October 18, 2022

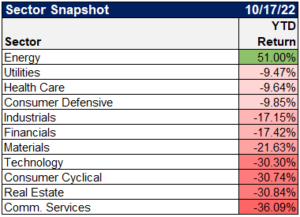

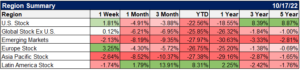

Market Performance (YTD)

Source: YCharts

Disclaimer: Past performance is no guarantee of future performance

Another hot inflation read, this one led by notably higher core inflation. Core inflation up 6.6% & 0.6% on a y/y & m/m basis, respectively. Stock futures flipped from up +1% to down 2% in a jiffy. pic.twitter.com/VgAYSrRVuc

— Liz Young (@LizYoungStrat) October 13, 2022

Year-on-year inflation is now mostly a core services story—rising prices for housing and consumer services are now responsible for half of total headline inflation, about as much as core goods, energy, and food combined. pic.twitter.com/uTiyXT2My4

— Joey Politano 🏳️🌈 (@JosephPolitano) October 13, 2022

Here is core goods and core services by month and also the 12 month changes–with core services finally equally core goods. Presumably more room for goods to slow or even fall (although new car prices should stay high/rising). pic.twitter.com/aX68whvuyS

— Jason Furman (@jasonfurman) October 13, 2022

Sorry to be a broken record here, but my take-verging-on-conspiracy -theory is that Fed policy is being largely driven by a "housing inflation" figure that we don't really know how to measure accurately in real-time. Like driving through a minefield with five broken dashboards. pic.twitter.com/yvZIxzAbAZ

— Derek Thompson (@DKThomp) October 13, 2022

The inflation chart that matters for dilettantes like me. Good news: we saw some improvement in the most useful metrics, median & trimmed mean (blue & orange). Bad news : even if the improvement is "real" and not monthly noise, key metrics are running far far far above target. pic.twitter.com/wN9vvjWBJ5

— Guy Berger (@EconBerger) October 13, 2022

Here's an update of the forward path for YoY CPI after the September 0.4% MoM print. Fed Funds Futures are now pricing a peak Fed Funds Rate of 4.9% from March-May 2023.

Look on the bright side, any headline MoM print below 0.7% next month gets the YoY number into the 7s. pic.twitter.com/UJJq1qGM59

— Bespoke (@bespokeinvest) October 13, 2022

New job postings — a more volatile measure — also rose over the week and are 62.9% above their Feb 1, 2020 level.

This measure is up ~2.2% over the past 28 days but has trended downward for most of this year. pic.twitter.com/bvQqJyNECk

— Nick Bunker (@nick_bunker) October 18, 2022

Wall St chiefs on the US economy

BofA's Moynihan: Consumers are spending, they have money, they are employed and they have good credit

JPM's Dimon: Consumers are in very good shape, companies are in very good shape

Citi's Fraser: The US economy remains relatively resilient

— Jonathan Ferro (@FerroTV) October 17, 2022

#Core retail sales growth is slowing of course but it is still higher than many cycle’s peak #growth rates. That doesn’t exactly sound like data pushing the #Fed to “pivot” anytime soon. pic.twitter.com/Qi3QUMsjZ3

— Richard Bernstein Advisors (@RBAdvisors) October 14, 2022

Social Security benefits will increase 8.7% next year https://t.co/FwknEaotg9 by @KerryHannon pic.twitter.com/NTkga3PS6m

— Yahoo Finance (@YahooFinance) October 13, 2022

At a drawdown of 28%, the stock market has now priced in 85% of a typical bear market (-33%), and 78% of a recession (-35%). pic.twitter.com/9RBP9Kg0nA

— Jurrien Timmer (@TimmerFidelity) October 17, 2022

The models by Bloomberg economists Anna Wong and Eliza Winger forecast a higher recession probability across all timeframes, with the 12-month estimate of a downturn by Oct. 2023 hitting 100%, up from 65% for the comparable period in the previous update https://t.co/dnQWwwmg0U pic.twitter.com/az4PSurqll

— Bloomberg (@business) October 17, 2022

Disclosure

Clear Rock Advisors, LLC is registered with the SEC as a registered investment advisor with offices in Texas. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy (including the investments and/or investment strategies recommended and/or undertaken by Clear Rock Advisors, LLC) or any investment-related or financial planning consulting services will be profitable, equal any corresponding indicated historical performance level(s), or prove successful. It remains the client’s responsibility to advise Clear Rock Advisors, LLC, in writing, if there are any changes in the client’s personal/financial situation or investment objectives for the purpose of reviewing, evaluating or revising Clear Rock Advisors, LLC’s previous recommendations and/or services, or if the client would like to impose, add to, or modify any reasonable restrictions to Clear Rock Advisors, LLC’s services. A copy of Clear Rock Advisors, LLC’s current written disclosure statement discussing its advisory services and fees are available upon request.