Market Commentary

Q3 2022

Economy: Surprisingly Strong but Tailwinds Fading

Growth has been more resilient than expected this year, despite the steepest Fed hiking cycle on record. Continued growth is a reminder that monetary policy works on a lag… typically taking hold 6-18 months after the first rate hike. In addition, healthy household balance sheets, strong labor markets, and growing corporate profits have helped defy the Fed’s best efforts to slow the economy. While two negative GDP growth quarters in a row in the first half of this year met an old “rule of thumb” definition for a recession, unemployment at 50-year lows and profit margins at all-time highs argued otherwise. While 2022 is unlikely to be officially declared a recession year, 2023 may not be so lucky.

Tailwinds to growth are fading fast, beginning with a marked slowdown in housing, more cautious consumers who are battling high food, energy and shelter inflation and a drawdown of their excess stimulus savings, and corporate earnings that are on the precipice of decline. Headline inflation has likely peaked, but it is stickier than anyone expected, forcing the Fed to “keep at it” in their effort to rein in prices. Inflation is a destructive force that can, on its own, create a recession. Years of overly stimulative zero-bound interest rates engineered by the Fed contributed to the current inflation mess we are in and makes the task of getting out even more difficult. We believe headline inflation will fall throughout the remainder of this year, likely reaching 6% or lower, but that Fed hikes will continue.

Monetary Policy “Not Even in Restrictive Territory”

How high the Fed goes depends on how quickly the economy, and in particular job growth, slows. Core PCE, the Fed’s preferred measure of inflation, is running at an annualized rate of about 7%, and has proven more persistent than expected. This measure is propelled by still rising rent growth that has more room to catch up with reality. Typically, the Fed does not stop raising rates until Fed Funds is higher than inflation. With their preferred inflation measure at 7% and Fed Funds at 3%, inflation would need to fall by half over the next couple of months to get any near-term relief. A recent comment from Fed board member Loretta Mester makes clear “we’re not even in restrictive territory on the Fed Fund rate” yet. Again, had the Fed pursued a less extreme zero-bound rate policy for the bulk of the last 14 years, normalization would not be such a difficult task.

Central banks in Europe and the UK are in a similar predicament but will see recession hit sooner, most likely in the current quarter. Hotter inflation and even lower artificial interest rates in Europe, combined with an energy crisis this winter spell trouble and explain why we eliminated all of our stock market exposure there earlier in the year. China’s growth, the real engine of the global economy over the past couple of decades, has different challenges mostly due to draconian zero-covid policies shutting down entire regions of the economy. Inflation in emerging and frontier countries is exacerbated by a strengthening US Dollar making imports of oil and other goods more expensive. We have maintained some exposure to emerging markets stocks in the belief faster growth, lower valuation companies will ultimately see above average appreciation.

Inflation – Higher for Longer?

Two big contributors to inflation that have been underappreciated over the past year are shelter and wage inflation, and both tend to be sticky. We have discussed the lagging shelter component to CPI that is starting to pick up steam while other prices are weakening. The US has a structural housing shortage and the outlook for new home and apartment construction to meet that demand is low.

Tight labor markets are driving higher wage growth, which interestingly, are not reflected in any of the measures of inflation like CPI or PCE, which gauge consumption only. Average hourly earnings are growing at over 5%, more than double the historical rate, but less than the rate of inflation, producing stress on the average household budget. In a worrisome development that portends consumer weakness, credit card balances have exploded recently, implying that households are borrowing to meet their living standards. This is in sharp contrast to a year ago when households were flush with cash as a result of Covid lockdowns and government stimulus checks. While most Americans have gone back to work post-Covid, a still depressed labor force participation rate means millions of Americans dropped out of the workforce permanently. Today, there are significantly more job openings than unemployed workers. Similar to shelter inflation, wage inflation has a structural underpinning that will likely make it harder to tame with a soft landing and may have an earlier resurgence in the next expansion.

Yield Curves Inverted

Bond yield curves around the globe are predicting distress similar to levels last seen during the Global Financial Crisis. When short-term interest rates are higher than long-term interest rates, the yield curve is considered “inverted,” an abnormal phenomenon that is predictive of a future recession. Today’s yield curve inversions are a function of central banks (led by the Fed but followed by the ECB, BOJ, and others) raising short-term rates to fight inflation. The entire world now has an inflation problem which has historically been treated by higher interest rates and reduced government spending. Moderate interest rate increases seem insufficient to stop inflation and, in a sign of the times, governments continue to spend more, not less, compounding the problem. The US, for now, continues to benefit from its “global reserve currency status” allowing what seems like infinite capacity for deficit spending and higher levels of indebtedness that would wreck a lesser currency’s value. Risks to the US and global economies should not be underestimated in our opinion. We remain cautious on risk assets, despite asset price declines in stocks and bonds which have created lower valuations and higher yields.

