Market Commentary

Q4 2020

Reopenings and Vaccines Point to Better Economic Growth in 2021

One month into the 4th quarter brought great news to markets around the globe – the first vaccine was approved for distribution. This news could not have come at a better time given worries about a third wave of COVID infections and the likelihood that rolling shutdowns were once again in the cards. The market recovery had been led by a relative handful of companies whose prospects actually improved with the economic shutdown, but the market broadened out significantly once the vaccine hope turned into reality. Immediately after the news broke in late October, small and mid-sized companies soared across a broad spectrum of industries – most of which had not yet meaningfully rebounded from the contraction in March.

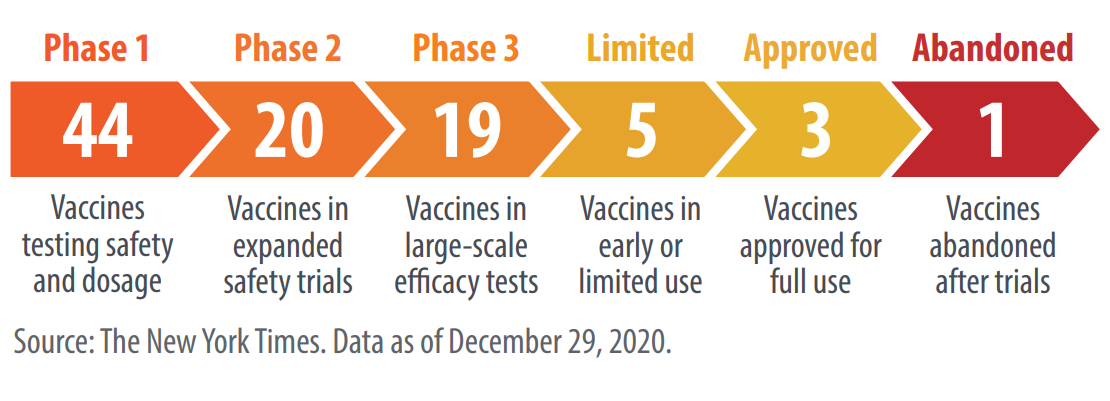

The rapid pace of vaccine development has been nothing short of astounding. By year end 2020, three vaccines had been approved with several others in limited use and late-stage testing. The path to herd immunity now seems clearer and many experts believe can be reached in the US by summer.

We believe synchronized global growth across all countries and regions is likely in 2021, as reopenings and monetary and fiscal stimulus take hold. Many are debating whether we are entering a new growth cycle or resuming the previous cycle that was long in the tooth. Our view is an optimistic one based on several factors, including an expected improvement in business investment and productivity. We believe the low cost of financing new projects and investments, supported by the Fed’s efforts to keep interest rates low for the foreseeable future, will help companies boost growth. This should lead a sustained period of job and wage growth. While mostly economically destructive, the 2020 shutdowns may have an unexpected lasting benefit – an increase in innovative technologies that ultimately lead to productivity growth, the main driver of GDP growth.

The US economy is on track to reach previous output levels by the end of this year. Consumer spending has hit new highs, bolstered by surprisingly strong wages through the recession and generous unemployment and stimulus benefits. Emerging markets, particularly China, have been bright spots through the pandemic. China shutdown early and set the pace to recovery in 2020 and will likely grow 9% in 2021, far above the expected 5-6% growth expected in the US and Europe. Chinese domestic consumption is booming, helping to diversify their historically export driven economy. Trade and manufacturing economies in Asia are booming, including Taiwan and Korea. These countries have been helped by low rates globally and accommodative COVID response policies domestically.

Macroeconomic Shifts

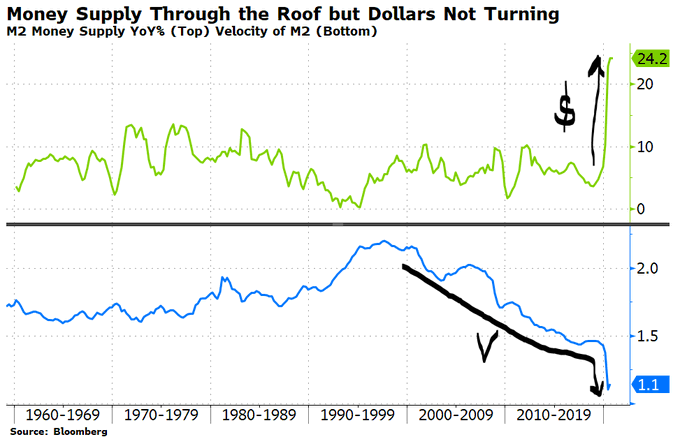

We believe rising inflation will become a new reality in 2021 and beyond. Massive global stimulus has created new money at an unprecedented rate, but the velocity of newly created currency has yet to take hold, as the chart to the right displays. Eventually, the flood of money should push asset prices higher, as the added liquidity seeks its way into demand for goods and services. We believe the sheer amount of money supply added this year will at least buck the weakening velocity trend we have experienced since the beginning of the century. In addition to traditional inflation, the declining value of the US Dollar relative to our export-oriented trade partners will make imported goods more expensive.

