Market Commentary

Q3 2021

Path to Normalization

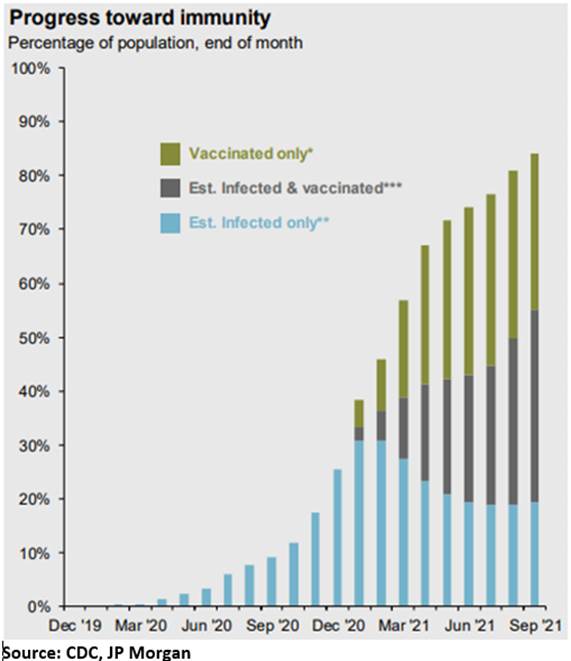

Our post-pandemic path to normalization has proven challenging on numerous levels, but we are optimistic the coming year will see the world back on a sustainable growth track. In the US, the percentage of the population that has been vaccinated plus those who have natural immunity is now over 80% according to the CDC. And, while concern over the lasting effectiveness of existing vaccines has increased, so have developments of new antiviral treatments such as Merck’s oral molnupiravir. This treatment is expected to be approved soon and shows a 50% reduction in hospitalization or death in those infected.

Normalization of fiscal spending has proven hard to shake with more stimulus likely on the way. The size and fate of the current spending package is unknown, but is likely in the $1-3 trillion range, $1 trillion of which is earmarked for much needed infrastructure spending that has bipartisan support. The accompanying $3.5 trillion “human infrastructure” bill will most certainly be pared down. Massive budget deficits over the last two years have increased the Debt/GDP ratio to about 100%, up from 30% 20 years ago and 80% post 2008 recession, ringing alarm bells for moderate politicians in the Senate who argue for slower growth in federal spending.

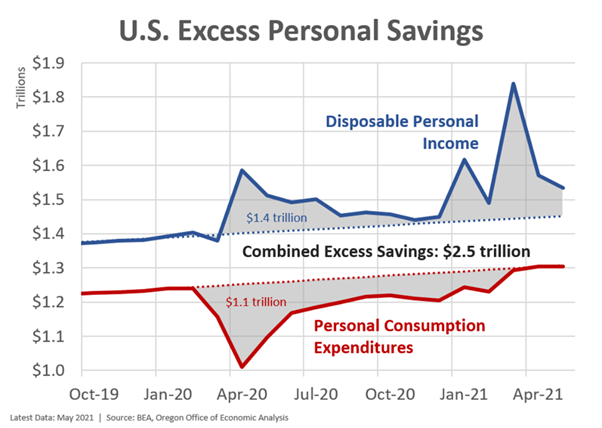

Abundant fiscal stimulus, paired with Covid shelter-in-place orders over the past 18 months created excess savings for households that should serve as an ongoing boost to the economy for the next few years. As you can see on the accompanying chart, spending fell while income increased. Each upward spike on the graph (blue line) represents new stimulus payments to households. This excess saving, estimated at $2.5 trillion, creates a floor for the economy. Consumption by households represents 69% of US GDP and consumers are flush with cash. This massive increase in household net worth should serve as a cushion as stimulus is reduced, minimizing negative effects of an inevitable fiscal cliff.

The most obvious negative effect of excessive fiscal stimulus, however, is higher than expected inflation. Inflation will continue to be the story over the coming months, exacerbated by supply chain delays, commodity price increases, and rent increases that are just now beginning to be reflected in inflation measures.

More persistent inflation is a headwind to Fed policy normalization. The Fed’s dual mandate of moderate inflation (target is 2%, now running at 4%) and full employment (unemployment at 4.8% approaching “full employment”) argues for the removal of emergency liquidity measures. Employment should continue to come down as more people re-enter the workforce, reflecting a labor shortage in many industries. Owner equivalent rent (OER) represents 31% of the Fed’s preferred inflation measure is headed much higher over the coming year, likely causing concern the Fed is behind. Wage inflation due to the current labor shortage plus accelerating rent increases will create problems for the Fed. But their hands may be tied forcing them to allow higher inflation at the risk of inverting the yield curve. Long term rates at or below short rates (flat or inverted yield curve) have historically been the best predictor of a recession, something the Fed is intensely focused on avoiding. With rates as low as they are on the short and long end, the Fed is unlikely to hike rates in 2022, 2023, and maybe much longer in our opinion.

