Market Commentary

Q4 2019

The new decade has started off with a bang. Rising geopolitical tensions began with the Iranian-backed US embassy attack in Baghdad followed by the retaliatory strike on the mastermind behind it. Market reaction thus far has been muted with stocks barely off their all-time highs. Investor complacency may partly be to blame but an improving outlook is also encouraging. Markets are being supported by massive stimulus on multiple fronts in the form of lower interest rates, liquidity injections and deficit spending, in addition to a more business-friendly regulatory environment, all of which are bullish, at least in the near term.

Last year’s stock gains purely a function of multiple expansion (i.e., investors paying a higher price for the same dollar of earnings). In fact, overall earnings were down last year while the P/E on the S&P 500 expanded from its low one year ago of 14.3x to 21.8x today (a 52% increase!). While further multiple expansion is possible, and even likely in the near term as the Fed pumps and the economy surprises to the upside, stocks are also discounting an earnings resurgence that will need to materialize quickly to hold on to recent gains.

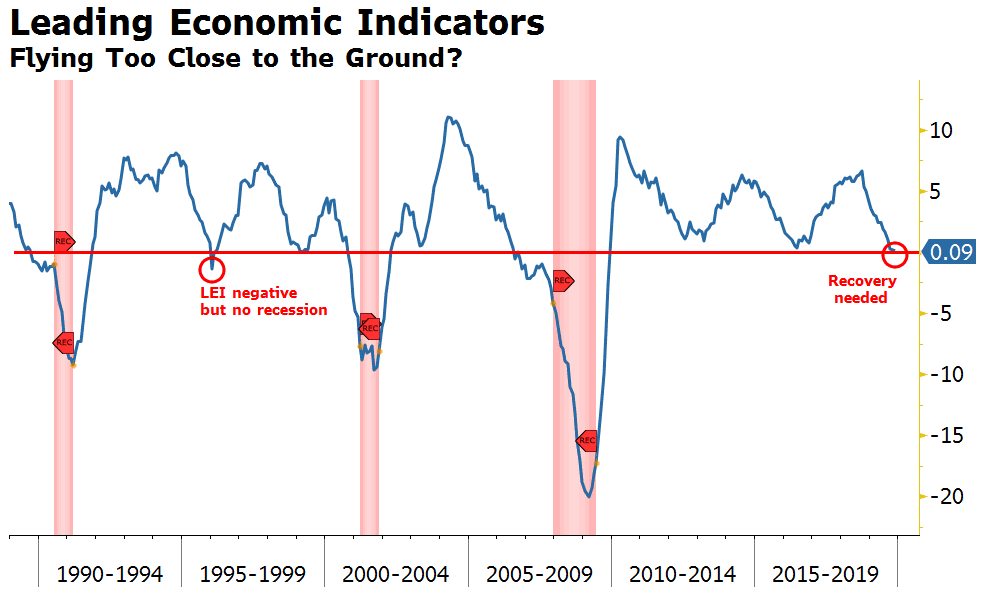

The economy gradually lost steam in 2019 which can be seen in the accompanying chart showing a decline in the composite leading economic indicators (LEI). Knowing economic momentum had shifted downward, the Fed quickly reversed course mid-year in hopes of extending the expansion. As you can see on the chart, deep negative LEI readings have been associated with recessions (red bars). 1995 saw similar LEI declines but recession was averted, in part due to a quick reversal in Fed policy, similar to the rate cuts enacted in 2019.

Recession will likely be avoided in 2020 – Recessions usually begin when the Fed overtightens due to wage pressures or a financial crisis, neither of which are likely in 2020. There is no question the tightening that took place in 2017 and 2018 slowed the economy but those moves were motivated more by normalization – removing emergency stimulus – than from threats of overheating. Lack of inflation in today’s economy and the Fed’s desire to allow price increases beyond the 2% target reduces the likelihood of rate hike in 2020.

We believe global growth will pick up in 2020. Recession prediction models that set off alarms last year have moderated as inverted yield curves (longer maturity bonds yielding less than shorter maturity bonds) have normalized. Manufacturing activity has been weak, impacted by trade and tariff uncertainty. However, that weakness has been more than offset by strong consumer spending. Strength in the household sector is supported by debt service obligations that are the lowest in 40 years. In addition, US labor markets are gaining momentum with unemployment hitting 50-year lows. Encouragingly, the lowest income households are experiencing the highest real wage increases (+4.5%), a reversal of a negative trend that pushed income inequality to new highs just a few years ago. Personal savings rates have also reached new highs as incomes rise, but also as workers nearing retirement recognize the need for more savings in a low yield environment.

Within the S&P 500, the percentage of stocks that outperformed the benchmark for the decade was a mere 32%” – BofA USD in 2020? Growth differentials have tightened, rate differentials tightened – rates.

2020 Potential Upside Surprises:

Trade War Truce – The worst case has already avoided with a Phase 1 deal with China and more punitive tariffs called off. It is likely Trump will back off from trade negotiations, recognizing the damage tariffs have done to US manufacturing and CEO confidence.

Brexit – The UK exit is likely to be resolved without serious economic disruption, despite the rhetoric emanating from negotiators the European Union. Unresolved issues include and trade and market access and customs and immigration.

Election Year Relief Rally – Election years have historically seen markets rise as politicians try not to rock the boat. This year should bring toned down trade war rhetoric, impeachment dismissal in the Senate, and most importantly, a lower likelihood of recession due to easy money.

Earnings Growth Beyond Expectations – Lower interest rates, higher fiscal spending, and no new tariffs, a turn in manufacturing, and easy comparisons should lead to a resurgence in earnings growth.

