August 10, 2022

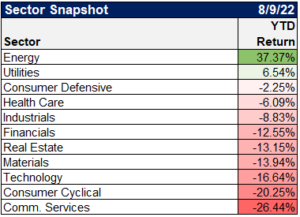

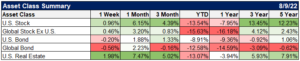

Market Performance (YTD)

Source: YCharts

Jul headline CPI 8.5%, below est of 8.7%. Core CPI 5.9%, below est of 6.1%. It's notable that Core Services decelerated to 0.2%, the lowest since Dec 2021. A small battle won, market clearly celebrating. pic.twitter.com/NMWxixLkT1

— Liz Young (@LizYoungStrat) August 10, 2022

What drove the CPI YoY% Change: {ECAN} pic.twitter.com/VwI0RUXomx

— Michael McDonough (@M_McDonough) August 10, 2022

The U.S. added 528,000 jobs in July and the unemployment rate fell to pre-pandemic levels in a muscle-flexing display for the economy. Yet the robust report could add to inflation worries and push interest rates higher, raising the odds of recession. https://t.co/Vnzd7xYjaG pic.twitter.com/TXisDTUhQE

— MarketWatch Economy (@MKTWeconomics) August 5, 2022

All 22 million jobs that were lost have been made up.

Here's something very interesting. The previous 10 recessions took 29.5 months on average to make up the lost jobs.

This time? 29 months. (insert scary music) pic.twitter.com/hJw2pgEy6E

— Ryan Detrick, CMT (@RyanDetrick) August 5, 2022

Friday’s Jobs Report showed wage inflation remains elevated, at 5.2%. This is the 7th straight month of +5% gains. History shows that Fed Funds on their own never alter the trajectory of wage growth. Only recessions have reduced it.$SPY pic.twitter.com/2xgNGkE1Lo

— DataTrek Research (@DataTrekMB) August 8, 2022

🧵Q2 productivity (-4.6%) & unit labor costs (+10.8%) not painting a great picture. Bumpy series, but even when we smooth it out (5-day MA) it's still not great. Labor costs growing at their fastest rate, while productivity growth at its most negative since early '80s. pic.twitter.com/6acpmo1Ljp

— Liz Young (@LizYoungStrat) August 9, 2022

Emerging theme from earnings reports: it has been such a tough road to staffing up & turnover is still high so firms are reluctant to freeze hiring & plan to use any slowdown to acquire or hold onto top talent. The opposite of the scar tissue from the Great Recession pic.twitter.com/svs1rsgXLz

— Dr. Julia Coronado (@jc_econ) August 1, 2022

The labor force participation rate is 1.3pp below what it was in February 2020.

You would have expected the aging population to lower it 0.4pp over that period.

The other 0.9pp is not explained by standard demographic changes. pic.twitter.com/wWvzoQzXfj

— Jason Furman (@jasonfurman) August 5, 2022

'Only a week ago Powell suggested that the Fed would stop talking so much. Well, that didn't last long. Witness the small army of Fed officials who have fanned out to warn markets that the Chairman didn't mean what he supposedly wasn't saying last week.' https://t.co/z6m63Cpl1D

— Jesse Felder (@jessefelder) August 5, 2022

Rate hike expectations surged in response to the employment report. Here is the probability of a 75 bps hike in September.

Today's issue of The Daily Shot Brief: https://t.co/5UdPqozQTo pic.twitter.com/zZD49odLfC

— Lev Borodovsky (@thedailyshot) August 8, 2022

More context for the yield charts we’ve shared: Markets now expect a higher peak Fed funds rate, pricing in a peak of 3.6% in April 2023. Markets were only pricing in a peak rate of 3.06% last week. #JobsReport pic.twitter.com/DiTooGQbes

— Kathy Jones (@KathyJones) August 5, 2022

The US recession scorecard: more expansionary than recessionary—at least for now… pic.twitter.com/ud7tjp7QQI

— Markets & Mayhem (@Mayhem4Markets) August 7, 2022

Difficult times ahead for the UK. Bank of England raising rates by 50bp — largest hike in nearly 30 years — while predicting a recession with 5 quarters of GDP contraction and inflation peaking close to 14%

Charts via @SoberLook @WellsFargo @commerzbank pic.twitter.com/YRpzpURUOJ

— Gregory Daco (@GregDaco) August 5, 2022

If you thought GameStop was wild, what's happening with this Chinese meme stock will blow your mind.

GameStop peak market capitalization: $24bn

AMTD Digital peak market cap: $450bn pic.twitter.com/fPWFbdI0uS

— Jeff Weniger (@JeffWeniger) August 4, 2022

It's been 50 straight days of gas-price declines in the U.S.: pic.twitter.com/JU88N9Itix

— Lisa Abramowicz (@lisaabramowicz1) August 4, 2022

FUNDSTRAT: Markets are “sniffing out lower inflation well ahead of Fed” — and stocks often bottom six months before the last hike. As a result, “we continue to see 2H 2022 as a rally period, taking the S&P 500 back to >4,800.”

– @fundstrat pic.twitter.com/E8Em6vSQlt

— Carl Quintanilla (@carlquintanilla) August 5, 2022

July saw largest monthly drop for average 30y mortgage rate since December 2008 pic.twitter.com/2wRhTPHy8f

— Liz Ann Sonders (@LizAnnSonders) August 5, 2022

The New York Fed recently developed a very cool index that measures the health of the Global Supply Chain.

In 2022, the situation has been steadily improving with July being the first month where the decline was uniform across index subcomponents. pic.twitter.com/3zFb05HxEL

— Alf (@MacroAlf) August 8, 2022

The #ECB's 'game' is pretty obvious! pic.twitter.com/f9L2HBXNHd

— jeroen blokland (@jsblokland) August 8, 2022

Disclosure

Clear Rock Advisors, LLC is registered with the SEC as a registered investment advisor with offices in Texas. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy (including the investments and/or investment strategies recommended and/or undertaken by Clear Rock Advisors, LLC) or any investment-related or financial planning consulting services will be profitable, equal any corresponding indicated historical performance level(s), or prove successful. It remains the client’s responsibility to advise Clear Rock Advisors, LLC, in writing, if there are any changes in the client’s personal/financial situation or investment objectives for the purpose of reviewing, evaluating or revising Clear Rock Advisors, LLC’s previous recommendations and/or services, or if the client would like to impose, add to, or modify any reasonable restrictions to Clear Rock Advisors, LLC’s services. A copy of Clear Rock Advisors, LLC’s current written disclosure statement discussing its advisory services and fees are available upon request.