Market Commentary

Q2 2021

Transition to Self-Sustaining Growth

The U.S. economy has blown past even the most optimistic predictions of what a recovery might look like only a year ago. Overly generous monetary and fiscal policy produced a snapback beyond anything we have experienced before. Stimulus obviously works – the question now is, can the economy transition from policy-induced growth to self-sustaining organic growth?

Supporting future organic growth are excess household savings that will continue to fuel a consumption-led boom. Consumer spending represents 2/3rds of GDP and is well-positioned to carry growth for years to come. Improvements in productivity and profitability, due to accelerating trends toward digitization, are also supportive. However, there are risks that the handoff to organic growth could be derailed by inflation and stubbornly high unemployment in certain industries. Persistent inflation could dent corporate earnings and erode recent wage gains.

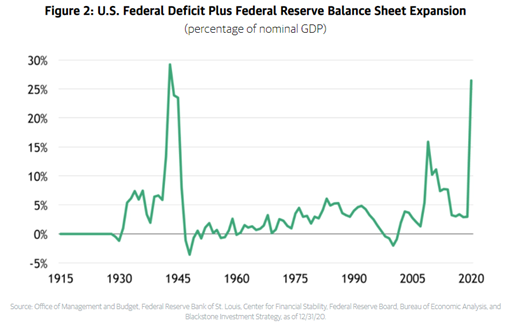

Also of concern is the unwinding of monetary and fiscal stimulus. Higher interest rates and weaning households off generous cash transfers could prove challenging. The magnitude of government intervention over the past 15 months has been staggering. The accompanying chart shows combined fiscal and monetary stimulus relative to the size of the U.S. economy (GDP), measured over the past 100 years. As you can see, the 2020 spike reached levels not seen since the build up to World War II. And the level shown does not include the additional $1.9 trillion Covid relief package earlier this year or the $1 trillion infrastructure bill likely to be enacted. With interest rates so low, none of this seems to be a clear and present danger because the government can currently fund these deficits at almost no cost. But massively higher debt compounds the risk if rates do rise in the future.

This cycle is likely to see peak economic and earnings growth achieved far quicker than the long cycles we have become accustomed to. A shorter cycle brings inflation, rising interest rates and inflated asset valuations sooner, shortening the corresponding bull market as a result.

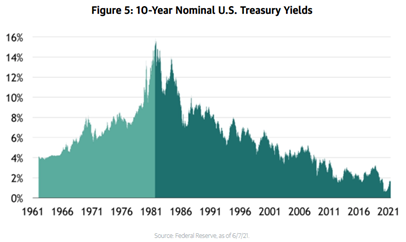

Have Interest Rates Bottomed?

Much was written about the end of the 40-year bull market in bonds last year as interest rates hit all-time lows. Interest rates in the future will be a function of the Fed’s determination to keep them low and inflation remaining in check. If GDP growth plods along at 2% or lower as it did in the last expansion, keeping them low will be easy. If the economy overheats and inflation proves to be more than a short-term Covid-related phenomenon, interest rates could move meaningfully higher. Low interest rates have benefitted governments, corporations, and households by lowering borrowing costs, lifting valuations for equities, and producing gains for bond investors. If this trend were to reverse meaningfully, these long-term tailwinds would shift to headwinds.

The Fed’s current plan is to hold short-term rates at zero and continue purchasing $120 billion of bonds per month, despite inflation fears becoming more pervasive. We believe normalization will begin sometime late next year with gradual rate increases and a multi-year reduction of the balance sheet. Hopefully, the economy will have strong enough footing to withstand this transition.

Inflation – Here to Stay or Gone Tomorrow?

Expectations for inflation have risen across a wide swath of the economy. Large price increases have been primarily related to supply chain disruptions, but generous cash stimulus checks also boosted demand for all types of goods, including appliances, sporting goods, and cars. In addition to goods inflation, wage inflation has emerged – at least temporarily – as many workers have been slow to reenter the labor force. Full expiration of extended and enhanced unemployment benefits by the end of August should begin to boost employment gains through year-end. How much of this temporary inflation becomes permanent as supply and demand go back to equilibrium remains a question.

Despite fears of new Covid variants threatening further shutdowns globally, the reopening story continues as vaccines are distributed around the globe. Expect more pent-up consumer spending to drive global growth beyond 2021 – and with it more inflation concerns.

