Market Commentary

Q1 2022

Despite Uncertainties, We Expect Continued Economic Growth

We believe economic growth will continue through the remainder of the year, albeit at a moderating pace. Consumer demand still has strong support from wage growth, continued reopening, and pent-up savings from stimulus. It is estimated that 60% of households continue to hold excess savings built up during the pandemic. The U.S. job market is as strong as it has ever been with the “jobs plentiful” survey at all-time highs and “jobs hard to get” near lows (see accompanying chart). An extremely tight labor market is bringing discouraged workers back into the fold, and companies are increasing wages and working harder to train and retain talent. Tight labor markets do bring risks of their own, though, putting pressure on profit margins and creating wage inflation which has signaled recession in the past. We are likely reaching an inflection point in the economy where gains will be harder to achieve as tighter monetary policy inevitably leads to slower growth.

Soft Landing vs Recession

“Soft landing” is an expression you will be hearing more of as the Fed embarks on a tightening cycle designed to curb inflation by slowing the economy. The trick is tightening just enough, but not so much that a recession ensues. Soft landings have only been achieved a few times in history and will prove harder this time around with inflation far above expectations, not to mention way beyond the Fed’s 2% target. What makes this hiking cycle different from the past few cycles is that inflation is already out of control, as opposed to previous anticipatory moves designed to keep inflation at or below 2%. Of the last 11 Fed tightening cycles, 8 have resulted in recession – albeit with an average lag of about 2-3 years.

It’s no secret that the Fed is behind the curve, recognizing far too late that the inflation wildfire will require aggressive action. This – after a period of denial and wishful thinking that the overheating was merely transitory – makes the task even harder. Fed Funds, the short-term interest rate set by the Fed, is expected to rise sharply over the coming year, approaching 3.0%, up from zero over the past two years. A move this quick and steep would be historic, which inherently carries more risk.

The Fed isn’t going to stop at raising rates, though. The days of the Fed buying treasury and mortgage bonds (“Quantitative Easing” or “QE”) are also over. Without the Fed’s intervention, market participants will determine interest rate levels going forward, and a market free of interference will almost certainly demand a yield more commensurate with expected inflation. That is, up until a point the market deems unsustainable.

