Market Commentary

Q4 2022

Hard to Find Reprieve in 2022

One year ago, we wrote about soaring inflation and the Fed’s need to act quickly to get it under control. Even as inflation approached double-digits early in the year, the Fed continued to downplay the threat and talk of a run-of-the-mill rate hiking cycle, one that seemed out of step with economic reality. By Spring, however, their tune had changed, and the speed and magnitude of interest rate hikes surprised the market. Originally expected to span two years, this hiking cycle will likely come to an end less than one year after it began. Hiking rates this fast proved to be a shock to financial markets and resulted in an immediate downturn in stocks, bonds, and housing. The days of easy money had quickly come to an end. The economic reverberations of higher interest rates are only now beginning to be felt.

It is rare for both stocks and bonds to produce negative returns in the same year, but that is what happened in 2022. Traditional diversification offered no protection against the macroeconomic backdrop of high inflation, aggressive rate hikes, new geopolitical tensions, and overvalued stocks. Stocks had their worst year since 2008 and long dated US Treasuries since 1792 (down -33%)! A traditional balanced portfolio split between 60% stocks and 40% bonds had a horrendous year – the worst since 1937 – down -17.5%. Cash, Commodities, and some Alternative and Private strategies were the only places to find positive returns in 2022.

Higher for Longer

Looking forward, inflation appears to have peaked which means rate hikes are near the end of their course. However, the Fed has made clear they will pause, but do not plan to lower rates anytime soon. When will the Fed lower rates? Historically the answer has been when labor markets begin to feel meaningful strain. The Fed’s dual mandate after all, is to ensure both low inflation and healthy labor markets. With unemployment still at 50+ year lows, it will take a significant economic slowdown to produce enough job losses for the Fed to reverse course. Interestingly, the Fed is saying, “higher for longer”, but the market is pricing in the opposite – rate cuts before the end of 2023. There are cross currents in financial markets: Equity markets have firmed up and seem to believe in a benign “soft landing” scenario, but the bond market seems to be discounting a recession. Our belief is that there is still enough stimulus (both fiscal and monetary) to keep the economy out of recession for a few more quarters, providing support in the near-term for asset prices.

The renewed interest in stocks over the past few months is based on the belief that inflation has run its course, the hiking cycle is largely over, and earnings will continue to grow. Lost in this narrative, however, is the worrisome reality that materially higher interest rates are intended to produce a meaningful economic slowdown. The Fed rate hiking cycle began in March of last year, so not even a year old. Hiking cycles work on a lag of 6-18 months, so it takes time for their impact to be felt. We believe it is too early to declare the beginning of a new cycle when the last one has not yet run its course.

Are Consumers Running on Empty?

Excess savings peaked in the summer of 2021 and has been declining since. The bottom-half income earning households have blown through their extra cash, but the highest income quartile who benefitted most (primarily through PPP loans) still has years of spending cushion. The extra money from stimulus and shutdown savings pushed the personal savings rate to 33.8% in the early days of the pandemic but has now plummeted to 2.3%, its lowest level since 2005.

Move back to “Normal” – Interest Rates and QE?

Short-term interest rates moving back to normal levels are one thing but removing the Fed’s emergency Quantitative Easing is another. Over the last 14 years, the Fed added about $8 trillion to their balance sheet, half of that in the last three years. This was done to artificially push down longer-term interest rates and stimulate growth and was achieved by Fed purchases of US Treasuries and Mortgages in the open market at higher and higher prices. Unwinding this portfolio is tricky. The Fed is unlikely to sell these bonds outright which would be disruptive to markets. Instead, they have chosen to let them mature or roll off at an orderly pace. That sounds benign enough but consider that the largest marginal buyer over the past 14 years is now on the sidelines.

Who will buy the new bond issuance? US Treasuries and Mortgages must now fend for themselves as the market moves back to equilibrium. Investors will demand inflation-adjusted yields that are competitive with other investment options. When the Fed began raising rates, mortgage rates skyrocketed to around 7% within a few short months, just as the Fed embarked on unwinding their $2.7 trillion Mortgage portfolio. Because mortgage rates spiked so quickly, the Fed has quietly pulled back on this normalization effort, fearing even higher mortgage rates and more damage to the housing market than they intended.

Economic forecasts are for this cycle to produce the mildest recession in history, a -1 to -2% decline in GDP, versus the average of about -3%. The combination of still massive fiscal stimulus and inflation falling back down to the 2% target over the next year could give the Fed breathing room and avoid serious damage to the economy as we move toward normal.

