Market Commentary

Q1 2020

The first quarter of 2020 saw new market highs that were followed by one of the quickest bear markets in history. Coronavirus hit the US hard in mid-March and investors reacted – the S&P 500 fell 34% and market volatility reached highs similar to those seen in the Great Financial Crisis. While quick and painful, the drop also created opportunity. Since the bottom two weeks ago, investors have begun to discount an improved outlook on the damage of the virus and a boost to the economy through fiscal and monetary stimulus. Virus deaths appear to be peaking and new treatments appear to be working.

Unfortunately, the rapid spread of Coronavirus and the shutdown to contain it came at a time when the economy was already slowing, and markets were stretched. In our last quarterly commentary, we began with a chart of leading economic indicators that pointed to a higher risk of recession but with hopes that recent monetary stimulus would give the economy a boost. We also outlined nine potential downside risks for 2020, none of which included a global pandemic. While we were hopeful the economy could pick up much needed steam, we were less sanguine about markets and highlighted the following risks:

- Valuations – Historically high stock valuations increase the risk of disappointment when things don’t go as planned and create added downside for stocks. The price-to-earnings ratio on the S&P 500 climbed above 19x in February which was 90th percentile over the past 100 years. In addition, credit investments (investment grade bonds, high yield, bank loans, etc.) were priced at extremely high levels as well. Today, both stock and bond valuations look attractive and in some areas are at levels not seen since 2008.

- Earnings declines – Large company profits were flat on average in 2019 and small company earnings fell. The economic shutdown will take some sort of toll on almost all businesses and result in an earnings collapse of -50% or greater through the first half of 2020. Hopefully a strong snapback in the second half will materialize.

- Market exuberance fueled by Fed liquidity – Investor sentiment had grown to unsustainably high levels based at least in part on Federal Reserve rate cuts and a restart to quantitative easing. The fear of missing out was palpable in late 2019 and early 2020. Three months later, risk assets have declined by -15% to -40% and the previous exuberance is gone.

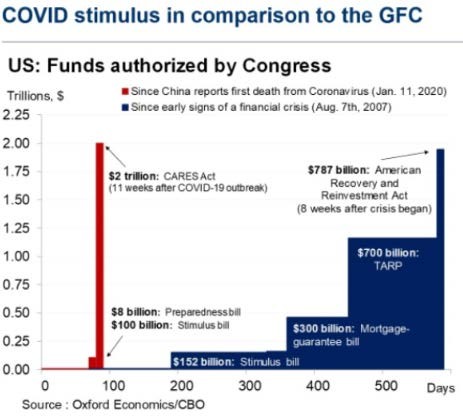

Severe but Short Recession met with Unprecedented Stimulus

A recession is defined by the NBER as “a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales.” There is no question we entered into a recession in March. The government-mandated shutdown of business, and the massive drop in economic activity it is causing, may actually do more harm to the United States than the Coronavirus itself. Job losses are likely to be in the millions hurting small business disproportionately, pushing unemployment up to levels this generation has never seen. In response, massive stimulus is being injected into our economy. Familiar monetary and fiscal measures have been reintroduced alongside new ones specifically focused on small businesses in an effort to keep employees on the payroll through the quarantine. The $2 trillion economic relief bill signed into law by Congress equals about 10% of annual US GDP. The Fed has unleashed unlimited bond buying to keep rates low which could add another $4-6 trillion in liquidity. These two rescue packages are roughly double the level implemented in the 2008 Financial Crisis. Congress and the Fed have worked well together thus far, and they’ll need to continue to as the recession deepens in the coming weeks and months.