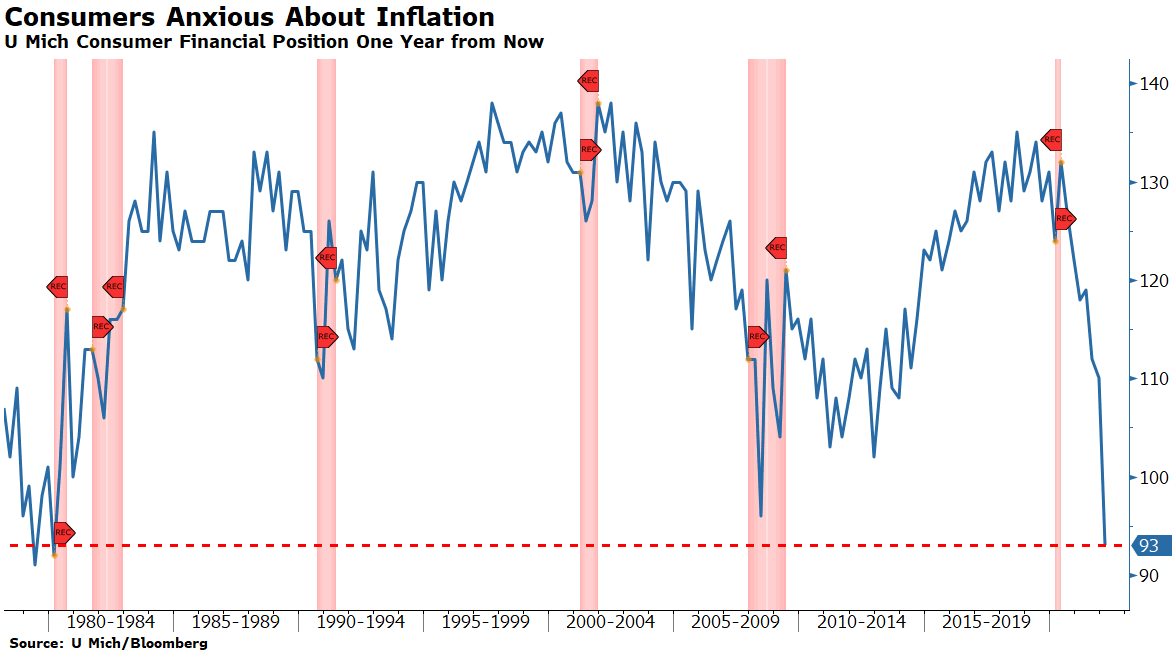

Anxious Consumers

Inflation increases the risk of recession as households are forced to cut spending on discretionary goods and services to cover more expensive necessities like gas and groceries. This unwanted shift shows up in business and consumer confidence surveys. Today, as seen on the accompanying chart, consumers are more worried about inflation eroding their future financial position than at any time since the early 1980’s.

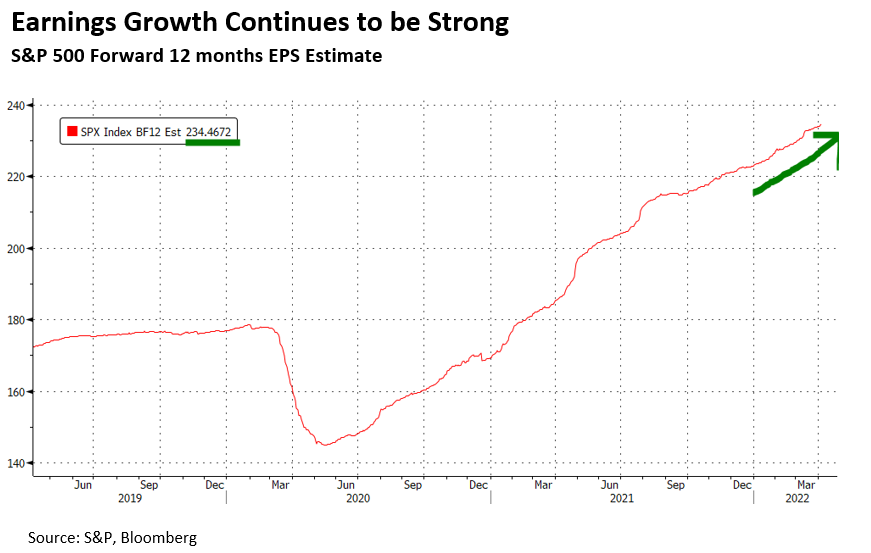

Earnings

Despite a cautious outlook for the economy beyond this year, history shows markets remain strong in the year following the first rate hike. Earnings growth post-covid have been incredibly strong and look set for more gains in the coming 12 months, overcoming geopolitical and inflation risks. The source of those earnings gains has changed, though, with Energy and Materials companies showing the strongest momentum and Consumer Discretionary, Industrials, and Financials losing steam, a reversal of what propelled earnings out of the Covid shutdown.

Portfolio Positioning

We prepared our portfolios early on for higher than usual inflation by investing in assets that have a history of withstanding inflation headwinds. Relative safe havens such as real estate, floating rate direct lending, distressed debt, and commodities are best able to manage through the negative impact of higher interest rates caused by inflation. High quality bonds with low and fixed coupons have borne the brunt of the Fed’s regime change. The U.S. Bond Aggregate (“AGG”), the largest proxy for high quality bonds, saw a drawdown of -9.9%, a loss not seen since the Volker tightening days of 1981. Our bond portfolios have been correctly positioned for higher interest rates by being short duration (interest rate risk) but have still been hurt by higher interest rates over the past few months. Recent moves have underscored our belief that the 40-year bull market in bonds, driven by ever lower interest rates and “emergency” actions by the Fed, would someday come to an end. The catalyst for this inflection point of course is inflation, and it will take more pain in the bond market to get it under control unfortunately. Over the past 6.5 years, since the founding of Clear Rock, we have gradually reduced client allocations out of bonds and into alternative investments that are less prone to losses associated with high inflation and artificially low bond yields.

