Market Commentary

Q2 2022

Market Performance Reflects Higher Likelihood of Recession

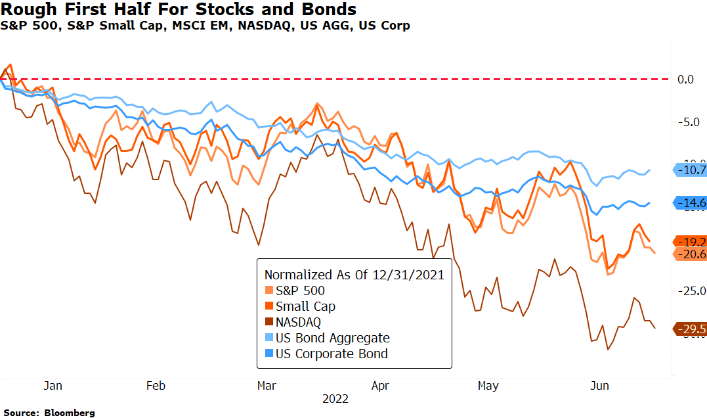

It was hard to hide in Q2. Stocks and bonds both recorded historically bad quarters as inflation continued to march higher and the Fed began aggressively hiking rates. Higher interest rates and abrupt rhetoric changes by Fed Chair Powell had the immediate effect of pushing down stock multiples and bond prices.

Although not as immediately evident, the economy has also started to show cracks. Manufacturing surveys, consumer and CEO sentiment, and real-time GDP estimates all point to an economy quickly contracting, and some pundits believe we are already in a recession. Recessions typically begin with job cuts and declines in consumer spending which have yet to materialize. But, if inflation remains stubbornly high, it’s highly likely the actions taken by the fed will produce a recession by 2023.

A few weeks ago, we outlined three reasons to remain underweight riskier assets (stocks, high yield bonds, etc.) with a focus on protecting client capital.

- High inflation and high multiples don’t mix

- Monetary policy tightening is just beginning

- Profits are at risk

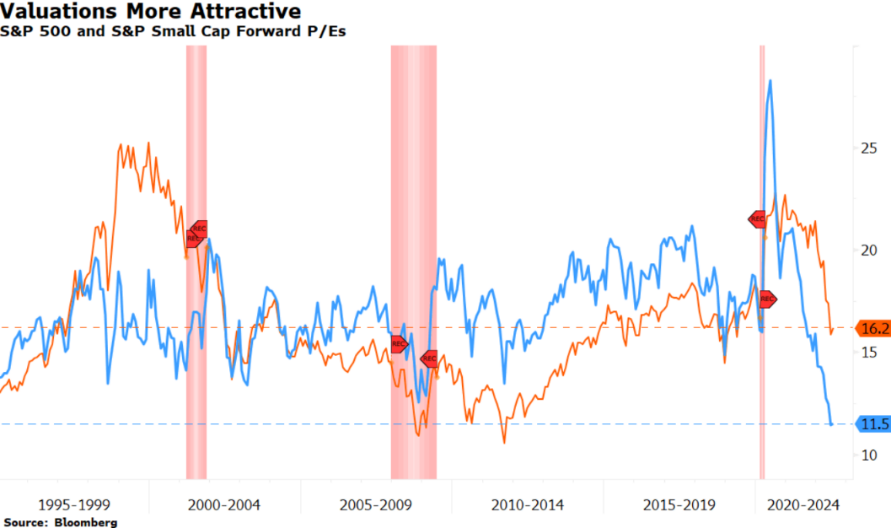

We still believe these risks are relevant and underscore our focus on protecting client capital. Since our memo, inflation has remained high and P/E multiples on the S&P 500 have continued to contract. In fact, the forward P/E multiple on the S&P 500 (orange line on valuation chart) is now 16.2x, in line with its 30-year average. Small Cap stocks (blue line on valuation chart) continue to get more attractive, trading at 11.5x the forward EPS estimate, significantly below the long-term average and below levels reached during the Global Financial Crisis in 2008.

Although stocks and bonds have gone on sale in unison, we continue to worry about the amount of financial tightening the economy is currently undertaking and the implications this has on earnings. In addition to the Fed raising rates, the Fed’s plan for quantitative tightening is still in its infancy. Earnings estimates, which have drifted lower since our memo, still have risk to the downside as margin pressures from increasing input costs, higher financing costs, and rock-bottom consumer confidence begin to take a toll.

