August 31, 2021

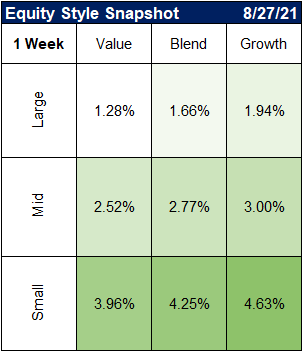

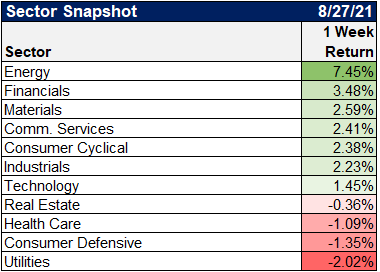

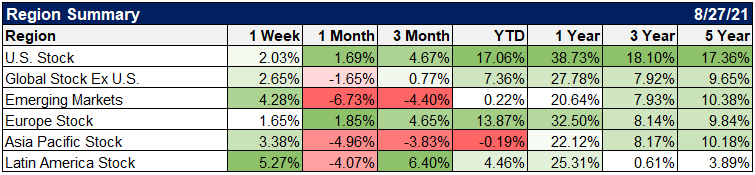

Market Performance For The Prior Week

Source: YCharts

Disclaimer: Past performance is no guarantee of future performance

The Good News

Q2 GDP revised upwards

BREAKING! US Q2 #GDP growth revised upward to 6.6% (was 6.5%). pic.twitter.com/OLlX6a0lGS

— jeroen blokland (@jsblokland) August 26, 2021

The Mixed News

Earnings revisions and surprises are at, or nearing, a record

Records are Records for a reason. pic.twitter.com/xcaBFZEb1E

— Lance Roberts (@LanceRoberts) August 26, 2021

The Bad News

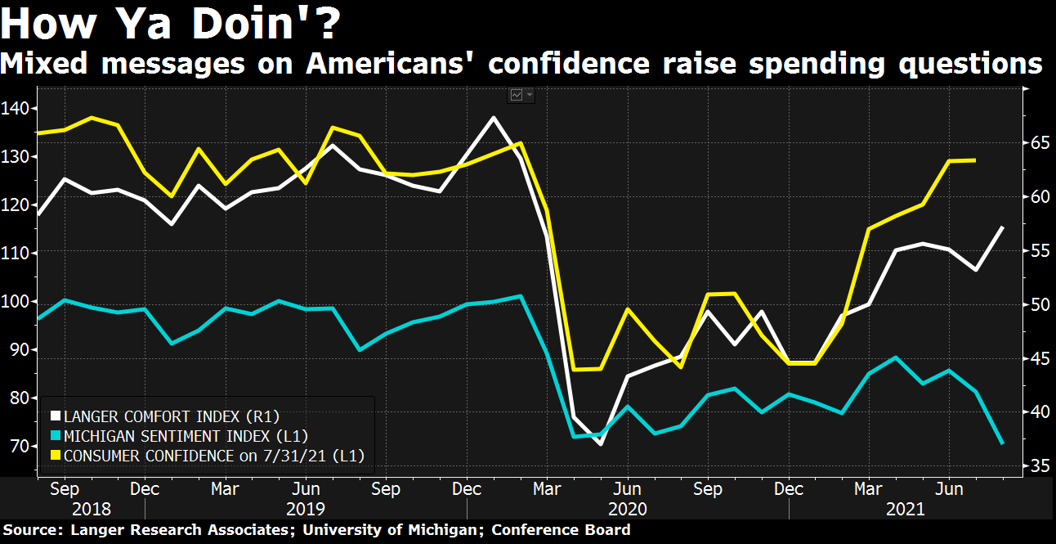

Consumer confidence is going in the wrong direction – and quickly

Final reading from @UMich for consumer sentiment in August fell to 70.3 vs. 70.8 est, down from 81.2 in prior month…a near decade low pic.twitter.com/qPUh1RCAba