Earnings Estimates Too High

The U.S. economy is likely to start feeling the effects of higher interest rates this year, including slower or negative GDP growth and reduced consumer spending and corporate sales volumes. Pricing power, which was strong in the early inflationary period, will fall alongside demand and profits will take a hit. Profit margins were artificially inflated due to massive post-covid stimulus and are likely to re-base at the old highs, which were about 20% lower than today. No hiking cycle or recession on record has avoided an earnings decline and this time should be no exception.

We believe current earnings growth estimates are too high with the 2023 consensus expectation around +5%. Historically, earnings have declined by -10 to -15% during recessions. Given our expectation for a recession over the next year or so, earnings are likely to fall.

Energy in the Spotlight

Oil stocks were by far the best performing sector in 2022. Oil prices recovered alongside demand since the 2020 Covid shutdown and then the Russia/Ukraine supply shock pushed them higher. In addition, the efforts of developed governments to restrict fossil fuel production in pursuit of green energy has further constrained supply and put a floor under the price of oil. However, high prices attract production and there is some evidence that the adoption of newer extraction methods such as fracking in the Middle East and Venezuela are beginning to bring new production online. More supply combined with a high likelihood of a global recession that will reduce demand for oil will likely cause oil prices to not climb much higher and maybe even drift lower this year.

Stock Valuations

The stock market peaked on the first trading day of the year last year, as did valuations, particularly for large cap stocks. The forward Price/Earnings on large cap stocks averaged 23x and the Price/Sales was 3.1x, both historically high levels that have proven poor entry points in the past. By the end of the year, both measures had contracted by 25%, forced down by higher interest rates that reduce the value of future cash flows.

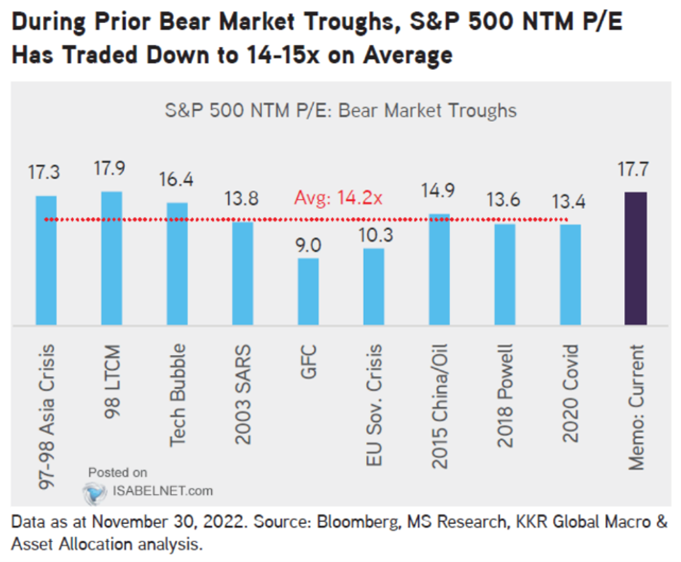

Despite cheaper valuations, multiples are still above previous bear market bottoms (as shown in the chart below). As you can see on the accompanying chart, the forward P/E on the S&P 500 is 17.7x which is higher than the average bear market trough valuation of 14.2x, looking at the last 9 bear markets. Applying the average trough multiple of 14.2x to earnings that decline -15% from their peak produces a downside target for stocks that is 25% lower than today’s level. But while there may be downside for large cap stocks, the current P/E of 17.7x is exactly in line with the 25-year average.

