Weekly ChartBook

Week of July 12, 2021

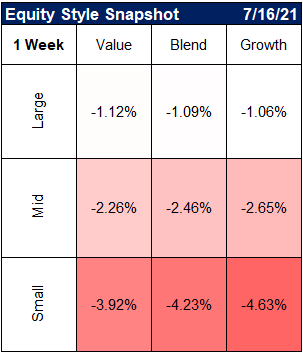

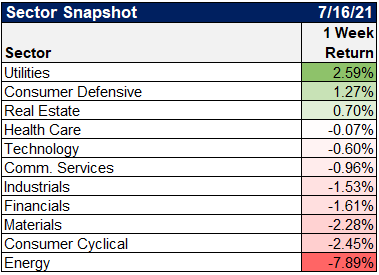

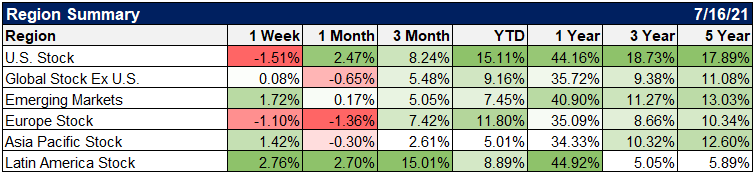

Market Performance For The Week

Source: YCharts

Disclaimer: Past performance is no guarantee of future performance

The Good News

Earnings – so far, so good.

$SPX is reporting Y/Y revenue growth of 20.2% for Q2, which is the highest revenue growth rate for the index since FactSet began tracking this metric in 2008. https://t.co/4UB2sQS34b pic.twitter.com/GleaTIp0TY

— FactSet (@FactSet) July 17, 2021

Via factset

Earnings Scorecard: For Q2 2021 (with 8% of S&P 500 companies reporting actual results), 85% of S&P 500 companies have reported a positive EPS surprise and 90% of S&P 500 companies have reported a positive revenue surprise

— Tracy (????????????) (@chigrl) July 19, 2021

“… >60% of S&P 500 companies forecast to grow their earnings at a double-digit clip over the next 12 months.” – BMO pic.twitter.com/46HLUwJsVb

— Sam Ro ???? (@SamRo) July 18, 2021

An increasing amount of business leaders are becoming optimistic about the future.

88% of business leaders surveyed by JPMorgan Chase are optimistic about their firm's prospects over the next six months https://t.co/HAKyDvFnOH

— Sam Ro ???? (@SamRo) July 19, 2021

And rating agencies are agreeing.

Ratings agencies very confident in corporate America … ~$361 billion of investment-grade bonds have been upgraded in past 2 months, including record $184 billion in June as per @BankofAmerica

@FT pic.twitter.com/CR5yXly6xp— Liz Ann Sonders (@LizAnnSonders) July 19, 2021

And consumers keep buying.

ECONOMY WATCH: U.S. retail sales increase a solid 0.6% in June – or 1.3% if cars are excluded. Better than Wall Street forecast. People are spending lots of money. More than enough to keep the economy growing rapidly. One caveat: Some of the spending reflects higher inflation.

— MarketWatch Economy (@MKTWeconomics) July 16, 2021

To put the retail sales numbers into perspective..

The power of #stimulus in one chart! #retailsales pic.twitter.com/OcmZKNJxt4

— jeroen blokland (@jsblokland) July 16, 2021

And there still remains a lot of cash out there.

The top 10% of #income #earners are holding a LOT of cash. pic.twitter.com/dCqzO9a4a0

— Lance Roberts (@LanceRoberts) July 16, 2021

The Bad News

Another inflation beat.

June PPI #inflation hotter than expected at +7.3% y/y (+1% m/m) vs. +6.7% est. & +6.6% in prior month; core PPI at +5.6% y/y (+1% m/m) vs. +5.1% est. & +4.8% in prior month pic.twitter.com/g3o1eC5jBN

— Liz Ann Sonders (@LizAnnSonders) July 14, 2021

And now Fed Chairman Powell is weighing in.

"I think we're experiencing a big uptick in inflation. Bigger than many expected. Bigger than certainly than I expected." – Powell

— Sam Ro ???? (@SamRo) July 15, 2021

Consumers may be reacting to the higher inflation.

Today's University of Michigan Consumer Sentiment report does suggest that rising inflation is starting to bite perceptions of the economy. https://t.co/ciaAuYYZGe pic.twitter.com/h1bKiZTxhF

— Joe Weisenthal (@TheStalwart) July 16, 2021

The State Of The Market

Analysts are raising their EPS and price targets.

JPMORGAN: “.. reopening of the economy is not an event but rather a process, which in our opinion is still not priced-in, and especially not now given recent market moves. .. We are revising higher .. our long-held 2021 year-end price target of 4,400 to 4,600.” pic.twitter.com/Uyf0JTiSyB

— Carl Quintanilla (@carlquintanilla) July 20, 2021

As the market seems to seems to be pouting about a growth scare.

US 10-year Treasury #yield down to 1.16%. No relief here, yet. pic.twitter.com/W2zUc6RKXq

— jeroen blokland (@jsblokland) July 20, 2021

Which has led to a reversal in small caps.

Small caps were huge outperformers early in the year through mid-March. Now lagging large caps, up 7.8% YTD vs. +14.8% for S&P 500. pic.twitter.com/NYlJt1cBIh

— Charlie Bilello (@charliebilello) July 19, 2021

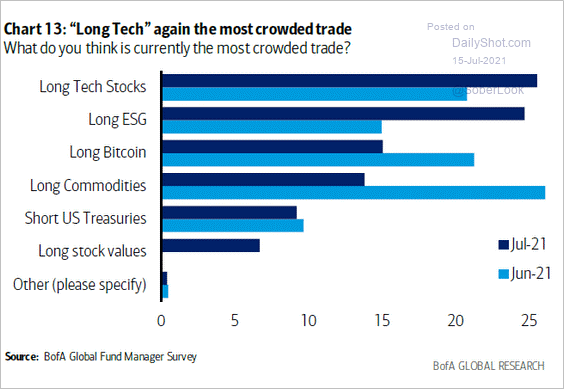

An official welcome back to the spotlight, Big Tech.

