July 26, 2023

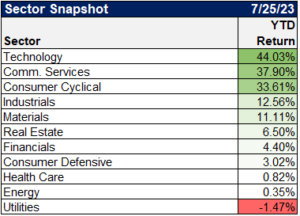

Market Performance (YTD)

Source: YCharts

Disclaimer: Past performance is no guarantee of future performance

12 Days in a row.

Just four other occurrences since WWII. pic.twitter.com/zP3vFO6kET

— Bespoke (@bespokeinvest) July 25, 2023

“.. The Citigroup Economic Surprise Index — a widely followed indicator that provides a quick-and-dirty snapshot of how the economy is faring against expectations — just hit its highest level in the last two years.”@axios https://t.co/MCilc6AQLg pic.twitter.com/ezcncJ33AF

— Carl Quintanilla (@carlquintanilla) July 19, 2023

top down analysts see the S&P falling to about ~4,100 by year end https://t.co/GOYuSI0FI1

bottom up analysts collectively see it climbing to ~4,800 in 12 months https://t.co/UjrGOcD6W8 pic.twitter.com/DP9vOTkX1g

— Sam Ro 📈 (@SamRo) July 19, 2023

U.S. leading economic indicators for June -0.70% M/M & -7.82% Y/Y. @Conferenceboard "We forecast that the US economy is likely to be in recession from Q3 2023 to Q1 2024."

In our view, we are in a late cycle risk-on rally. Managing risk in portfolios is still a focus. @Factset pic.twitter.com/2GyPpi3Y2J

— Matthew Miskin, CFA (@matthew_miskin) July 20, 2023

Stocks (blue) seem to be pricing in significant rebound in Leading Economic Index (orange) from @Conferenceboard as gap has grown to be incredibly wide

[Past performance is no guarantee of future results] pic.twitter.com/agXTDjRMCJ— Liz Ann Sonders (@LizAnnSonders) July 24, 2023

Initial jobless claims came in below expectations, falling to 228k last week, the smallest number of claims since mid-May. pic.twitter.com/NQqdnBuBcs

— Kathy Jones (@KathyJones) July 20, 2023

Loan growth is slowing rapidly at both large and small banks, Apollo's Slok notes. He expects loan books to keep shrinking. pic.twitter.com/cRAvO0VvlT

— Lisa Abramowicz (@lisaabramowicz1) July 19, 2023

The S&P 500 has crossed above the 76.4% retracement of its peak-to-trough decline. After all declines of 20%+ (bear markets) since 1929, the retracement proved the start of a new uptrend. No retests of former lows. Gains post the 76% retrace were stronger than average – see below pic.twitter.com/fUqvD0AfVi

— Gina Martin Adams (@GinaMartinAdams) July 21, 2023

LEVERAGED LOAN DEFAULTS pic.twitter.com/28JN8ymvwI

— Win Smart, CFA (@WinfieldSmart) July 24, 2023

Consumer confidence just hit its highest level in two years

The mood is getting better — not something you typically see right before a recession😎 pic.twitter.com/Au4Cvh4BuY

— Callie Cox (@callieabost) July 25, 2023

Mike Wilson’s “My bad!”$SPX $SPY $QQQ $IWM $DIA pic.twitter.com/gf8pfDwzRE

— Seth Golden (@SethCL) July 24, 2023

The Housing Market Index looks like a pretty good summation of where residential real estate is.

Not remotely close to 2008 bad, but also not booming either. Just sort of muddling along. pic.twitter.com/S2zM7hkXaU

— Cullen Roche (@cullenroche) July 20, 2023

Since the pandemic:

– Prices have gone up 17%

– Wages have gone up 24% for the bottom 10% of earners, but just 15% for those at the medianIn other words, it's not only the gender wage gap that has narrowed recently, but wage gaps overall. https://t.co/INJynk4jLH pic.twitter.com/7Cy8zwNNl5

— Julia Pollak (@juliaonjobs) July 20, 2023

Disclosure

Clear Rock Advisors, LLC is registered with the SEC as a registered investment advisor with offices in Texas. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy (including the investments and/or investment strategies recommended and/or undertaken by Clear Rock Advisors, LLC) or any investment-related or financial planning consulting services will be profitable, equal any corresponding indicated historical performance level(s), or prove successful. It remains the client’s responsibility to advise Clear Rock Advisors, LLC, in writing, if there are any changes in the client’s personal/financial situation or investment objectives for the purpose of reviewing, evaluating or revising Clear Rock Advisors, LLC’s previous recommendations and/or services, or if the client would like to impose, add to, or modify any reasonable restrictions to Clear Rock Advisors, LLC’s services. A copy of Clear Rock Advisors, LLC’s current written disclosure statement discussing its advisory services and fees are available upon request.