Higher inflation will create upward pressure on interest rates, particularly at longer maturities where the Fed has a harder time keeping them low. Even marginally higher rates could produce negative returns on high quality bond portfolios. The average yield on the US Bond Aggregate fell to a record low of 1.1% in the 4th quarter, below the rate of inflation. With the tailwind of declining rates creating above-coupon bond returns over the past three decades, disappointment is likely, particularly for investors with a traditional 60/40 allocation. The 40% in high quality bonds is likely to be a major drag on overall performance. We believe expected returns from US Treasuries and high-quality corporate bonds over the next 5-10 years will come almost entirely from coupon – less than 2% annualized returns are likely. Those returns adjusted for inflation will be even worse and likely negative.

Higher inflation should benefit small companies, real estate, natural resources, and cyclical industries. Growth stocks on the other hand, are likely to see valuation contraction given their sensitivity to rising discount rates.

A worrisome trend and a term that will become more familiar to investors is “debt monetization”. This refers to the practice of financing government deficits through debt issuance that is then purchased by that country’s central bank. To stimulate the economy, the COVID shutdowns created the need for deep fiscal deficit spending while the Fed simultaneously pursued a bond buying strategy to push interest rates lower. In 2020, the Fed purchased $2.4 trillion in US Treasuries, offsetting 73% of the $3.3 trillion budget deficit. While tax revenues should bounce back with a stronger economy, the continued need for fiscal stimulus spending will command historically high federal debt issuance for years to come. While the alarm bells are not presently ringing, continued debt monetization has historically resulted in inflation beyond the Fed’s stated goal of 2%.

Portfolio Positioning

We believe stocks are likely to outperform bonds in 2021. A growth recovery pushing earnings up as much as 30% this year should keep stocks in the limelight. The combination of strong domestic earnings growth, strong global growth, continued stimulus, and highly accommodative business conditions will be supportive of the market in 2021. We believe small cap stocks, which had a spectacular 4th quarter, will continue their momentum and outperform large cap stocks for the next year. A rotation away from the COVID-winning growth stocks into small and value stocks began late last year and is likely to continue in 2021. The lower starting valuations in smaller companies should provide a boost to returns for small-cap stocks. From 2010 to 2016, the first six years of the last expansion, small companies outperformed large companies meaningfully. With the strong rebound in 2020, the low hanging fruit has already been picked. Valuations have expanded across all asset classes and future performance will be determined more by fundamental growth than valuation expansion.

We believe fixed income credit sectors continue to have upside, particularly emerging markets debt and securitized credit. Credit spreads (the yield earned above Treasuries) have tightened but still have room for gains. Given the positive outlook for economic growth and the scarcity of attractively yielding fixed income investments, we believe high yield credit spreads will reach their all-time lows last seen in 2007. This will produce attractive returns given relatively high coupons, price improvements, and low interest rate sensitivity as rates gradually rise.

We continue to look for alternative investment strategies that have low correlation to traditional stock and bond portfolios, providing added diversification and differentiated sources of return to our portfolios. Private debt was a new category of investment for Clear Rock clients in 2020. These strategies consist of loans to privately owned US middle market companies with revenues of around $500 million per year. Diversification by industry and avoidance of the hardest hit sectors – hospitality, leisure and energy – led to surprisingly strong performance through the recession.

4Q 2020 Performance

Stocks

- Stocks continued their historic rebound since March. Growth stocks outperformed on the year, but value stocks outperformed growth in Q4. Small cap stocks, though, outperformed large cap stocks by a wide margin—it was the best quarter ever for small cap stocks. International and Emerging Markets also experienced strong quarters after a significant lift from the vaccine news.

- Globally, stocks were up (↑17.01%) with gains in US Small Cap (↑27.10%), US Mid Cap (↑18.03%), US Large Cap (↑12.79%), International Developed (↑17.01%), and Emerging Markets (↑19.70%).

Bonds

- Yields on high quality bonds fell a few percent while the yields on high yield bonds fell ~20%, leading to a healthy return. Emerging Markets Debt experienced the best quarter (↑7.52%), followed by High Yield Corporates (↑5.02%), Securitized Credit (↑2.40%), and Municipal Bonds (↑1.88%).

Alternatives

- The Alternatives portfolio was up (↑5.76%) for the quarter. Category performance was led by Managed Futures (↑7.23%), followed by Private Credit (↑6.98%), Multi Strategy (↑5.65%), Real Assets (↑5.54%), and Market Neutral (↑3.52%).

As always, contact us if would like to discuss these topics further.

Respectfully,

![]()

Royce W. Medlin, CFA, CAIA

Chief Investment Officer