— Liz Ann Sonders (@LizAnnSonders) August 27, 2021

Which is starting to raise spending questions

Source: Bloomberg

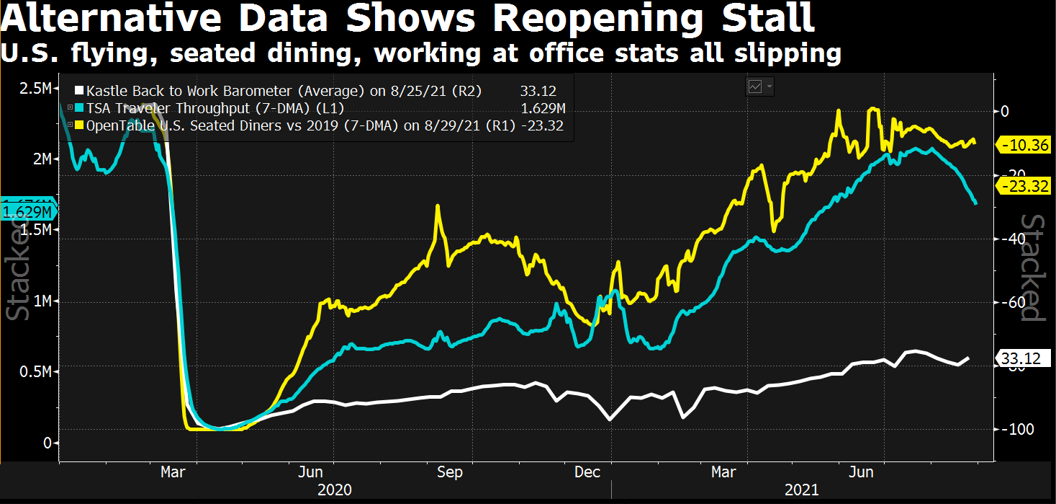

And we have already seen some figures stalling

Source: Bloomberg

And the supply chain crunch will be around for a while longer

A supply chain crunch that was meant to be temporary now looks like it will last well into next year. The cost of sending a container from Asia to Europe is about 10 times higher than in May 2020. The cost from Shanghai to LA has grown more than sixfold, https://t.co/q8Xd3X8l7N

— Lisa Abramowicz (@lisaabramowicz1) August 26, 2021

The State Of The Market

Markets continue to go up

2021 currently tied in 4th with 2014 on leaderboard for most closing highs in any year; only 10 more highs before year ends required for spot in top 3; 1995’s total of 77 new highs provides number to beat for all-time record

@SPDJIndices @hsilverb pic.twitter.com/Xvu0uLCESp— Liz Ann Sonders (@LizAnnSonders) August 31, 2021

Stat(s) of the day via @MarketWatch…

S&P 500 has posted *53* record closes this yr.

Year-to-date return = approx 21%, on track for largest Jan-Aug gain since *1997*.

Over past 50yrs, average gain during same period = 6%.

Index has yet to experience 5% pull back this yr.

— Nate Geraci (@NateGeraci) August 31, 2021

12 new all-time highs for the S&P 500 in August.

This tops the previous record set in 1929.

No, we don't think now is like 1929, but this is still amazing. pic.twitter.com/Fekl6EMGzP

— Ryan Detrick, CMT (@RyanDetrick) August 30, 2021

The 'EVERYTHING RALLY' is now the longest on record! The average Sharpe ratio across the spectrum of assets has been above 1-to-1 for 270 straight trading days.

Such tightly packed risk-adjusted returns have only occurred ahead of the onset of tightening cycles (2004 and 2015). pic.twitter.com/6eaNRS8R83

— Ben Breitholtz (@benbreitholtz) August 30, 2021

And the US is leading the way

US economy wins G-7 race to return to normal, leaving behind European peers that suffered sharper Covid contractions. Acc to OECD’s Q2 GDP data, its 38 members as whole haven’t reached pre-crisis readings. UK has largest gap to close to get back to pre-pandemic levels. (via BBG) pic.twitter.com/ZoFNpjAznR

— Holger Zschaepitz (@Schuldensuehner) August 30, 2021

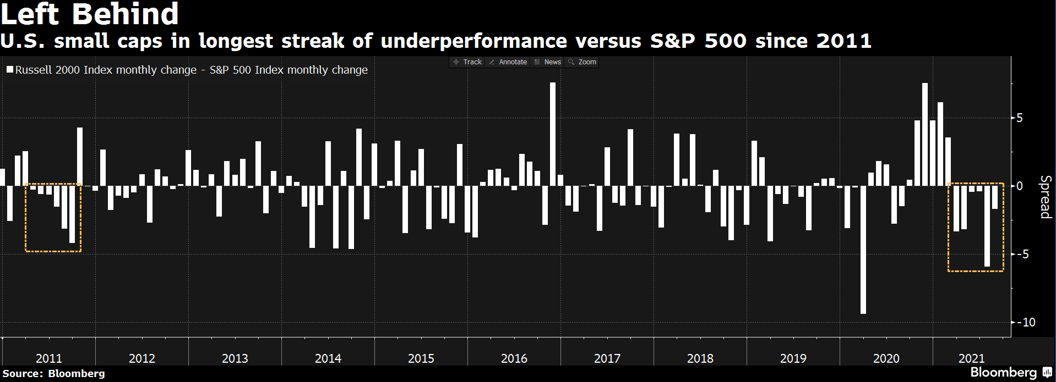

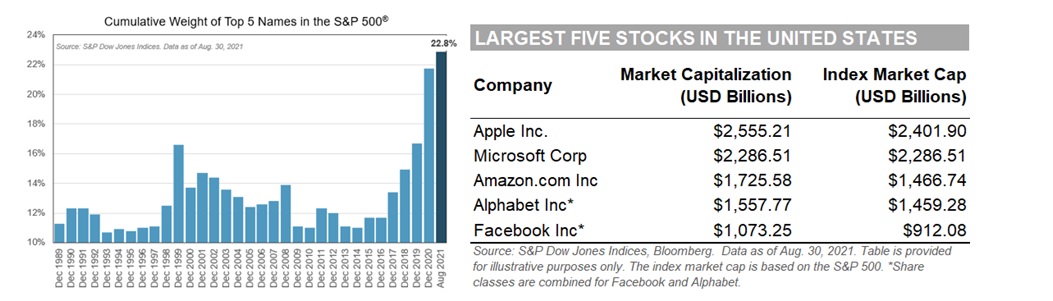

More specifically, US large caps recently

Source: Lawrence Hamtil

Source: Bloomberg

Leaving small caps in the dust recently

🇺🇸 Forward price-earnings ratio for the S&P SmallCap 600 has been as much as 23% lower this month compared to S&P 500, according to data compiled by Bloomberg.

