January 26, 2022

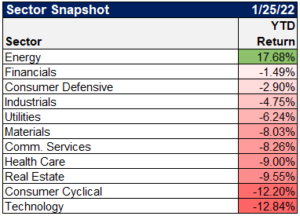

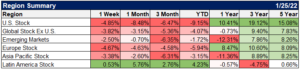

Market Performance (YTD)

Source: YCharts

Disclaimer: Past performance is no guarantee of future performance

What’s happened in 2022?

It’s been a tough start for equities

S&P 500: 2022 vs. the Past pic.twitter.com/bwKKibyR6c

— Michael McDonough (@M_McDonough) January 24, 2022

“The S&P 500 has dropped 11% — heading into correction territory — in the first 16 trading days of 2022 in its worst-ever start to a year, according to Bloomberg data that goes back over nine decades”@luwangnyc @emily_graffeo https://t.co/Qz8FUiJwMk pic.twitter.com/CN6gpT9y3C

— Jonathan Ferro (@FerroTV) January 24, 2022

Especially tech stocks

NASDAQ 100 is having its worst month since October 2008

[Past performance is no guarantee of future results] pic.twitter.com/1bfINUpmLr— Liz Ann Sonders (@LizAnnSonders) January 24, 2022

On the Nasdaq exchange, 42% of stocks have now been cut in half from their 52-week highs.

Since the 2008 financial crisis, only Mar 12 – Apr 8, 2020, saw more stocks down 50% or more.

— SentimenTrader (@sentimentrader) January 21, 2022

And also a tough start for bonds

Investment-grade bonds are having their worst start to the year in at least two decades, with a loss of 2.2% since the start of the year. https://t.co/joBIdZ8gNE

— Lisa Abramowicz (@lisaabramowicz1) January 20, 2022

And volatility is rising, though from a relatively muted level

Holy moly, $SPY traded over $100b worth of shares for only second time ever (3/2/2020 was other time), which is more than top 4 stocks combined. And $QQQ smashed its record with $66b (set Fri lol). If you combine the two, they did $170b, which is all time record, here's chart: pic.twitter.com/4QfhFeAkVx

— Eric Balchunas (@EricBalchunas) January 24, 2022

VIX threatened to break 40 intraday yesterday, reaching as high as 38.94 as S&P 500 carved through a nearly 200-point range (roughly 5%) between day’s highs and lows – widest since March 2020

@SPDJIndices pic.twitter.com/OTCP5GfVRa— Liz Ann Sonders (@LizAnnSonders) January 25, 2022

It’s been a tough couple of weeks, but also equally as strange

First time in over 20 years that the Nasdaq was up 1%+ intraday and finished down more than 1% on back to back days.

— Bespoke (@bespokeinvest) January 20, 2022

First time the Dow has reversed a 1,000+ point drop to close higher on the day.

— Bespoke (@bespokeinvest) January 24, 2022

Updated through yesterday, January is now on pace to be the worst month for last-hour trading since October 1987. https://t.co/H4p1RcpfIn pic.twitter.com/vQ0k5xVWgA

— Bespoke (@bespokeinvest) January 21, 2022

In case you were wondering, since at least 1984, the S&P 500 has never erased 2%+ declines and finished higher two days in a row.

— Bespoke (@bespokeinvest) January 25, 2022

6th time the Nasdaq has reversed a 4%+ intraday drop to close higher (since '88).

Other days:

10/28/97

10/26/00

7/15/02

10/10/08

11/13/08— Bespoke (@bespokeinvest) January 24, 2022

Okay, so why is this happening?

Momentum is slowing

“Forward estimates are also trending weaker than prior COVID quarters… We expect forward earnings to be revised lower on continued margin pressure, particularly from rising wage pressure” – BofA pic.twitter.com/XFYYhbVMiR

— Sam Ro 📈 (@SamRo) January 25, 2022

GDP estimates for 1Q2022 getting cut … per @Bloomberg consensus, estimate is now for 2.9% q/q annualized growth, down from nearly 4.5% in November pic.twitter.com/GJjtvPBxSu

— Liz Ann Sonders (@LizAnnSonders) January 19, 2022

🇺🇸Flash @IHSMarkitPMI US Composite Output Index fell to 50.8 (-6.2pt): 18-month low

⬇️Services 50.9 (-6.7pt): 18-month low

⬇️Manufacturing 55.0 (-2.7pt): 15-month low pic.twitter.com/IgcqLFlGpx— Gregory Daco (@GregDaco) January 24, 2022

Rough start to the new year: January Empire #Manufacturing Index shows a huge drop in economic activity. pic.twitter.com/lB04SK4DHR

— Kathy Jones (@KathyJones) January 18, 2022

Disappointing Markit #PMIs for services are adding to the market's sour mood. The #Fed will have to balance high #inflation w/signs of slowing in the economy and downturn in risk appetite. We still see 3 #RateHikes this year and a measured approach to reducing the balance sheet pic.twitter.com/q5BAxmZ7Ds

— Kathy Jones (@KathyJones) January 24, 2022

And this is all happening while inflation remains high and yields continue to rise

US fixed income markets remain on the move. On the day, the 5-10Y part of the curve is moving the most (9-10bp).