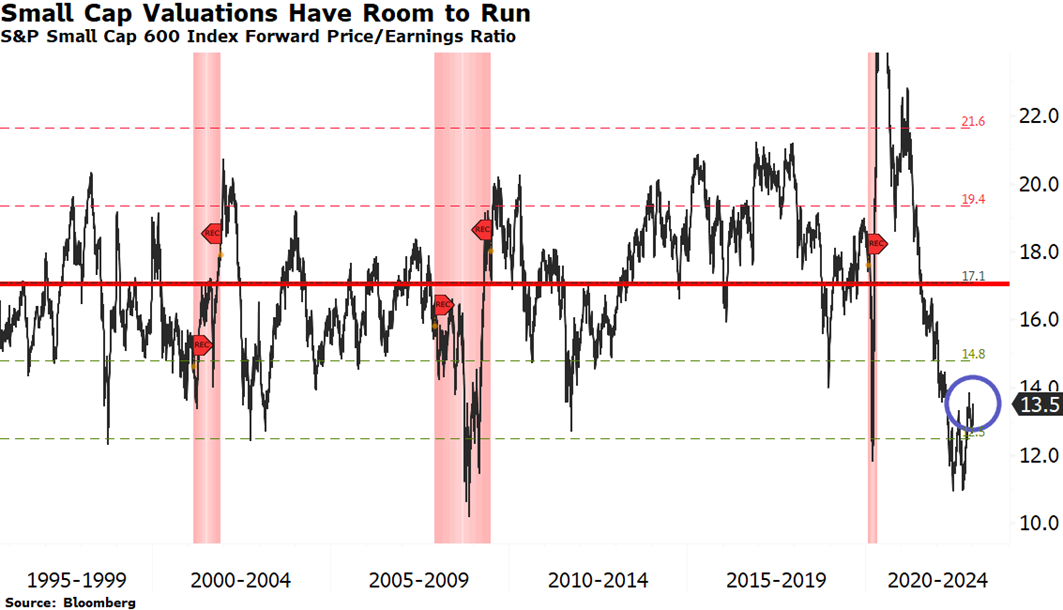

Small cap stocks are at a very different place. Only three months ago, P/Es bottomed at 11x forward earnings estimates, -2 standard deviations below the mean and an indicator of significant value (see chart below). The challenge will be earnings declines if the economy contracts sharply. Small companies tend to have much more exposure to the economic cycle and therefore could see a bigger earnings drawdown. We are constructive on US Small and Micro Cap companies at these levels given the damage that has already been done and the likelihood that most of the potential earnings softness is already discounted in today’s prices.

Two consecutive annual losses for stocks are rare, but our outlook remains cautious. Despite the selloff in stocks last year, investors did not abandon hope, as evidenced by the lack of equity outflows. Most bear markets bottom when fear becomes palpable and retail investors panic sell, which we would argue did not occur last year.

Our highest-conviction equity investment continues to be US-based, large-cap, dividend-growers. We believe companies who grow their dividends at an above average rate are signaling strong free cash flow growth, the best indicator we know of for financial quality and durability. From a geographic standpoint, we continue to prefer US stocks over International, in the belief that domestic companies are better managed and can weather adverse economic conditions better.

While we favor US stocks, we also believe there is upside opportunity in Emerging Markets stocks. Rock-bottom valuations, waning currency headwinds, and accelerating economic growth led by a rebound in China, make a compelling investment case for companies in these regions.

Fixed Income More Attractive

Yields have moved up significantly, allowing high-quality bonds to resume their role in a portfolio as an income generator. We believe bonds will also once again provide portfolio stability as stock market volatility is likely to remain high as the cycle deepens. After positioning our bond portfolios in very short maturities in anticipation of higher rates, we are now more comfortable extending maturities and taking on more duration risk. Over the past few months, we have moved from short duration (roughly 2 years) to neutral (roughly 5 years). Long term, we expect our base return on bonds to equal the income that they produce which was around 5.5% at the end of the year. If a recession transpires, interest rates will fall, pushing up bond prices and adding price appreciation above this base income return. Within investment grade bonds, we find value in US Treasuries, Corporates, Mortgages and Municipals. It has been several years since we have been this constructive on high quality bonds.

At the same time, we are less optimistic toward lower quality bonds whose credit is more susceptible to a recession. High yield bonds are highly correlated with the stock market. Just as P/Es are too high, we believe credit spreads on high yield bonds are too low, introducing risk that the income return could be offset with capital losses in a deeper bear market. We are avoiding this segment of the bond market for now.

Alternatives and Private Investments

The lack of diversification between traditional stocks and bonds over the past year highlighted the importance of non-correlated investments in a portfolio. Alternatives and Private Investments including Managed Futures, Merger Arbitrage, Commodities, Private Real Estate, Direct Lending, Private Equity, and Distressed Debt offered refuge to the volatile markets of 2022. Our portfolio overweight to these strategies buttressed performance and was the primary reason we were able to “protect in down markets,” a core tenet of the Clear Rock philosophy.

This outperformance, however, has led to an even larger overweight that will need to be monitored as we move forward, particularly in the less liquid strategies. Private Real Estate had strong performance despite property valuation mark downs due to higher cap rates. Strong cash flow growth from higher property rents provided significant support. Direct Lending benefitted from higher yields as coupons moved up with interest rates. These loans are senior secured, focused on defensive sectors like Enterprise Software and Health Care, and are supported by strong business models, low debt ratios, and favorable covenants. We will continue our search for alternative investment opportunities with compelling risk/return ratios.

Conclusion

The market volatility of the past year does have a silver lining for long-term investors – expected returns for Stocks, Bonds, Alternatives, and Private Investments have risen over the past year. We are moving out of the artificially created world of “TINA” (There Is No Alternative) that pushed investors into the riskiest asset classes over the past 14 years, creating imbalances along the way, to a world that looks more normal. This means the menu of investment opportunities is expanding and the opportunity to meet client objectives is more attainable.

As always, contact us if would like to discuss these topics further.

Respectfully,

![]()

Royce W. Medlin, CFA, CAIA

Chief Investment Officer