Since mid-March, NASDAQ has reasserted strength relative to Russell 2000, though ratio not back to September 2020 peak … pattern is somewhat similar to post-March 2000 peak (this time from lower peak)

[Past performance is no guarantee of future results] pic.twitter.com/lCZAqizW6v— Liz Ann Sonders (@LizAnnSonders) July 14, 2021

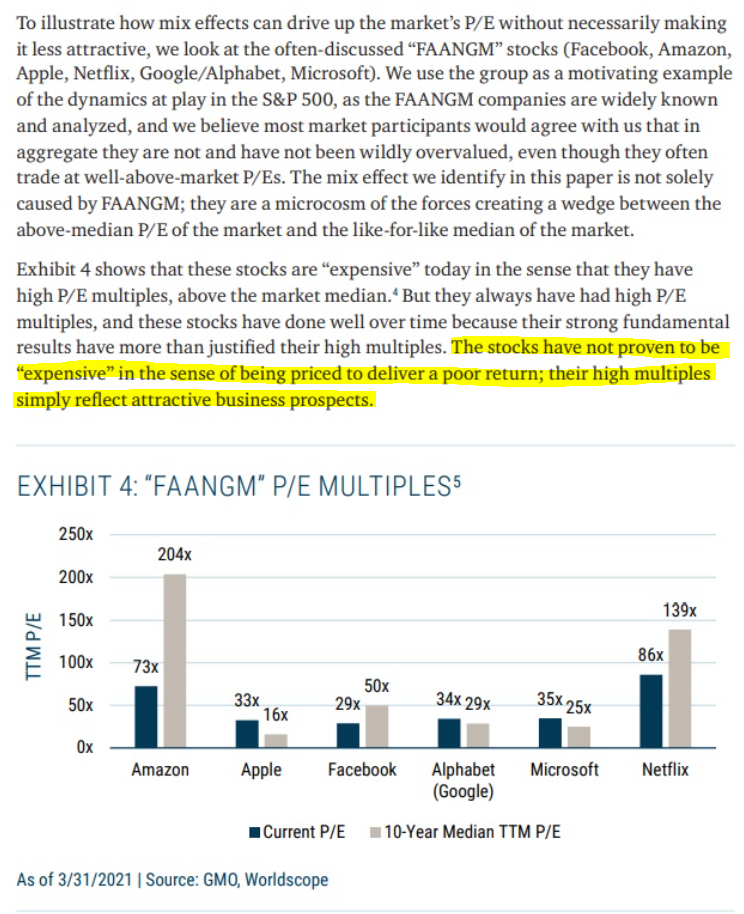

While out of the spotlight, their valuations softened. But still not cheap.

Cheaper but certainly not cheap … NYSE FANG Index (10 largest/most popular tech/growth companies) forward P/E down from high of 51 last September to (still-high) 34.2 pic.twitter.com/forZkM98At

— Liz Ann Sonders (@LizAnnSonders) July 19, 2021

Are they still worth their multiples? Maybe.

Source: Lawrence Hamtil

But these charts are still pretty shocking.

The 5 largest S&P 500 stocks account for 16% of earnings – GS pic.twitter.com/0Em0hoyRQE

— Sam Ro ???? (@SamRo) July 18, 2021

Mega caps are still crowded among institutional investors. Reminds me of the “must own” Nifty 50 theme of the 1970s. The end of “secular stagnation,” a topic that @NancyRLazar1 has discussed, could be a blow to these stocks over the next decade. #macro #stocks pic.twitter.com/pXMnxaynEl

— Michael Kantrowitz, CFA (@MichaelKantro) July 15, 2021

The largest stock in the S&P 500 (Apple) has a weighting equal to the bottom 170 pic.twitter.com/vNVE4IWcC8

— George Maroudas (@ChicagoAdvisor) July 15, 2021

Charts Of The Week

maybe this is the big pullback that comes in year 2 of bull markets https://t.co/8VeKpdZxMA pic.twitter.com/et8xwyR46a

— Sam Ro ???? (@SamRo) July 19, 2021

It is official.@nberpubs officially says the recession was only 2 months long.

This topped the previous fastest recession ever at 6 months from the early 1980s. pic.twitter.com/tKA83DWuUu

— Ryan Detrick, CMT (@RyanDetrick) July 19, 2021

Story Of The Week

The crazy, crazy car market may stay crazy for a while: https://slate.com/business/2021/07/car-prices-used-new-supply-chain.html

Disclosure

Clear Rock Advisors, LLC is registered with the SEC as a registered investment advisor with offices in Texas. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy (including the investments and/or investment strategies recommended and/or undertaken by Clear Rock Advisors, LLC) or any investment-related or financial planning consulting services will be profitable, equal any corresponding indicated historical performance level(s), or prove successful. It remains the client’s responsibility to advise Clear Rock Advisors, LLC, in writing, if there are any changes in the client’s personal/financial situation or investment objectives for the purpose of reviewing, evaluating or revising Clear Rock Advisors, LLC’s previous recommendations and/or services, or if the client would like to impose, add to, or modify any reasonable restrictions to Clear Rock Advisors, LLC’s services. A copy of Clear Rock Advisors, LLC’s current written disclosure statement discussing its advisory services and fees are available upon request.