The economy is clearly—at the very least—cooling, and the Fed is not likely to pivot away from its hawkish stance until its abundantly clear inflation is anchored near their 2% target. This likely means Fed policy will remain tight even as economic weakness becomes more apparent. The Fed has already gotten inflation wrong once, making them unlikely to make the same mistake again.

In order for us to move back up to our “Normal” equity targets, we would like to see convincing evidence that inflation has peaked and that the Fed can achieve a soft landing (or at least a shallow recession). For now, we remain focused on protecting the assets we manage on your behalf.

Portfolio Positioning

Our high exposure to Alternatives across client portfolios has benefited relative performance this year. A traditional portfolio allocation of 60% stocks and 40% bonds registered its worst first half performance on record. The uncorrelated nature of our Alternatives allocation has allowed our client portfolios to perform better than a traditional 60/40 portfolio during this period.

Our weighting in Equities (stocks) is intentionally and meaningfully below long-term targets and will remain so until we see compelling evidence that inflation has been tamed. This underweight is primarily a result of lowering our exposure to international stocks. We continue to believe that Europe is most exposed to a recession given the cost of their energy transition and over reliance on artificially low interest rates. Financial conditions are deteriorating globally, but Europe is likely to feel an inordinate impact relative to other developed markets. We eliminated our exposure to Europe to the extent possible earlier this quarter.

Since Clear Rock’s founding, we have believed high quality investment grade bond returns would disappoint given their low yields and high sensitivity to upward moves in interest rates. We also believed interest rates would eventually rise because of the inflationary nature of excessive money creation by the Fed. Over the years, our overall Fixed Income allocations declined by more than half in favor of Alternatives which has been particularly beneficial this year.

In addition to our transition from Fixed Income into Alternatives, our move toward “Protect” this year has meant reducing Equities and further overweighting Alternatives. We believe this overweight will continue to provide portfolio defensiveness given the low correlation of these strategies to stocks and bonds. Last, during “Normal” market periods, we maintain very low cash levels, typically less than 2%. Today however, cash is temporarily running higher as we navigate more volatile markets and take our time to determine the best home for sales proceeds. With higher-than-normal allocations to both cash and Alternatives, we have ample “dry powder” to add to stocks at more compelling levels while also helping ride out this period of uncertainty by reducing overall portfolio volatility.

2Q 2022 Performance

Stocks

- Stocks across the board fell throughout the quarter in response to higher inflation, an increasingly hawkish Fed, and concerns about economic growth.

- US Stocks (↓16.70%) closed the quarter down sharply. The selling was indifferent to size as US Large Cap (↓16.8%), US Mid Cap (↓16.95%), and US Small Cap (↓16.88%) all finished down similarly. Although slightly better, Global Stocks Ex US (↓13.73%) and Emerging Markets (↓11.45%) also had negative quarters.

- The Dividend Growth strategy was down (↓13.21%) during the quarter, slightly better than the S&P 500 (↓16.35%). The best performing sectors were Real Estate, Consumer Discretionary, and Utilities, and the worst performing sectors were Technology, Communication Services, and Financials. The top performers were Humana, American Tower Corp, and Domino’s Pizza, and the worst performers were Stryker Corp, Bank of America, and Cisco Systems.

Bonds

- Interest rates continued higher for the quarter, hurting Investment Grade Bonds (↓6.86%) and Municipal Bonds (↓2.48%). Credit spreads also widened throughout the quarter, hurting areas most exposed like High Yield Corporates (↓9.48%) and Emerging Markets Debt (↓6.80%). Securitized Credit (↓2.51%) also had a lackluster quarter.

Alternatives

- Alternatives had another good quarter. Managed Futures (↑3.13%) continued its strong year as volatility remained elevated. Market Neutral (↑.26%) had another modest quarter and Multi Strategy (↓.89%) sold off a little at the trail end of the quarter. Private Real Estate had strong months of April (↑1.35%) and May (↑.46%) while Private Credit had a strong month of April (↑.4%) but then retreated some in May (↓1.2%). We are still waiting for the June numbers for both strategies.

As always, contact us if would like to discuss these topics further.

Respectfully,

![]()

Royce W. Medlin, CFA, CAIA

Chief Investment Officer