August 9, 2023

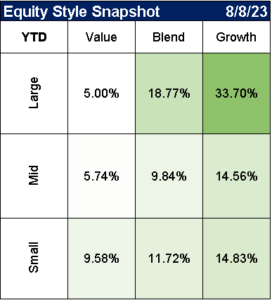

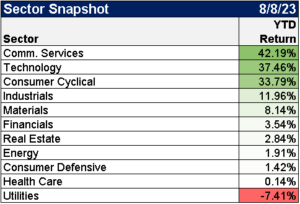

Market Performance (YTD)

Source: YCharts

Disclaimer: Past performance is no guarantee of future performance

There has been an absolutely wild divergence in macro data surprises in the past few months and I am old enough to know that there is no such thing as decoupling… pic.twitter.com/GwE5BIMpkH

— Julia Coronado (@jc_econ) August 2, 2023

Key takeaways from July job report:

1) The economy is humming

2) Job growth is slowing, but solid (+187k jobs now vs. +399k avg. last yr)

3) Service sector is hiring (health, social)

4) Women have done so well they make up 49.9% of workers (!)

5) Wage growth +4.4% y/y is well… pic.twitter.com/jeG0GfdQPW— Heather Long (@byHeatherLong) August 4, 2023

6th consecutive month of negative Nonfarm Payroll revisions (bottom panel). That's occurred twice before: in 2H 2007 and 1H 2002. #hopE pic.twitter.com/4rtC5gBPv1

— Kantro (@MichaelKantro) August 4, 2023

Nothing pointing to an imminent recession in today's jobs report, but the housing industry lost 5,500 residential construction jobs.

This is the worst monthly jobs loss post-COVID.

At that pace, we should be on recession watch next summer (8% drawdown). pic.twitter.com/b8dQJXqGVx

— Warren Pies (@WarrenPies) August 4, 2023

Market-implied inflation expectations over the next 5-10 years have risen to the highest levels in more than a year. Traders are starting to game out a future with sustainably higher inflation and higher long-term bond yields. https://t.co/AX0CQH7Ox3 pic.twitter.com/bP2WVhAWfi

— Lisa Abramowicz (@lisaabramowicz1) August 7, 2023

Real yields on 30-year Treasuries have surged to the highest levels since 2011. pic.twitter.com/yjXFb0Emvr

— Lisa Abramowicz (@lisaabramowicz1) August 4, 2023

Can oil hold above $80? Since falling below $80 in late 2022, that area has served as resistance in 2023. Crude got near or a bit above it on five separate occasions before falling once again. Will this time be different? pic.twitter.com/2Qj15bM6Bz

— Liz Young (@LizYoungStrat) August 3, 2023

The 2-10 yld curve has steepened by 35 bps since July

Most of the steepening has been due to the 10-year rising (bear steepener)

Bear steepeners are rare and usually occur at two distinct points of the cycle:

1) Heading into recession (inverted YC)

2) New expansion (pos YC) pic.twitter.com/ZHsGqtt3y3— 3Fourteen Research (@3F_Research) August 6, 2023

$AAPL worst 2-day performance in 9 months.

SPX is cool with that. pic.twitter.com/XAJthARHvX

— Mike Zaccardi, CFA, CMT 🍖 (@MikeZaccardi) August 7, 2023

This failed breakout from the Tech sector is a problem pic.twitter.com/AfIeLDr018

— Austin Harrison, CFA, CMT (@meanstoatrend) August 7, 2023

BI Market Pulse Index has pushed to manic levels — an early sign that the equity rally might be getting a bit overheated and due for another consolidation phase. The last time the index hit manic was Jan 2023. pic.twitter.com/MKuYJADWqA

— Gina Martin Adams (@GinaMartinAdams) August 2, 2023

Here's how the trend of Nasdaq 100 / Russell 2000 has evolved since the 2000 bubble.

Interesting. pic.twitter.com/0HKDAyZPsJ

— Koyfin (@KoyfinCharts) August 4, 2023

At 40x trail 12m sales, 25x fwd sales, Nvidia is highest valuation stock of any stock in top 500

Odds it out-performs now? 231 companies reached similar multiple last 50+years

Only 20% beat market next 12m.

>90% fail 3/5/10 years.

Median stock loses by 36% next 12m.

🧵👇 pic.twitter.com/ObSjLzuppD— Jeremy Schwartz (@JeremyDSchwartz) July 28, 2023

The Odds Are Stacked Against You

At a 40x trailing and 25 expected Sales, NVDA joined the club of 99 companies with highest P/S multiple within 500 largest stocks in last 60 plus years.

Some stats on winners /losers from these 99 companies that became THE highest multiple stock… pic.twitter.com/2QC7bi9GDG

— Jeremy Schwartz (@JeremyDSchwartz) August 3, 2023

Disclosure

Clear Rock Advisors, LLC is registered with the SEC as a registered investment advisor with offices in Texas. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy (including the investments and/or investment strategies recommended and/or undertaken by Clear Rock Advisors, LLC) or any investment-related or financial planning consulting services will be profitable, equal any corresponding indicated historical performance level(s), or prove successful. It remains the client’s responsibility to advise Clear Rock Advisors, LLC, in writing, if there are any changes in the client’s personal/financial situation or investment objectives for the purpose of reviewing, evaluating or revising Clear Rock Advisors, LLC’s previous recommendations and/or services, or if the client would like to impose, add to, or modify any reasonable restrictions to Clear Rock Advisors, LLC’s services. A copy of Clear Rock Advisors, LLC’s current written disclosure statement discussing its advisory services and fees are available upon request.