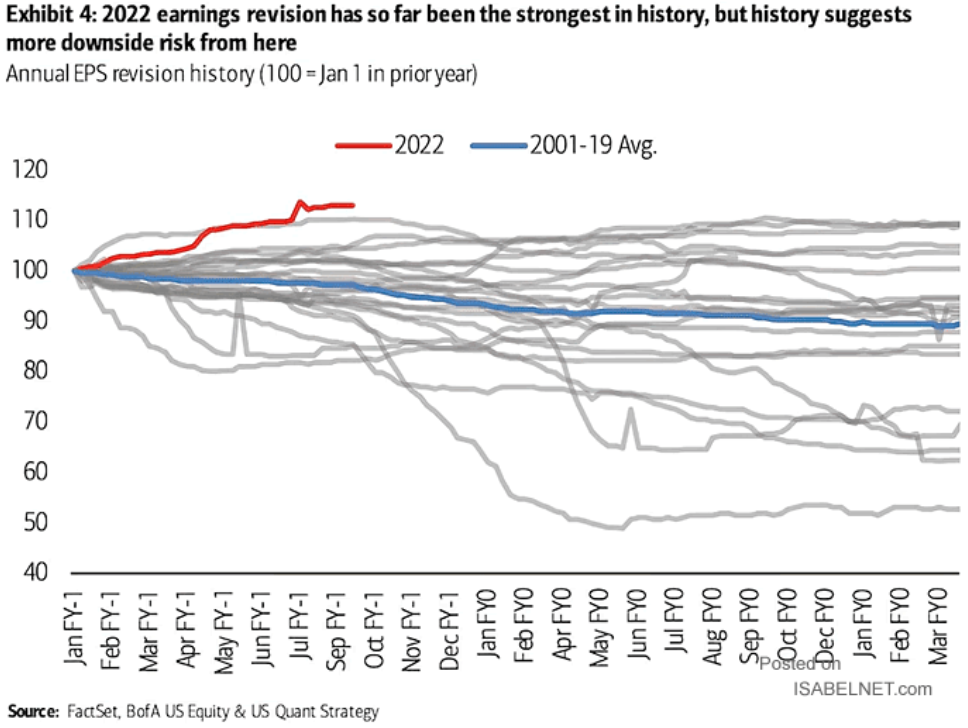

Earnings will probably remain strong, but estimates can only keep rising for so long

Wondering why #stocks are doing well??

2021 has seen the fastest improvement in #earnings expectations since at least 1986. The year isn’t over yet! #macro #markets pic.twitter.com/zJWRU9cZRF

— Michael Kantrowitz, CFA (@MichaelKantro) September 15, 2021

The Bad News

Earnings revisions are already showing signs of peaking

And investor sentiment is dropping

Sentiment unwind is happening, fast: AAII bears rise to highest level since Oct 2020, bulls drop to lowest level since Jul 2020. pic.twitter.com/PeXnNZ6vt7

— Willie Delwiche (@WillieDelwiche) September 16, 2021

The State Of The Market

It’s been a while since we’ve seen a 5% pullback

This Ain't It

"The index has been within 5% of its all-time high for the last 220 days. This streak, which looks like it’s coming to an end, is the 8th longest, going back to 1950."https://t.co/a6Lv94MDZG

by @michaelbatnick pic.twitter.com/PMFZpG7HOO

— Ritholtz Wealth (@RitholtzWealth) September 20, 2021

$SPY volume (the People's Fear Gauge) was over $70b today, well into the freak out zone. The last time $SPY traded this much was March 2020. Altho it's had a couple spasms since and nothing much came of it. The key is whether this volume is sustained vs one-off. Tomorrow imp. pic.twitter.com/bBs20KFCIr

— Eric Balchunas (@EricBalchunas) September 20, 2021

China fears, and most notably the impending default of Evergrande, are a big reason why

🇨🇳 #China | #Evergrande Tumbles Further After S&P Says Default Is Likely – Bloomberg

*Link: https://t.co/B4XfD7czaZ pic.twitter.com/4EvMjJlWns— Christophe Barraud🛢 (@C_Barraud) September 21, 2021

Here’s a good thread digging deeper on Evergrande

Evergrande is the train wreck that the financial world and media can’t help but watch.

