Where do home prices go from here? You don’t want to know.

Home prices in the US have blown through previous cycle highs set in 2006. Their rapid ascent to that peak (now almost 10 years ago) saw a 122% rise in the median home price to $185,000, according to the Case-Shiller Index. Many believe it was the housing run-up that created the bubble that ultimately burst, providing a catalyst for the deepest recession since the Great Depression.

From the 2006 peak, home prices declined 27% over the subsequent 5 years, bottoming at $135,000 in late 2011. There was disparity of performance by region of course, mostly attributable to the level of froth (and fraud) that drove the home-buying frenzy in particular parts of the country. Where are we today? From the 2011 low – only six years ago – median home prices have increased 45%.

For the average American, home equity is by far their biggest asset, far bigger than financial assets like stocks and bonds. That partially explains the unprecedented and emergency measures the Fed took almost 10 years ago to lower interest rates across the maturity spectrum, not just on the short end of the curve which was their historical policy tool. They decided the recession was deep enough and the outlook bleak enough to try anything. New techniques to push down long rates faster (Quantitative Easing + Operation Twist) were introduced and for the most part, worked.

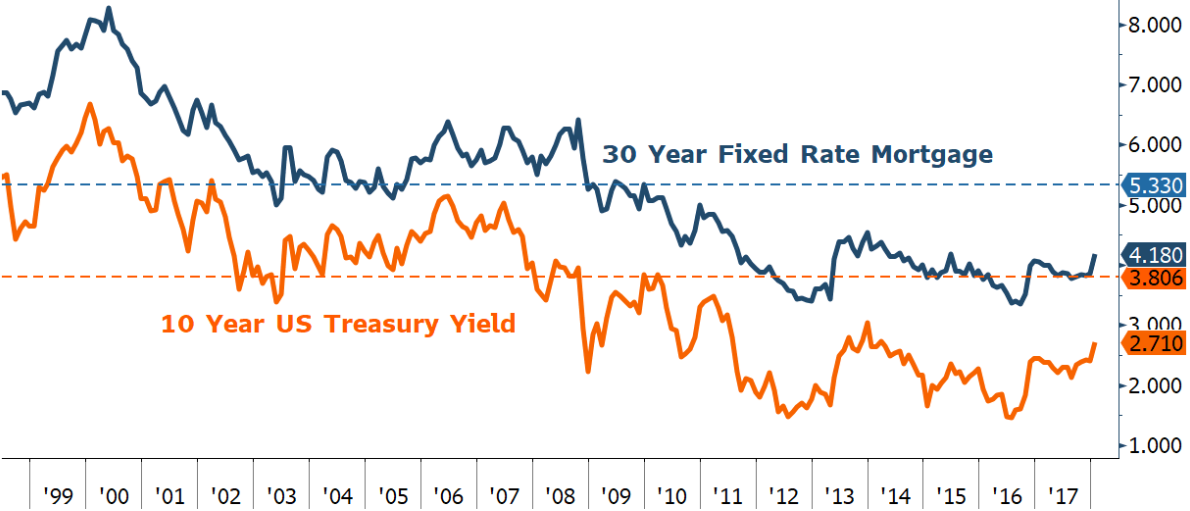

The relationship with US Treasury yields and mortgage rates is shown on the chart above and is fairly obvious to followers of financial markets and investment types. Moreover, the relationship is well-understood by the Fed and one of the primary reasons emergency measures were put in place. The desire was to push down longer-term US Treasury rates as fast as possible. Lowering these rates would quickly translate into lower mortgage rates which would accomplish two things, (1) provide homeowners immediate cash flow relief through refinancing and (2) putting a floor on home prices – perhaps faster than would be the case if the market were to find equilibrium on its own. Again, it’s hard to argue that this didn’t work. Where do home prices go from here though, as the Fed moves to unwind the massive stimulus that it began in 2008?

There is no doubt a relationship exists between home prices and interest rates. As the cost of financing goes up, homebuyers can afford less house. To get an idea of where mortgage rates might be headed, some historical perspective relative to US Treasury yields is helpful, per the chart above. Beginning two years ago and picking up considerable steam lately, the Fed has begun the process of removing monetary stimulus. This “normalization” is resulting in higher short and long-term interest rates.

Over long-time periods, the yield on the 10-year US Treasury has tracked nominal GDP closely. Applying this relationship to today’s average nominal GDP suggests a “normal” yield on the 10-year of around 4.0% to 4.5% today. In addition, 30-year mortgage rates have tended to be priced about 1.50% higher (see median levels in chart above). That means a “normal” mortgage rate today might be closer to 5.5% to 6.0%, again, without Fed intervention. I think it’s fair to say that rates at that level would meaningfully alter the outlook for home price appreciation, and not in a good way.

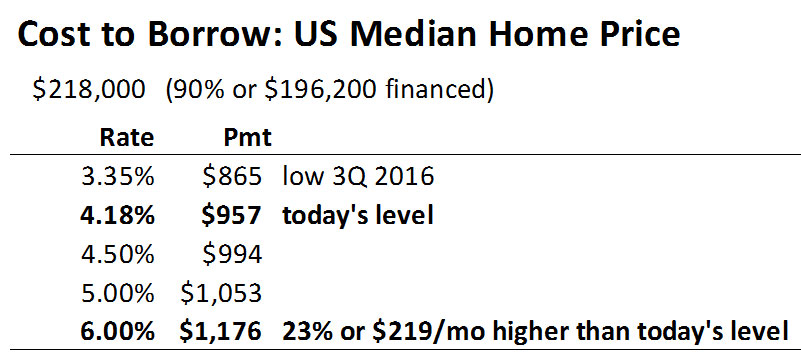

So how much cold water would higher rates throw on hot home prices? The last part of my analysis overlays increasing mortgage rates on today’s median US home price of $218,000. The idea is to see how tough a higher payment would be on a new homebuyer. In this simple analysis, I assumed 90% financing which equals $196,200, financed over a 30-year term.

As you can see, mortgage rates hitting the higher end of the “normal” range (6.0%) would have a negative effect on home affordability with a payment that would increase by $219 per month.

Looking at it another way, what would a monthly payment of $957 (today’s payment on a median priced home) buy if rates go back to 6.0%? The answer is a $178,000 home. So, holding the monthly payment constant means new homebuyers would be able to buy -18% less home.

A faster growing economy producing higher wages solves lots of our country’s problems and could help homebuyers absorb higher financing costs. More likely however, is that we’re near the top in home prices and that the headwinds of higher rates will soon be felt. This isn’t a prediction of impending doom, rather, a call to reduce expectations for gains and prepare for a future that includes rational behavior by homebuyers, investors, and yes, even the Fed.

![]()

Royce Medlin

Chief Investment Officer

CFA, CAIA