High Valuations Moderated by Strong Earnings

It is hard to ignore high valuations across most all investment categories, despite strong growth. What is rare is reaching these levels this early in a new economic cycle. Price/Earnings and Price/Sales ratios for the S&P 500 reflect premiums driven higher by savers searching for return in a market where central banks have pushed yields on safe investments to unsatisfactory levels. Studies have shown that high valuations lead to disappointing forward returns as multiples have historically reverted to their averages. This is true over long periods of time, but in the short run, valuations are terrible predictors of returns. A better short-term predictor is earnings growth – and today we are in one of the most powerful earnings growth resurgences on record. Second quarter earnings reports begin this week and blockbuster results – 60%+ gains versus last year – should sustain market momentum and bring valuations down to more palatable levels. Longer term however, valuations may be negatively impacted by a reversal of what propelled them higher over the past decade: higher interest rates, higher taxes and lower profit margins.

An Emerging Generation of Millennial Investors

According to a recent Morgan Stanley study, over the next thirty years, roughly $70 trillion dollars is expected to be passed down to younger generations, mostly millennials. An often discussed, yet not fully appreciated fact about the markets is just how much the wealthy controls the market—85% of the market is owned by those in the top 10% and 40% of the market is owned by the 1%ers. Much of this wealth will be transferred to a younger generation, and with younger investors, comes different investing behavior.

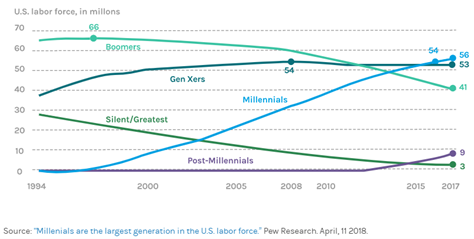

As we have seen recently with the rise of stocks like GameStop and AMC, the influx of new investors—who are more technologically savvy and more interactive on social platforms—are impacting markets. But these investors do not have the ability to structurally change the markets, quiet yet. While Millennials have already overtaken Baby Boomers to become the largest demographic cohort in the labor force, they still control a relatively small percentage of investable assets. Over the next two decades, Millennials will reap the benefits of a large inheritance, all while entering their prime earnings years. The oldest millennials turn 40 this year, and their investment path is beginning to look like what Boomers experienced during their prime earning years in the 1980s and 1990s. Currently, only 6.5% of Millennials’ assets are in equities, similar to the 6.0% allocation Boomers had at age 40. In subsequent years, the Boomers’ allocation to equities grew to over 25%, implying further stock-market inflows may be in store in the relatively near future. More generally, we expect one of the broader themes in the coming years to be an increased appetite for riskier assets like equities and less appetite for very safe assets like bonds with negative real yields.

Q2 2021 Performance

Stocks

- Stocks were up across the board for the quarter. After a red-hot six month stretch for value and smaller cap stocks, they took a back seat to growth and larger cap stocks in the back half of the quarter. Emerging and International Developed stocks also had relatively strong quarters as vaccine distributions continued to make headway.

- Globally, stocks were up (↑73%), led by US Large Cap (↑7.28%), Emerging Markets (↑3.95), and International Developed (↑3.93%). US Small Cap (↑2.87%) and US Mid Cap (↑2.12%) trailed slightly.

- The Dividend Growth strategy also had a relatively strong quarter. Being underweight a couple big tech names and having a slight value tilt hurt performance during the back half of the quarter. A reversal of what we saw in Q1.

Bonds

- A slow unwinding in long rates helped bond performance for the quarter, and the best performers were the riskier assets. Emerging Markets Debt (↑03%) led the way, followed by High Yield Corporates (↑1.67%), and Securitized Credit (↑1.50%). Municipal Bonds (↑1.35%) also had a strong quarter.

Alternatives

- The alternatives category had another steady quarter. Managed Futures (↑56%) and Market Neutral (↑1.49%) had relatively strong quarters while Multi Strategy (↑1.3%) lagged slightly. Real Assets and Private Credit had impressive months of April and May—they were up ↑5.05% and ↑2.41% for the two months, respectively. We are still waiting for the final June numbers.

As always, contact us if would like to discuss these topics further.

Respectfully,

![]()

Royce W. Medlin, CFA, CAIA

Chief Investment Officer