Market Commentary

Q1 2021

Reopening and Stimulus Support Strong Growth for the Remainder of the Year

After months of exceeding expectations, the economy did more of the same in the first quarter of 2021. The vaccine rollout in the US has advanced much faster than expected as initial worries about distribution, willingness, and effectiveness waned over the quarter. We have now vaccinated roughly 25% of the US population and are expected to reach 75% by the middle of the summer. As the vaccine rollout gained steam, Covid cases decreased substantially.

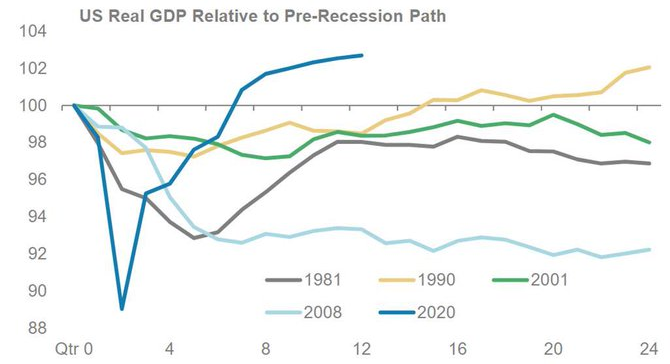

In addition to progress on controlling the Covid pandemic, Congress passed another round of stimulus, the size of which also exceeded expectations at $1.9 trillion. This round of stimulus targeted direct payments to households to an extent never seen before, including large stimulus checks, child tax credits and more. If that were not bullish enough for stocks and the economy, the quarter ended with another new stimulus plan, this one focused mostly on infrastructure spending, at a proposed level of $2.25 trillion. The economy is recovering at a post-recession pace never seen before as can be seen on the accompanying chart, in large part due to unprecedented levels of government spending and monetary easing.

With the virus fading, vaccines gaining steam, and the government continuing to provide substantial assistance to households, there is little reason to not be optimistic about the economy. As deep and painful as the sudden drop-off in GDP a year ago was, the magnitude of the recovery has been just as quick. This trend is likely to continue through 2021 as lockdowns continue to ease throughout the spring and summer months. Consumer spending will continue its strong upward trend as pent-up demand for travel and dining takes hold. Companies will continue to add jobs as demand increases—we already saw a huge and much needed bump in hiring during the month of March. Corporate earnings are constantly being revised upwards, and CEO confidence is steadily on the rise.

Economies around the globe have also seen a resurgence of growth. Europe has been a notable disappointment on the vaccine rollout front, lagging the rest of the developed world and even some emerging countries. A resulting “fourth wave” of infections has brought new lockdowns to countries like Germany and France, dampening expectations for a full recovery this year.

Higher Interest Rates Reflect an Expected Uptick in Inflation

Over the past few months, investors have begun to demand higher yields to compensate for an expected uptick in inflation. By mid-February, rates had risen to a level that caused concern the Fed would be forced to tap the brakes sooner and harder than expected, which would create a meaningful roadblock for the market.

