December 14, 2021

Market Performance (Last Week)

Source: YCharts

Disclaimer: Past performance is no guarantee of future performance

The Good News

Household net worth has skyrocketed

Growth in household net worth in current expansion has been rapid at +19.6% annualized; in prior expansion, rate was much more tame at +6.5% annualized pic.twitter.com/8XmkUxjuMp

— Liz Ann Sonders (@LizAnnSonders) December 10, 2021

Strong growth expected to continue next year

Even with a difficult comparison to 2021, analysts expect $SPX to report earnings growth of 9.0% and revenue growth of 7.3% in 2022. https://t.co/eaPj9wbKL5 pic.twitter.com/uEZy8BeTcl

— FactSet (@FactSet) December 10, 2021

And initial jobless claims are now very, very low

US Jobless Claims hit their lowest levels since 1969.

The US population in 1969 was 203 million. Today it's 333 million. If you adjust for this population increase, jobless claims have never been lower than they are today.

Charting via @ycharts pic.twitter.com/Zl2PVilySm

— Charlie Bilello (@charliebilello) December 9, 2021

The Mixed News

Inflation is high, but last Friday’s report was in line with expectations

Estimate was right on the money, market is so far happy with the lack of surprise. Nov CPI +6.8% y/y. All major components up, highest headline number since June 1982. pic.twitter.com/xPkFuAwY3O

— Liz Young (@LizYoungStrat) December 10, 2021

And here’s what’s leading the inflation charge

Inflation in November hit 6.8%. Here are the biggest annual increases:

Gas +58%

Rental car 37%

Used car 31%

Hotels 26%

Steak 25%

Utilities 25%

Bacon 21%

Pork 17%

Furniture 12%

Fish 11%

New cars 11%

Chicken 9%

Bikes 9%

Eggs 8%

Coffee 7.5%

Apples 7%

Milk 7%

Flour 6%

Rent 3.5%— Heather Long (@byHeatherLong) December 10, 2021

And there’s good reason to believe rent is actually understated right now (thread)

Reported inflation is understated. Owners’ Equivalent Rent (OER) relies on owner surveys to estimate inflation in housing costs. This is an extremely imprecise metric. The single family rental market provides more accurate data. OER in today’s reported core CPI was 3.5% YoY.

— Bill Ackman (@BillAckman) December 10, 2021

The Bad News

Although increasing, wage growth is still shy of recent inflation numbers

Wages are increasing at a rapid pace in the U.S., but they're still not keeping pace with consumer price inflation. U.S. real average hourly earnings are still deeply negative. pic.twitter.com/IQ7QjzDGdJ

— Lisa Abramowicz (@lisaabramowicz1) December 10, 2021

But with the unexpected rise in job openings & record high profit margins, there’s still room for higher wage increases

With job openings on the rise, #hiring should follow. #JOLTS pic.twitter.com/TdJDRddjfm

— Kathy Jones (@KathyJones) December 8, 2021

And PPI came in much higher this morning

'Prices paid to U.S. producers posted a record annual increase of almost 10% in November, a surge that will sustain a pipeline of inflationary pressures well into 2022.' https://t.co/kgXEe3wWTs pic.twitter.com/2Wjl4O8pIs

— Jesse Felder (@jessefelder) December 14, 2021

The State Of The Market

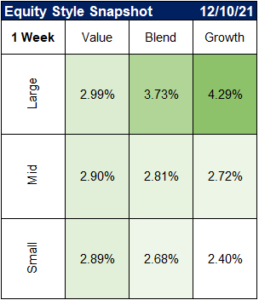

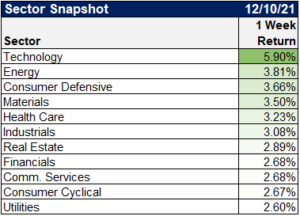

Last week was very strong

this is the best week for the S&P 500 since February pic.twitter.com/klC36EPmA4

— Katie Greifeld 🎄 (@kgreifeld) December 10, 2021

But it’s been pretty concentrated

According to $GS, 3️⃣5️⃣% of the $SPX YTD return has come from just 5 stocks: $TSLA $NVDA $GOOGL $MSFT and $AAPL pic.twitter.com/UpcD5afakJ

— 𝐁𝐫𝐚𝐧𝐝𝐨𝐧 𝐕𝐚𝐧 𝐙𝐞𝐞 (@BrandonVanZee) December 12, 2021

The Top 10 companies in the S&P500 are up 20% over the past six months. An index for the remaining 490 companies is up only 5%. This chart tells the story. pic.twitter.com/JlIQ2eXAwo

— Peter Mallouk (@PeterMallouk) December 10, 2021

1) Once and for all: here are the final numbers. I did them myself under the supervision of two math wizards.