Here’s breakdown on the story: pic.twitter.com/P9ncxSFWW9

— Sahil Bloom (@SahilBloom) September 20, 2021

Be weary of the Lehman comparisons

— Urban Carmel (@ukarlewitz) September 21, 2021

And supply shortages are getting worse and worse

How backed up is global trade?

The number of container ships waiting to enter LA and Long Beach reached an all-time high of 65 vessels yesterday.

The cargo stuck on those ships would stretch halfway across the country if lined up end to end per @business. pic.twitter.com/rv4E0h8C7S

— Morning Brew ☕️ (@MorningBrew) September 17, 2021

If anything, supply chain disruptions are getting worse, not less! Container rates, chart via @benbreitholtz pic.twitter.com/YXHxKxUl5L

— jeroen blokland (@jsblokland) September 17, 2021

US supply-chain bottlenecks persist. pic.twitter.com/F5tHlx7Oqj

— (((The Daily Shot))) (@SoberLook) September 16, 2021

And options expiring are playing a role

Wild x 2: Short term options – maturing in two weeks or less – also account for 71 per cent of all equity option volumes. pic.twitter.com/3zcvANi7BG

— Robin Wigglesworth (@RobinWigg) September 17, 2021

Like clockwork.

(via @jkrinskypga)pic.twitter.com/CwKUeXXmvj

— Carl Quintanilla (@carlquintanilla) September 17, 2021

Digital Bananas!

This Cyberkong (#670) sold for $3,178 in June. Today, it sold for $356,291.

Each original Cyberkong generates 10 bananas a day for its owner. Each banana is currently worth $45.15 and the market cap on bananas alone is $5.24 million.

This is getting tougher to follow. pic.twitter.com/GKyAL36eOW

— Darren Rovell (@darrenrovell) September 16, 2021

Charts Of The Week

The housing crisis is a global phenomenon. pic.twitter.com/5SkYd09io0

— Steve Saretsky (@SteveSaretsky) September 20, 2021

and by popular demand if you miss best 10 and worst 10 days you beat the market by a bit. pic.twitter.com/P7CK3vfnZa

— David Taggart-PDMacro.com (@DavidTaggart) September 17, 2021

Missing out on bull markets is FAR more costly than holding throughout bear markets pic.twitter.com/kjcwrAEuKA

— Brian Feroldi (@BrianFeroldi) September 18, 2021

second mover advantage pic.twitter.com/RYlTHYkzv4

— Callum Thomas (@Callum_Thomas) September 17, 2021

Today's valuations are still below those of the tech bubble and nifty fifty. These comparisons are interesting, but also lead people to believe we should brace for impact. Instead, brace with diversification. pic.twitter.com/M6hhxB3JtY

— Liz Young (@LizYoungStrat) September 17, 2021

Maybe we shouldn't have illustrated this as a pyramid lol https://t.co/PyUApzxrJu

— Frank Chaparro (@fintechfrank) September 16, 2021

Make sure that you own the 1.5% of all stocks that generate #wealth.

The trick is being lucky enough to #pick which stocks will be THOSE stocks over the next 30-years. @RealInvAdvice @soberlook pic.twitter.com/4eNzgb9osb— Lance Roberts (@LanceRoberts) September 17, 2021

Disclosure

Clear Rock Advisors, LLC is registered with the SEC as a registered investment advisor with offices in Texas. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy (including the investments and/or investment strategies recommended and/or undertaken by Clear Rock Advisors, LLC) or any investment-related or financial planning consulting services will be profitable, equal any corresponding indicated historical performance level(s), or prove successful. It remains the client’s responsibility to advise Clear Rock Advisors, LLC, in writing, if there are any changes in the client’s personal/financial situation or investment objectives for the purpose of reviewing, evaluating or revising Clear Rock Advisors, LLC’s previous recommendations and/or services, or if the client would like to impose, add to, or modify any reasonable restrictions to Clear Rock Advisors, LLC’s services. A copy of Clear Rock Advisors, LLC’s current written disclosure statement discussing its advisory services and fees are available upon request.