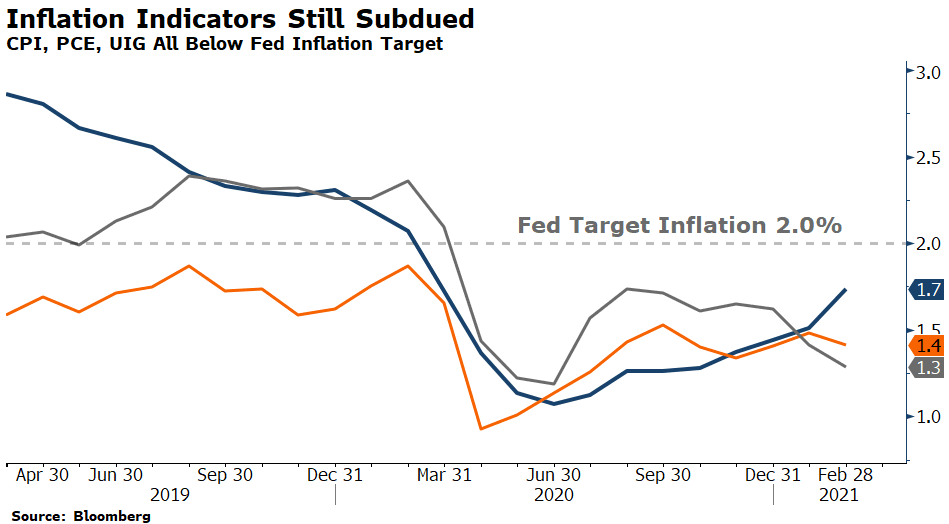

We continue to believe inflation will meet the Fed’s 2% target this year, although current indicators do not reflect imminent danger of overheating, as shown on the nearby chart. While tracking at low levels now, inflation will appear much higher by mid-year – possibly reaching 3% in the 2nd quarter. This bump up will likely be transitory, meaning rates will likely settle back down by year-end, due to base effect comparisons in 2Q from the prior year shutdown. But stronger growth and more Treasury issuance has emboldened bond buyers to demand more yield, pushing the 10-year US Treasury from 0.91% to 1.75%. These rates are still low by historical standards but more than 3.5x higher than the low reached last August. We believe Fed alarm bells will ring if rates rise above 2.5% or so, which, if that happens, would likely force the Fed to activate both existing and new interest rate suppression tools. The reason the Fed is willing to overheat the economy for a short stint of time is to bring the unemployment rate back down to at least historical averages, which we currently are not close to achieving despite the strong recovery.

Portfolio Positioning

We continue to believe stocks will outperform bonds in 2021, as they did in the first quarter. We are maintaining our “Normal” risk allocation, despite high valuations, to take advantage of the powerful recovery that is still in the early stages. Earnings growth of 30%+ over the coming year should keep stocks in the limelight despite stretched valuations in certain sectors. Small cap stocks continued their winning streak and have more upside given leverage to an improving economy. The rotation we wrote about last quarter away from the COVID-winning growth stocks of 2020 into small and value stocks is likely to continue. While valuations quickly went from cheap to expensive based on current earnings, potential for above average growth over the next 2-3 years looks attainable. One trend that did reverse in the first quarter was the outperformance of emerging market stocks. Strong returns in emerging markets are highly correlated to a weakening US Dollar, which was happening in the early stages of the pandemic. Rates have now made a significant move upward, rescuing the US Dollar’s decline, and thus dampening the performance of emerging market stocks.

While the return potential for safe bonds continues to be poor, made worse by higher rates, certain credit sectors still have upside in our view, particularly emerging markets debt where debt ratios remain low, growth recoveries are on track, business optimism is high, and manufacturing activity and net exports are accelerating. We are also constructive on direct/secured lending to private companies in the US middle-market – companies with revenues around $500 million – that are highly collateralized and have coupons that will adjust higher if interest rates continue to increase.

Over the past few years, we have identified and invested in several alternative investment strategies designed to offset the low expected returns of safe bonds. Finding strategies that can replace the lost returns of bonds—returns north of 5%—at overall risk levels similar to bonds is challenging in this environment. Our investments in private real estate and direct/secured lending strategies have helped us achieve this goal thus far.

1Q 2021 Performance

Stocks

- Stocks were up this quarter, led by Value, Cyclicals, and Small Cap. Many 2020 high-flyers like Zoom and Tesla experienced difficulty during the quarter as interest rates rose and retail interest waned. Emerging and Developed International stocks lagged as vaccine rollout fell behind.

- Globally, stocks were up (↑5.14%) with gains across the board. US Small Cap (↑18.24%) led the way, followed by US Mid Cap (↑9.28%), and US Large Cap (↑6.17%). International Developed (↑3.48%) and Emerging Markets (↑2.29%) trailed slightly.

- The Dividend Growth strategy performed well relative to the overall market due to slight factor tilts to value and size. An overweight to Financials and underweight to laggards like Apple, Amazon and Tesla helped performance during the quarter. An underweight to Energy hurt performance slightly although that sector now only represents 2.7% of the total market capitalization of the S&P 500.

Bonds

- The dramatic rise in long maturity yields during the quarter led to poor performance of core bonds including Municipal Bonds (↓.35%). Best performing bonds sectors were credit focused including Securitized Credit (↑1.21%) and High Yield Corporates (↑.85%). After a strong 2020, Emerging Markets Debt (↓1.38%) slightly traded off for the quarter.

Alternatives

- The Alternatives portfolio was up (↑3.15%) for the quarter. Category performance was led by Managed Futures (↑5.89%), followed by Real Assets (↑4.30%), Private Credit (↑3.93%), Multi Strategy (↑2.45%), and Market Neutral (↑.70%). Strong trends in rates and commodities helped Managed Futures turn in impressive gains.

As always, contact us if would like to discuss these topics further.

Respectfully,

![]()

Royce W. Medlin, CFA, CAIA

Chief Investment Officer