Market Commentary

Q3 2020

Recovery Intact but Also in Need of Additional Stimulus

The 3rd quarter started off strong with markets and economic indicators continuing to roar back from their COVID-shutdown lows. In September, though, U.S. equities experienced a 10% drawdown. The correction was led by a 12.5% sell-off to the COVID-winning stocks of the Nasdaq 100. Extended technology valuations and stalled stimulus conversations were the catalysts for the drawdown. As Fed Chair Jay Powell has repeatedly warned, the recovery may wane without further action from Congress. The market recovered roughly half of the drawdown by quarter end, primarily from increased stimulus conversations.

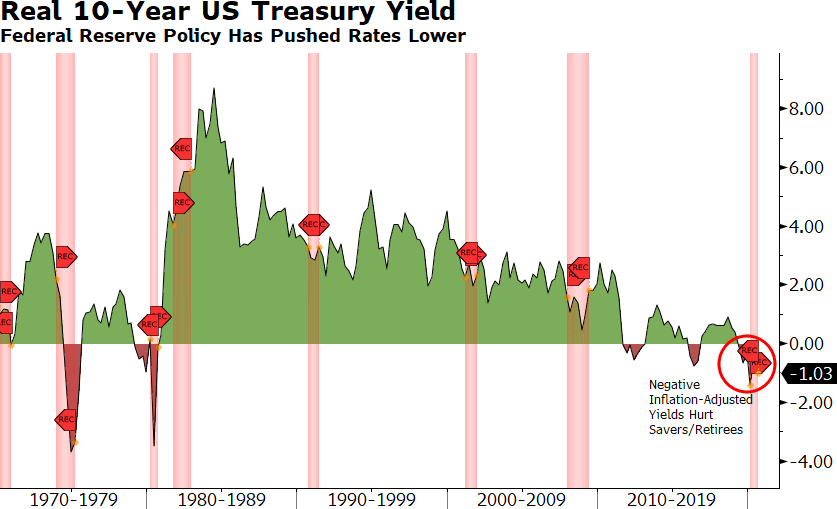

Interest rates hit historic lows post-COVID as the Fed continued its emergency measures to revive the economy. This effort was in full view in the 3rd quarter as the 10-Year US Treasury hit an all-time low yield of 0.51%. This historic low, when adjusting for inflation, was negative -1.55% which is highly stimulative. So even though the Fed is not pursuing negative nominal rates as central banks in Europe and Japan are, real rates are deep into negative territory having a similar effect.

If the recovery continues as we believe it will, longer term interest rates should begin to rise along with growth and inflation expectations. This would put downward pressure on bond prices but also on Nasdaq growth stocks that have benefited most from valuation expansion. However, higher rates would also be a sign that the recovery is sustainable. A sustained recovery, in turn, would be a catalyst for better earnings across a more economically sensitive and diverse set of companies including industrials, financials, and smaller companies in general.

Narrow Market Breadth Set to Broaden Out

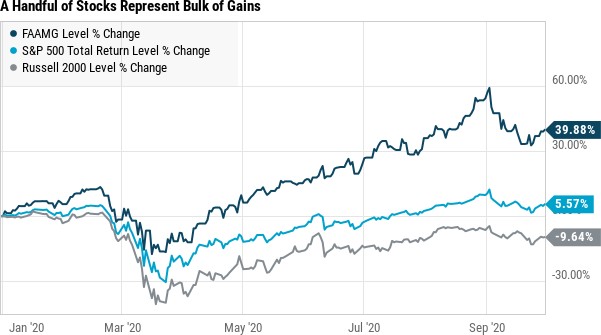

Although necessary, the fiscal and monetary actions, in combination with the lockdowns, have disproportionally helped a select few companies. As shown on the chart to the right, the returns of a relative handful of companies (Facebook, Apple, Amazon, Microsoft, Google, Facebook) that often go by the acronym FAAMG have far outperformed the rest of the market. Without these leaders, which now represent an outsized 25% of the S&P 500, the market would be down for the year. This level of concentration in the top five stocks is rare and has not been seen in decades. While worrisome, the price performance of these market leading companies has not been divorced from fundamentals. The pandemic played into these company’s strengths, pushing their revenues higher while less defensive and smaller companies struggled. As the expansion picks up steam, we believe the market performance will broaden out to include a broader swath of companies who have yet to fully recover.

Portfolio Positioning

At the end of the first quarter, near the bottom of the market, we moved our strategic allocations across all client objectives from “Protect” to “Normal,” effectively increasing equity exposure across all client portfolios. This decision allowed us to take advantage of attractive buying opportunities created by the sell-off. Today, after a 50%+ rebound in stock prices, most of those table-pounding buy opportunities are gone, and some areas of the market appear more overvalued than before the sell-off.

However, we continue to see value and attractive long-term upside in select parts of the market. We believe credit sectors such as high yield corporate bonds, securitized credit, and emerging markets debt continue to have room for price improvement. They also pay cash yields that remain attractive. Within equities, lagging sectors such as financials, industrials and energy should get a lift from improving economic growth. Small cap equities are still attractive in the long-term as they have not fully participated in the rest of the markets rebound and historically outperform after recessions. Emerging market equities remain attractive as we believe the weakening dollar is a long term trend. We also continue to favor high quality companies with improving fundamentals who are capable of higher than average dividend growth. Within our alternatives portfolio, real estate looks particularly attractive with room to grow given relatively high cap rates versus overall interest rates. Of course, this is sector specific where we favor apartments and ecommerce warehouses and dislike office towers, malls and retail properties.

3Q 2020 Performance

Stocks

- Stocks continued their run from March lows but peaked on September 2nd. Despite a tough September, stocks were still up for the quarter.

- Globally, stocks were up (↑7.58%) with gains in US Mid Cap (↑5.60%), US Small Cap (↑5.63%), US Large Cap (↑8.38%), International Developed (↑5.26%), and Emerging Markets (↑8.08%).

Bonds

- Yields on high quality bonds did not budge much during the quarter. Total return on Municipal Bonds gained slightly during the quarter (↑1.24%). Securitized Credit continues to recover (↑3.24%), as are High Yield Corporates (↑3.56%) and Emerging Markets Debt (↑1.95%).

Alternatives

- The Alternatives portfolio was up slightly (↑3.44%) for the quarter. Category performance was led by Multi Strategy (↑2.94%) Market Neutral (↑2.05%), Managed Futures (↑.38%), and Real Assets* (↑5.07%).

*calculated using a trailing three months (June to August) due to a price lag.

As always, contact us if would like to discuss these topics further.

Respectfully,

![]()

Royce W. Medlin, CFA, CAIA

Chief Investment Officer