Earnings Sure to Weaken

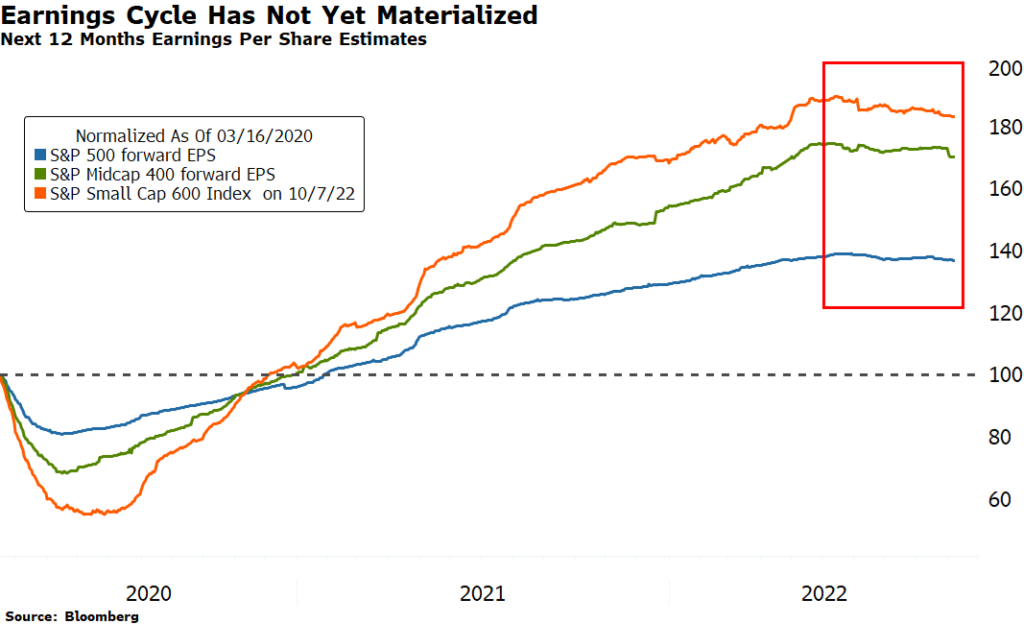

Stocks are down 20-30% this year, the result of higher interest rates pushing up the discount rate of future cash flows, making businesses worth less. What we have not seen this year is weakness in fundamentals. As you can see on the accompanying chart, earnings per share of large, mid, and small cap stocks have climbed over the past two years. Only over the past few months have expectations begun to peak and earnings expectations begin to roll over.

Post-Covid, as unprecedented levels of stimulus were applied to our economy, corporate profit margins expanded to all-time highs, reaching levels 30% higher than pre-Covid levels, which were themselves all-time highs. If margins merely revert back to pre-Covid highs, aggregate earnings would see a meaningful earnings decline. Typically, earnings decline around 10% in a recession but from these elevated levels, with wage and materials pressure and reduced demand from end consumers, a larger drawdown seems possible. The question is, how much of this future earnings decline is already discounted into today’s stock prices? Third quarter earnings announcements begin this week which will give us a peek into earnings growth sustainability and durability as the economy slows.

Higher Credit Spreads Likely

Like stocks, bonds are also down double digits this year, in the 13-21% range. Also, like stocks, the decline is almost fully attributable to higher interest rates, rather than deteriorating fundamentals that typically drive credit spreads higher. Credit spreads (the extra yield premium investors demand for higher risk of default) for investment grade and high yield bonds, currently show little signs of stress and are hovering around their historical averages. As the economy slows, investors are likely to shift their concerns about interest rate risk to credit risk. Recessions always bring a higher level of corporate defaults, and we expect this time to be no different. Wider credit spreads mean more price weakness for bonds. We continue to be cautious in our Fixed Income portfolio positioning, emphasizing shorter duration bonds with less downside if longer term rates continue to rise and higher credit quality, avoiding non-investment grade “junk” bonds completely. Yields of almost 10% today for high yield corporates are tempting but we need to be more comfortable with potential earnings downside before re-allocating to this area of the market.

The 60/40 Portfolio

As most investors are aware, the ubiquitous “60/40 Portfolio” has experienced its worst decline since 1949, down about -20% this year. Fourteen years of climbing P/Es on stocks and lower interest rates on bonds (thank you Fed) pushed prices higher and higher, making investing look easy. This year however, valuations on stocks have contracted while the historical diversification provided by bonds in a down market has not delivered. The 40-year bull market for bonds is over with structural inflation supporting higher interest rates into the foreseeable future. That is actually good news for bond investors who will finally get paid a reasonable rate of return after years of artificially suppressed rates.

While Clear Rock clients have not avoided the weakness of stocks and bonds this year, those losses have been significantly mitigated by a relatively large allocation to Alternative strategies and Private Investments that have performed well. As mentioned, stocks and bonds are much more attractive today than they were just a few months ago. Over the next few months, we believe we will get the opportunity to reallocate accumulated cash and even a portion of our Alternatives back into stocks and bonds. For now, though, given the fundamental risks described above, we remain underweight risk assets and overweight cash and Alternatives that provide ballast to the portfolio in volatile and uncertain times.

As always, contact us if would like to discuss these topics further.

Respectfully,

![]()

Royce W. Medlin, CFA, CAIA

Chief Investment Officer