*That’s the biggest discount since May 2001, in the midst of a bear market. pic.twitter.com/yvPYko945X— Christophe Barraud🛢 (@C_Barraud) August 29, 2021

The recent rally doesn’t mean markets can’t keep going up

The S&P 500 is up 19.7% YTD.

What happens the rest of the year if it is up 20% by the end of August?

Well, the past two times the final 4 months gained another 9.6% (1995) and 7.9% (1997).

So just because it is up a lot, doesn't mean it can't keep trending higher.

— Ryan Detrick, CMT (@RyanDetrick) August 25, 2021

But September has historically been a bad month

Reminder from @RyanDetrick that September is often rough for the market. "September is historically the worst month of the year for stocks…even last year, in the face of a huge rally off the March 2020 lows, we saw a nearly 10% correction in the middle of September.”

— Paul R. La Monica (@LaMonicaBuzz) August 31, 2021

And China continues to crack down

Over the past 24 hours China has:

– Restricted the amount of time kids can play online games to a maximum of 3 hours/week

– Vowed to crack down on private equity

– Described the crackdowns as a "profound revolution" & "a return from the capital group to the masses of the people"— Tracy Alloway (@tracyalloway) August 30, 2021

NFT Update:

this JPEG of a tulip is selling for $3.2 million pic.twitter.com/7ppboKsBwO

— Turner Novak 🍌🧢 (@TurnerNovak) August 29, 2021

Joe has a lot of ETH and multiple wallets:

– Joe pays 1 ETH for a punk NFT

– Joe pays 50 ETH for the same NFT

– Joe pays 500 ETH for the same NFT

– Joe pays 1,500 ETH for the same NFT

– Frank thinks this is real and buys it for 1,600 ETH

This is not real.

Don’t be Frank. pic.twitter.com/aB8hhj7rcj

— CommonState (@StateCommon) August 29, 2021

I’ll just leave this here..

I'm 28 years old living in a 1 bedroom 750 square foot apartment with my wife and dog that cost $2,200 a month. I bought a Jpeg of an ape for $252,800 today. I just want you to know that if you're reading this, you're not too late. pic.twitter.com/0t3BIjX0jr

— dankcoldturkey (@dankcoldturkey) August 30, 2021

Charts/Tweets Of The Week

I used to say this @Robeco chart is the "Chart of the Year", where the worst year of value was 1999, followed by best in 2000. UNTIL 2020, which was worse.

The more I think about it, it may turn out to be the "Trade of the Decade".

Adding a recent AQR @CliffordAsness chart too. pic.twitter.com/mIosmEsilV

— Meb Faber (@MebFaber) August 30, 2021

Income distribution in the US vs. Europe 👇 Is anybody surprised by the raise of populism in the US? Ht @PIIE pic.twitter.com/Tfi3m1EkQ3

— Michael A. Arouet (@MichaelAArouet) August 27, 2021

Fastest growing urban areas in U.S. with >300k residents, based on projected annual growth rate from 2020 to 2025@VisualCap @UN pic.twitter.com/O9D837HYIp

— Liz Ann Sonders (@LizAnnSonders) August 25, 2021

Story Of The Week

One of the CRAZIEST stories you'll ever see.

Bishop Sycamore, an alleged fake high school, reportedly lied to ESPN to get on national television.

FULL STORY: https://t.co/HNtJqdYHEg pic.twitter.com/uw1G0OM3Hx

— Complex Sports (@ComplexSports) August 30, 2021

Disclosure

Clear Rock Advisors, LLC is registered with the SEC as a registered investment advisor with offices in Texas. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy (including the investments and/or investment strategies recommended and/or undertaken by Clear Rock Advisors, LLC) or any investment-related or financial planning consulting services will be profitable, equal any corresponding indicated historical performance level(s), or prove successful. It remains the client’s responsibility to advise Clear Rock Advisors, LLC, in writing, if there are any changes in the client’s personal/financial situation or investment objectives for the purpose of reviewing, evaluating or revising Clear Rock Advisors, LLC’s previous recommendations and/or services, or if the client would like to impose, add to, or modify any reasonable restrictions to Clear Rock Advisors, LLC’s services. A copy of Clear Rock Advisors, LLC’s current written disclosure statement discussing its advisory services and fees are available upon request.