The Nasdaq is up 21.17% YTD.

AAPL, MSFT, GOOGL, TSLA & NVDA are the top 5 return contributors YTD.

Excluding the top 5 contributors, the Nasdaq is up 5.79% this year. pic.twitter.com/QOGMOOSi1H

— Gavin Baker (@GavinSBaker) December 9, 2021

64% of 23% YTD gain in Nasdaq (3780 stocks) down to just 5 stocks:

Microsoft/Google/Apple/Nvidia/Tesla pic.twitter.com/K5yFc9rWn6

— Mike Zaccardi, CFA, CMT (@MikeZaccardi) December 10, 2021

And the weightings of the top 5 just keep going up

Concentration of the 5 largest stocks in the S&P 500 pic.twitter.com/agHkB8sp2t

— Scott Galloway (@profgalloway) December 10, 2021

And it seems like their weightings are decoupling from their earnings contribution

Top 10 SPX weights represent a growing share of the index while their earnings contribution drops. pic.twitter.com/Burr9zauJ4

— Mike Zaccardi, CFA, CMT (@MikeZaccardi) December 12, 2021

So where could we be in the market cycle?

Will the current market cycle, which is about 20 months old, last 4 years too? Our work points to a leadership transition to phase 4 in 2022. #macro #marketcycle #growth $SPY pic.twitter.com/gW1Qi6pIh1

— Michael Kantrowitz, CFA (@MichaelKantro) December 12, 2021

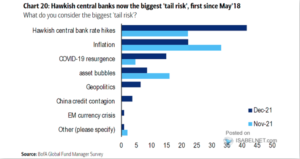

And so now all eyes turn to the Fed

"Investors seem to think there is only one risk that matters: a policy error by central banks. Almost half of those surveyed say this is their major concern, close to the largest reading ever for a top concern:" BofA December credit investor survey

— Lisa Abramowicz (@lisaabramowicz1) December 13, 2021

Central banks on inflation in 2021. pic.twitter.com/foYE9l0wd2

— Gold Telegraph ⚡ (@GoldTelegraph_) December 10, 2021

Charts Of The Week

Your annual reminder that what the stock market does this year tells you essentially nothing about what the stock market will do next year. @ritholtz pic.twitter.com/jnoTK93ANz

— Michael Mauboussin (@mjmauboussin) December 13, 2021

USA now > 60% of global equity market cap. Well done. 🇺🇸🇺🇸🇺🇸 $ACWI pic.twitter.com/4PSbWvpla1

— Mike Zaccardi, CFA, CMT (@MikeZaccardi) December 12, 2021

This graph is very telling https://t.co/Hlpfzmnx7l pic.twitter.com/IEMim3YVBp

— Giles Wilkes (@Gilesyb) December 10, 2021

Mentioned in the FT today by @RobinWigg & @HarrietAgnew "Ark’s Cathie Wood: ‘Queen of the bull market’ faces her toughest test" https://t.co/rLQi4BjqJu pic.twitter.com/Bj7Dvu0DDs

— PensionCraft (@PensionCraft) December 10, 2021

Corporate America better listen up.

88% prefer WFH. pic.twitter.com/1k43XknoeQ

— Mike Zaccardi, CFA, CMT (@MikeZaccardi) December 8, 2021

Disclosure

Clear Rock Advisors, LLC is registered with the SEC as a registered investment advisor with offices in Texas. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy (including the investments and/or investment strategies recommended and/or undertaken by Clear Rock Advisors, LLC) or any investment-related or financial planning consulting services will be profitable, equal any corresponding indicated historical performance level(s), or prove successful. It remains the client’s responsibility to advise Clear Rock Advisors, LLC, in writing, if there are any changes in the client’s personal/financial situation or investment objectives for the purpose of reviewing, evaluating or revising Clear Rock Advisors, LLC’s previous recommendations and/or services, or if the client would like to impose, add to, or modify any reasonable restrictions to Clear Rock Advisors, LLC’s services. A copy of Clear Rock Advisors, LLC’s current written disclosure statement discussing its advisory services and fees are available upon request.