In the early days of the Russian invasion of Ukraine, we trimmed our exposure to European stocks. It became clear to us Europe would have a difficult time avoiding a recession given their reliance on Russian energy. On the other hand, U.S. stocks, particularly small companies, are more domestically focused and mostly insulated from weakness abroad, further supporting our home-country bias. The downside of our U.S. overweight is valuations that are still historically high, particularly in light of inflation. In our Spotlight Webcast, we discussed the “Rule of 20,” which points to lower P/Es in the face of higher inflation, an idea that is also supported by studies showing multiple contraction during Fed rate hiking cycles. As was the case last year, multiples sometimes contract as earnings grow faster than stock prices, which has been the case in the U.S. for the past 18 months. If inflation is brought back down to the Fed target of 2% over the next couple of years without recession, the Rule of 20 (P/E+inflation=20) would point to a fair market P/E of 18x. The current forward P/E on the S&P 500 has already contracted to 19x which implies a contraction, but one that earnings growth can provide in a soft-landing scenario.

Last, our alternative investment strategies continue to perform as expected in 2022, providing downside protection and uncorrelated upside long term. These investments have risk levels similar to bonds but without meaningful exposure to rising rates. Our search for strategies with the potential to earn annualized returns north of 5% with risk levels similar to bonds led us to a new strategy focused on commodities where the managers have the ability to benefit from prices moving up or down, which we believe is attractive in a period of rising volatility.

1Q 2022 Performance

Stocks

- Stocks rebounded in the latter part of the quarter after one of the worst starts to a year in recent memory. The market sold off at the beginning of the quarter due to heightened uncertainties resulting from the Russia-Ukraine war and a Fed set to reverse course.

- Driven mostly by growth stocks, US Stocks finished down (↓5.28%) for the quarter. US Large Cap (↓5.11%), US Mid Cap (↓5.46%), and US Small Cap (↓5.72%) had fairly similar quarters. Global Stocks Ex US (↓7.19%) and Emerging Markets (↓7.61%) also had down quarters.

- The Dividend Growth strategy had a down quarter, as well. A few of the top performers for 2021 in the Consumer Discretionary and Technology sectors were the biggest detractors. The top contributing sectors for the quarter were Industrials and Consumer Staples.

Bonds

- With the Fed reversing course and inflating proving resilient, interest rates across the maturity spectrum rose, leading to one of the worst quarters on record for bonds. The areas most exposed to rising interest rates, like Municipal Bonds (↓5.40%) and Investment Grade Bonds (↓4.83%), had historically tough quarters. High Yield Corporates (↓2.18%) and Securitized Credit (↓1.47%) hung in there, while Emerging Markets Debt (↓6.89%) sold off due to uncertainties surrounding the Russia-Ukraine war.

Alternatives

- Considering the rough quarters for stocks and bonds, the alternatives category had another good quarter. Managed Futures (↑9.67%) led the way by taking advantage of the rising volatility across markets and oil’s price spike. Market Neutral had a modest quarter (↑.32%) while Multi Strategy (↓3.09%) sold off a little bit. Private Real Estate and Private Credit also had relatively strong months of January and February—they were up ↑2.99% and ↑.8%, respectively. We are still waiting for the final March numbers.

As always, contact us if would like to discuss these topics further.

Respectfully,

![]()

Royce W. Medlin, CFA, CAIA

Chief Investment Officer