But over the last month (21 trading days), the 2-year move is very dramatic, up >30bp, and the biggest move since the Global Financial Crisis (2009). pic.twitter.com/uxoewPbOgH

— Jens Nordvig (@jnordvig) January 18, 2022

U.S. 10-year yields are on track for their fastest monthly increase since November 2016, with traders betting the Fed will soon make its first 50bp rate hike since 2000. https://t.co/siuWDkHtFE

— Lisa Abramowicz (@lisaabramowicz1) January 19, 2022

Here’s what an optimist might say

Credit spreads aren’t showing signs of panic

On the list of other things to watch: spread between High Yield and the 10Y Tsy. At 3.1% today, up from 2.7% to start the year. Bond market not showing as much stress as equities. pic.twitter.com/sRVQQbXHDl

— Liz Young (@LizYoungStrat) January 24, 2022

And leading indicators remain high

LEADING indicators actually accelerated a bit and strongest in 4 months. Hard to see the #economy in peril when leading #indicators are heading upward. pic.twitter.com/JQo0nYZa7B

— Richard Bernstein (@RBAdvisors) January 21, 2022

And inflation might be peaking

Repeat. Inflation has peaked. More supply coming as demand decelerates in 2022. #inflation #macro thx @BittelJulien !! https://t.co/mSPbW5V3iy

— Michael Kantrowitz, CFA (@MichaelKantro) January 20, 2022

You want a decent predictor of inflation in 4-6 quarters from now?

Here you go.In May 2020, my prop G5 Credit Impulse indicator was screaming 4%+ GDP-weighted global inflation by summer 2021 – check.

Now, it's screaming 1% inflation by Q422. pic.twitter.com/ItVUyCUxdJ

— Alf (@MacroAlf) January 20, 2022

And there’s still a ton of cash out there

The liquidity hand-off from the Fed & US gov’t to corporates & consumers pushed combined consumer and corporate cash to a record $19T+, up 35% from 2019 pic.twitter.com/SiJPGqMzcZ

— Mike Zaccardi, CFA, CMT (@MikeZaccardi) January 20, 2022

And if inflation does continue higher, history says earnings might follow a similar path

CPI vs. S&P 500 NTM EPS, via Credit Suisse pic.twitter.com/KaNUC7YdKG

— Sam Ro 📈 (@SamRo) January 18, 2022

And drawdowns like this are just a part of the process

This is Normalhttps://t.co/NWKIcG628x pic.twitter.com/z9qWIbdqyU

— Ben Carlson (@awealthofcs) January 25, 2022

And maybe the correction has already gone a little too far

More than 85% of Nasdaq 100 $NDX $QQQ stocks are now in a correction.

This is a level of wipeout that has led to a rebound 100% of the time.*

* Assuming one chooses to ignore 2000-02 and 2008. pic.twitter.com/xYVDPONm1g

— SentimenTrader (@sentimentrader) January 26, 2022

Here’s what a pessimist might say

Wages are continuing to rise and are weighing on margins

"What is noteworthy about the higher labor expenses that JPMorgan, Citi, & Goldman talked about in their earnings calls is that the wage gains are now reaching the upper echelons of the pay scale and it's not just a minimum wage and leisure and hospitality influence:" @pboockvar https://t.co/qWORMIsQok

— Lisa Abramowicz (@lisaabramowicz1) January 19, 2022

LMFAOOO MCDONALDS IS STRUGGLING 😭 pic.twitter.com/Zh7wLooxg1

— kira 👾 (@kirawontmiss) January 22, 2022

Wages 🚀🚀🚀@thedailyshot pic.twitter.com/Q4PRH4KfXZ

— Win Smart, CFA (@WinfieldSmart) January 18, 2022

And consumer sentiment remains low

Once upon a time plummeting consumer confidence was at times a leading indicator for the direction of U.S stocks. https://t.co/2TclKWVaEp

— Avid Commentator 🇦🇺 (@AvidCommentator) January 19, 2022

And the recent action is historically not great

Today the NASDAQ reversed a >4% intraday loss to close the day higher. Here are the other times that happened and the fwd returns in x+# of days.

The main takeaway is this is bear market stuff. Not bullish.

inspired by a tweet from @bespokeinvest HT Gitt pic.twitter.com/YmsrvXliVK

— ʎllǝuuop ʇuǝɹq (@donnelly_brent) January 24, 2022

And the fed is set to begin tightening into an economy that is losing some momentum

Tightening into a slowdown… Déjà vu? pic.twitter.com/pczXzMVSxb

— Julien Bittel, CFA (@BittelJulien) January 22, 2022

Meanwhile, a positive development: China

Hang Seng China Enterprises Index closes above 100-DMA for the first time in nine months.