While recessions typically last months, not weeks, and bear markets historically take over a year to bottom, we believe investors with long term investment horizons have the opportunity to invest at attractive prices today with an improved foundation for potential future gains. This downturn is different from anything we’ve experienced before and brings new uncertainties that are hard to discount. We believe it’s likely however, that the unprecedented effort by the government to build a bridge for businesses, employees and households will actually work. Yes, we will see job losses, production declines and profit deterioration, but the response, particularly for small businesses, looks like the right medicine. Our job is to make the best investment decisions we can based on each client’s long-term needs, taking into account our understanding of economic and market cycles and expected returns a new set of investment opportunities as a new business cycle emerges.

We expect the next cycle to have a different set of growth leaders and are preparing portfolios to take advantage of those emerging trends. A trend we believe will lead to above average returns is a greater focus on cash return in the form of dividends and interest in addition to capital gains. Its unlikely multiple expansion in stocks, which accounted for an inordinate proportion of gains in the last cycle, will propel returns as it did for the past 10 years. Companies with the strongest financial health that can consistently grow their dividends at an above average rate will be favored. On the credit side, improving fundamentals, whether investment grade or below, will likely perform better than companies that let themselves get overleveraged in this period of inexpensive debt. Smaller companies have not been afforded the cheap debt large companies have issued to buy back their own shares which has inflated their per share earnings. As the buyback culture comes to an abrupt halt, former stock market leaders are likely to be susceptible to slower earnings growth. In addition, sectors such as healthcare, financials and industrials are likely to benefit as inflation picks up and capital investment rebounds.

Portfolio Positioning

Equities

Global equities have been hit hard by the pandemic. Valuations across all equity categories have shrunk to levels where that we believe are attractive enough to begin gradually increasing positions back to normal long-term strategic allocations after being underweight. US Large Cap stocks that led the market higher in the bull market also held up better in the downturn. US Small Cap stocks have lagged in the late stages of the bull market but underperformed in the selloff despite hitting valuation levels similar to the lows of the last cycle. Small stocks tend to show greater volatility in market selloffs and may be particularly vulnerable in this cycle as most stimulus is designed for very large companies and for small private businesses. Over the course of history, when coming out of bear markets, US Small Caps have returned more than their larger peers and we believe this will occur again and maintain our overweight to smaller companies.

Fixed Income

Bond returns generally remain relatively paltry as yields reach record lows. For multiple quarters, the returns have been driven largely by price appreciation, and we’ve waited for attractive opportunities. Due to the recent panic, spreads have blown out, creating opportunities in credit. Although riskier, history suggests spreads at these levels generate appealing returns. With the added risk in mind, we intend to slowly enter this space and remain diligent about finding reliable and worth-while investments in the investment grade space.

Alternatives

Through the selloff, our alternatives portfolio has performed well, despite the added volatility and uncertainty. In an effort to create uncorrelated returns, we removed most of the equity beta in our portfolio, allowing this category to mostly sidestep the recent panic. Our managed futures fund performed especially well over the past quarter as these investments tend to outperform during bear markets.

1Q 2020 Performance

Stocks

- Stocks were globally down during the 1st quarter (↓19.46) with strong losses in US Small Cap (↓31.83), US Mid Cap (↓28.68), International Developed (↓22.39), Emerging Markets (↓21.73), and US Large Cap (↓17.58).

Bonds

- The yield on the US Aggregate Bond Index is ticked up to 2.59% from 2.30% at the end of 4Q of 2020. Total return on Municipal Bonds fell slightly during the quarter (↓1.60), Securitized Credit (high quality mortgages and asset-backed securities) fell sharply along with other credit strategies (↓13.16), and High Yield Corporates (Junk Bonds) fell ↓14.79.

Alternatives

- The Alternatives portfolio was down (↓2.34%) for the quarter. Category performance was led by Managed Futures (↑7.18%) and Real Assets (↑1.15%). Multi Strategy was down (↓8.84%) as credit spreads widened and Market Neutral was down (↓3.91%). As always, contact us if would like to discuss these topics further.

As always, contact us if would like to discuss these topics further.

Respectfully,

![]()

Royce W. Medlin, CFA, CAIA

Chief Investment Officer