March 15, 2023

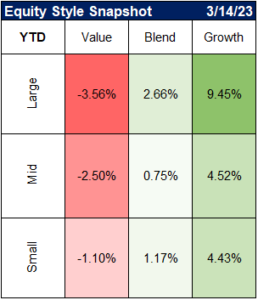

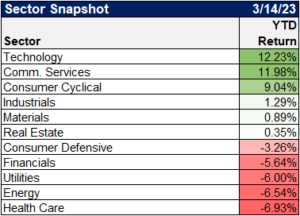

Market Performance (YTD)

Source: YCharts

Disclaimer: Past performance is no guarantee of future performance

Look at that policy path repricing!

From the gray bars at the beginning of last week to the blue bars today (now a sub<5% terminal rate and 100 bps of cuts starts in June), a huge shift in expectations for Fed rates. pic.twitter.com/Qc8P0hQdZp— Cameron Dawson (@CameronDawson) March 13, 2023

Just an interesting stat. I guess I would say that nothing good is going on when this type of stuff happens. Going to see a lot of firsts this year and next I suspect. pic.twitter.com/YMhCmerbu0

— Francois Trahan (@FrancoisTrahan) March 13, 2023

Feb headline CPI in-line at 0.4% (m/m) & 6.0% (y/y), core a bit higher at 0.5% m/m vs 0.4% est. Somewhat worrying trend is that core services ex-housing (aka "supercore") continued to move up m/m. That's what the Fed is 👀, futures say a 25bp hike has a 76% chance. pic.twitter.com/yggFvfQZvu

— Liz Young (@LizYoungStrat) March 14, 2023

Today's #JobsReport is the best of all worlds:

– slower but still robust job growth

– the 3rd increase in labor force participation in a row

– slower wage growthHigher participation makes it easier for companies to fill open roles without inflationary wage increases.

— Julia Pollak (@juliaonjobs) March 10, 2023

JPMORGAN: SVB “was in a league of its own,” with an “unusually high reliance on corporate/VC funding .. and very low reliance on stickier retail deposits .. Bottom line: $SIVB carved out a distinct and riskier niche .. setting itself up for large potential capital shortfalls ..” pic.twitter.com/8JRHRk1YXe

— Carl Quintanilla (@carlquintanilla) March 12, 2023

SVB is/was not like the others because a prudent bank hedges interest rate risks. SVB did not.

Chart from JPAM / Michael Cembalest pic.twitter.com/qfm6MbM0Oz

— AndreasStenoLarsen (@AndreasSteno) March 11, 2023

This is a roadmap to why some regional banks were selling off disproportionately today. This is a measure of unrealized losses on banks' available for sale securities as a proportion of the firms' equity. via @DavidInglesTV pic.twitter.com/Eknp5pXlV7

— Lisa Abramowicz (@lisaabramowicz1) March 14, 2023

Today's surge in U.S. high-yield bond spreads was the biggest one day pop since March 2020. pic.twitter.com/eP5QLqeSqC

— Lisa Abramowicz (@lisaabramowicz1) March 14, 2023

Here's an explainer on the term facility that the Fed just rolled out pic.twitter.com/q46ITyomZ9

— Ben Eisen (@BenEisen) March 12, 2023

Zooming out, it's the 2nd worst day of underperformance since the financial crisis pic.twitter.com/xBsGTMqEZk

— Joe Weisenthal (@TheStalwart) March 13, 2023

I've removed the paywall on this one https://t.co/JwKSTcndM3

— Marc Rubinstein (@MarcRuby) March 10, 2023

Jobs growth has now exceeded consensus forecasts 11 months in a row, which should basically be impossible.

Probability = 0.5^11 = an 0.05% chance.

Or these aren't independent draws, and too many have underestimated this economy for too long. (Not me.)https://t.co/1rezYFKclN

— Justin Wolfers (@JustinWolfers) March 10, 2023

Disclosure

Clear Rock Advisors, LLC is registered with the SEC as a registered investment advisor with offices in Texas. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy (including the investments and/or investment strategies recommended and/or undertaken by Clear Rock Advisors, LLC) or any investment-related or financial planning consulting services will be profitable, equal any corresponding indicated historical performance level(s), or prove successful. It remains the client’s responsibility to advise Clear Rock Advisors, LLC, in writing, if there are any changes in the client’s personal/financial situation or investment objectives for the purpose of reviewing, evaluating or revising Clear Rock Advisors, LLC’s previous recommendations and/or services, or if the client would like to impose, add to, or modify any reasonable restrictions to Clear Rock Advisors, LLC’s services. A copy of Clear Rock Advisors, LLC’s current written disclosure statement discussing its advisory services and fees are available upon request.