Growth or Value – Is one better than the other?

Billions of dollars are at stake by investors betting on value stocks outperforming growth stocks and vice versa. Is one better than the other? Value investors cite the success of Warren Buffett and Benjamin Graham, which is hard to argue against. However, growth investing has also rewarded investors in companies like Google, Apple and Facebook. But, active investment managers pursuing both styles have not proven very successful at beating the overall market.

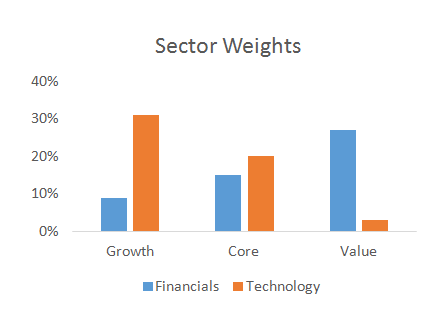

The idea of both growth and value are compelling. The difficulty becomes defining which companies belong in which bucket. High fundamental growth rates versus low valuation are the obvious company characteristics to sort out. But, what about companies that are somewhere in the middle? Another problem with defining style is that certain sectors will be over represented, reducing the benefits of diversification. For example, companies in the technology sector have historically had faster growth rates and represent a large part of the “growth stock universe”. Financial stocks tend to have lower valuations and represent a large part of the “value stock universe”. However, most investors probably don’t want to make a large sector bets which can lead to more performance volatility.

The idea of both growth and value are compelling. The difficulty becomes defining which companies belong in which bucket. High fundamental growth rates versus low valuation are the obvious company characteristics to sort out. But, what about companies that are somewhere in the middle? Another problem with defining style is that certain sectors will be over represented, reducing the benefits of diversification. For example, companies in the technology sector have historically had faster growth rates and represent a large part of the “growth stock universe”. Financial stocks tend to have lower valuations and represent a large part of the “value stock universe”. However, most investors probably don’t want to make a large sector bets which can lead to more performance volatility.

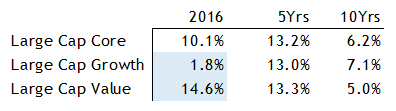

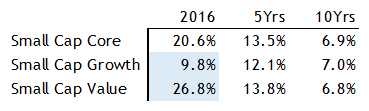

Over long time periods, style tends to average itself out, but with significant swings in performance along the way. For example, last year, per the highlighted figures below, value dramatically outperformed growth in both large and small cap.

However, over the last 5 and 10 years, the difference between the two is minimal. In the end, is an investor better off in one versus the other? We believe the answer is no and that long term investors should be focused on getting core equity exposure rather than focusing on style which goes in and out of favor. Core investing also avoids the performance swings that can cause investors to lose confidence and make changes at inopportune times.