The market seems to believe the Fed’s announcement of tapering and eventual termination of Fed bond buying (QE) will be a non-event this time around. The Fed’s current program buys $120 billion per month of US Treasuries and Mortgage-Backed Securities with the goal of keeping long-term interest rates low. Thus far, long rates have remained relatively low, with the 10-year US Treasury yield moving up slightly to 1.60%. However, with inflation elevated, the “real” interest rate hit a 40-year low of -3.09% in July and currently stands at -2.69%, a level that is still highly stimulative and supports the benign view of the taper’s potential effect.

Earnings in Focus

The post-shutdown recovery has seen earnings growth beat expectations quarter after quarter, but that streak may be coming to an end. Growth expectations are moderating as worries about supply chain issues, materials cost increases, higher wage costs, and to a lesser extent, concerns over an increased tax rate are factored in.

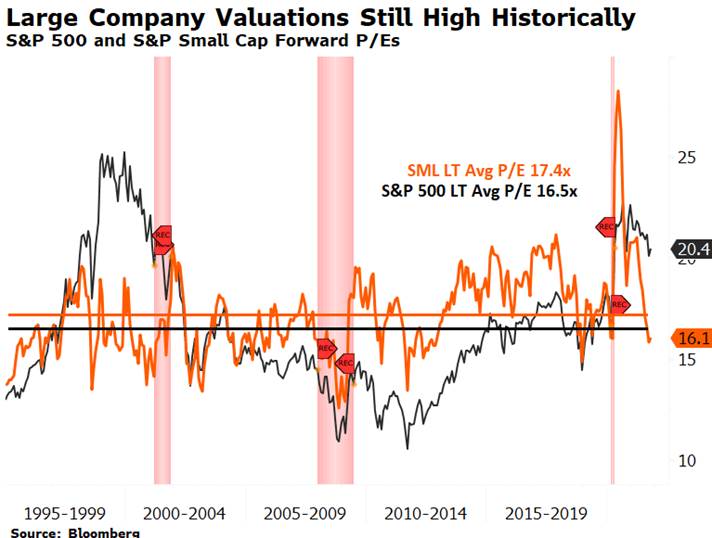

Valuations have come down to more reasonable levels as a result of strong earnings, particularly small companies whose earnings recovery has brought the Forward P/E (orange line) below its 25-year average. Large companies continue to trade at a premium relative to their historical range.

Despite increased volatility over the past few weeks, our belief is that the economy should continue to recover and that the stock market can continue to do well despite slowing momentum. We also believe diversification is more important than ever, particularly in alternative strategies, as yields on high quality bonds remain at all time lows combined with inflation pressures that should push up interest rates and push down bond prices.

3Q 2021 Performance

Stocks

- Stocks had a topsy-turvy third quarter, especially those outside the US. Energy and Financials had a strong back half of the quarter, as inflation and rising rates continued to weigh on investors. Outside the US, China crackdowns and default fears pushed emerging markets into the red for the quarter.

- Globally, stocks were down (↓1.21%), led by Emerging Markets (↓7.67%) and International Developed (↓2.96%). US Small Cap (↓3.47%) and US Mid Cap (↓2.52%) were also negative for the quarter, while US Large Cap (↑.05%) was slightly positive.

- The Dividend Growth strategy also had a topsy-turvy third quarter, ending the quarter basically flat. Factor attribution for the quarter is difficult, as the market was relatively trendless, causing most of the slight tracking error for the quarter to be due to security selection.

Bonds

- With inflation being stubborn and the Fed set to ease policy, rates creeped higher at the back end of the quarter. Securitized Credit (↑.60%) managed the volatility well, followed by High Yield Corporates (↑.25%), and Emerging Markets Debt (↑.10%). Municipal Bonds (↓.27%), though, struggled with the rise in rates.

Alternatives

- In the aggregate, the alternatives category had a solid quarter. Managed Futures (↓1.63%) and Multi Strategy (↓.61%) had relatively weak quarters, but Merger Arbitrage (↑1.03) managed the volatility well. Private Real Estate (↑5.28%) and Private Credit (↑1.42%) had strong first two months of the quarter. We are still waiting for the final September numbers.

As always, contact us if would like to discuss these topics further.

Respectfully,

![]()

Royce W. Medlin, CFA, CAIA

Chief Investment Officer