Short squeeze or start of an epic rally? pic.twitter.com/pv9D5hQ18i

— David Ingles (@DavidInglesTV) January 21, 2022

Chinese stocks listed in the US set to outperform NASDAQ for fourth week. Last time that happened was about a year and half back, well before the regulatory squeeze on Chinese tech. pic.twitter.com/o1ovWdqwSx

— David Ingles (@DavidInglesTV) January 20, 2022

China cuts benchmark interest rate -10bps to 3.70%

i.e. the 1-year LPR [Loan Prime Rate]. n.b. the PBOC also cut the 5-year loan prime rate by -5bps to 4.6%

This cements the pivot to easing: follows a -5bp cut in December last year. pic.twitter.com/jJ3KmAMg3h

— Topdown Charts (@topdowncharts) January 20, 2022

🇨🇳 Credit Impulse higher in December.

Supportive for EM vs. DM equities in ‘22. pic.twitter.com/TRBA8uAJ4j

— Julien Bittel, CFA (@BittelJulien) January 17, 2022

China : better numbers everywhere. Even in real estate…

Buying Chinese equities ? #MondayMotivation

G from @PkZweifel pic.twitter.com/zm3JWq1t7o— Frédéric Rollin (@RollinFrederic) January 17, 2022

Charts Of The Week

"S&P 500 P/E is typically flat during 12 months around the first hike" – GS pic.twitter.com/A5KZDIJfD0

— Sam Ro 📈 (@SamRo) January 17, 2022

The amount of people applauding players changing their salary into Bitcoin as if they were heroes has been comical.

Rams WR Odell Beckham Jr., at least in the moment, provides a cautionary tale. pic.twitter.com/uW0QDdJrYy

— Darren Rovell (@darrenrovell) January 23, 2022

"We estimate that the US dollar’s appreciation over the past six months has cost us roughly $1 billion in expected 2022 revenue" $NFLX

— Jerry Capital (@JerryCap) January 20, 2022

This should make sense. Just like a bond, as the yield on the S&P has fallen, duration has risen.

Volatility around rate movements could be uncomfortable.

H/t @SoberLook pic.twitter.com/XPoYb1VjcE— Chris D’Agnes, CFA (@ChrisDagnes) January 20, 2022

At current inflation levels, the S&P 500 P/E ratio should be much lower.

Source: @Cresset_Capital, @JackAblin pic.twitter.com/qIgPxbQk4W

— (((The Daily Shot))) (@SoberLook) January 20, 2022

Yes, the S&P 500 is concentrated in five names. But these five names are more like 35 names. Customers use these businesses in way more than five ways. https://t.co/3PyiA8ygQy

— Sam Ro 📈 (@SamRo) January 20, 2022

The U.S. Agg. #Bond index has now seen a peak to trough decline/drawdown of -4.3%.

This is the 7th drawdown this size over the last 20+ years.

When high quality #bonds are ⬇️ 4-5%, historically this has represented a better entry point than time to exit. 🤔 @FactSet chart 👇 pic.twitter.com/WszEbYATGR

— Matthew Miskin, CFA (@matthew_miskin) January 19, 2022

Patrick Mahomes has had the greatest start to an NFL career we have seen, by far#nflverse pic.twitter.com/wmBmSqHqVf

— Jack Lichtenstein (@jacklich10) January 24, 2022

KC 1st & 10 at BUF 31

Q4 (0:02) H.Butker 49 yard field goal is GOOD, Center-J.Winchester, Holder-T.Townsend.

BUF 36 @ KC 36

KC: 51.3% (-106)

BUF: 48.7% (+106) pic.twitter.com/m9M7rNya8o— NFL Win Probability Bot (@nfl_win_bot) January 24, 2022

Disclosure

Clear Rock Advisors, LLC is registered with the SEC as a registered investment advisor with offices in Texas. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy (including the investments and/or investment strategies recommended and/or undertaken by Clear Rock Advisors, LLC) or any investment-related or financial planning consulting services will be profitable, equal any corresponding indicated historical performance level(s), or prove successful. It remains the client’s responsibility to advise Clear Rock Advisors, LLC, in writing, if there are any changes in the client’s personal/financial situation or investment objectives for the purpose of reviewing, evaluating or revising Clear Rock Advisors, LLC’s previous recommendations and/or services, or if the client would like to impose, add to, or modify any reasonable restrictions to Clear Rock Advisors, LLC’s services. A copy of Clear Rock Advisors, LLC’s current written disclosure statement discussing its advisory services and fees are available upon request.