Global Central Bank Easing – Low inflation continues to give cover to more accommodative monetary policies around the globe. Low rates, looser lending standards, and asset purchases support risk asset prices. Inflation in Emerging Markets is at modern-era lows (around 4%) giving these smaller countries room to ease.

US Dollar Stabilization – An appreciating US Dollar has dented profits over the past two years. Our stronger economy and higher interest rates attracted foreign investment, but those differentials are narrowing. Dollar stability will allow lower valuation stocks outside US to perform better.

Stronger Consumer – Wage gains continue to support consumer confidence and spending. Households have been reluctant to take on new debt but as confidence grows, new household formations will stimulate the housing and consumer durables sectors.

CEO Confidence Rebound – CEO confidence plummeted in 2019 on tariff and recession concerns but is likely to rebound in 2020 supporting higher capital spending and investment which has been lackluster.

Inflation Remains Subdued – Inflation is likely to remain low, allowing the Fed to stay on the rate hiking sidelines, pushing off a recession beyond 2020.

2020 Potential Downside Risks:

Military/Geopolitical Conflict – Recent provocations by Iran and other disruptions in the Middle East have the potential to produce spikes in oil prices that can be disruptive to growth.

Election Year Surprises – Typically, incumbents fare well under a strong economy but the populist groundswell on both the left and right has created more uncertainty. The election of Warren or Sanders would be unfriendly to markets. Potential policy changes include higher personal and corporate income tax rates, a wealth tax, bans on stock buybacks, and enhanced collective bargaining.

US/China Trade Tension – Phase 2 of the trade talks will be much more difficult, addressing technology transfers. China, still ranked as the worst offender of mercantilist policies by the OECD, is likely to draw out negotiations beyond the election in November. Trump may continue to play hardball with tariffs despite the negative impact on our economy and the damage it could do to his reelection.

Inflation Resurgence – Both monetary and fiscal policy are highly pro-inflation, yet inflation targets have not been hit in over a decade. This may be the year reflation in goods and services starts to take hold. Rising costs will ultimately be passed on to consumers.

Budget Deficit Funding – With Japan and China becoming smaller purchasers of newly issued US debt, funding issues are likely to become a problem for the US government. The short-term Repo market is receiving liquidity injections to keep Fed Funds within the targeted rate.

Profitability Challenges – Rising labor, interest, and tariff costs are having a negative impact on earnings. Effective tariffs now average 5%, up from 2% before the Trump trade war (5% is a huge increase but well below the Smoot Hawley levels from the 1930s that peaked at 20%).

Corporate Debt Levels – Expanding debt in the corporate sector is likely to result in downgrades. The proportion of investment grade bonds rated BBB has increased to over 50% as companies take advantage of cheap borrowing rates.

Leveraged Loan Defaults – A flood of capital looking for higher yields has expanded the leverage loan sector but also led to a sharp deterioration in loan covenant protections. This sector primarily serves private mid and small cap companies that face restructuring risks despite low interest rates as debt service burdens have increased.

Asset Valuations – After a sharp increase in valuations last year, stocks now trade at over 90th percentile relative to history. Corporate bonds also trade at historically rich levels with credit spreads near all-time lows. We are at or near a tipping point where low rates no longer drive higher equity valuations. Forward returns from these high levels have been low historically.

Portfolio Positioning

Fixed Income

Low yields on high quality bonds have pushed investors into riskier debt. The yield on the US Aggregate bond index stands at 2.30% which is the base rate of cash return that can be expected by owning bonds. The abnormally high total return on the index last year of +8.72% was mostly due to price appreciation as interest rates plummeted. On an inflation-adjusted basis bond returns look even more paltry. Investors are still stretching for yield but have become more discerning, avoiding the lowest quality credits in the B- to CCC sector. With a near term pick up in economic activity, we believe the 10-year Treasury yield will continue to rise, perhaps as high as 2.50% as supply and demand drive yields higher and Japan and China gradually retreat from Treasury auctions. Typically, economic fundamentals and inflation are the primary drivers of higher rates but 2020 may be the year deficit spending and massive new issuance push rates higher despite tepid growth. Until we see more attractive yields, we will continue to avoid the highest risk portion of the corporate debt market. Given strong consumer balance sheets and higher wage growth, we prefer to earn higher yields in the mortgage-backed security market.

Equities

US vs International

We continue to overweight US equities relative to international. Outside the US, we prefer Emerging Markets to Europe and Japan where we are most underweight. The US continues to outperform as market gains in a low-growth world tend to come from growth sectors like Technology where the US leads rather than sectors with lower and more volatile earnings growth like Basic Materials, Energy, and Industrials which are sectors that are over represented relative to the US in Europe and Japan . US companies generate significantly higher ROEs on average and maintain a much healthier banking sector than foreign markets. Negative interest rates in Europe and Japan are designed to stimulate the economy but there is some evidence they are slowly bankrupting the financial sector there. Given the structural advantages of US industries and higher corporate returns and profitability, it is unlikely the US would underperform on a sustained basis, even with a valuation headwind.

Emerging Markets

China continues to be the swing factor in emerging market returns, however, the rumors of their death is greatly exaggerated. Chinese stimulus is coming many forms and economic growth, which has been managed lower, may have bottomed at 6% with the potential for stronger growth in 2020. Chinese corporate bond defaults have been worrisome but are focused only in sectors with overcapacity targeted by the government. Chinese manufacturing orders have bottomed as exports contracted due to higher US tariffs but are now rising again. Shockingly, only 3% of Chinese corporate revenues are sourced from the US making the slowdown in exports less threatening to the overall economy that most investors understand. Chinese stocks trade at a significant discount to the rest of the world and earnings are rebounding, making them a compelling opportunity.

Beyond China, markets like India and Brazil look compelling after struggling with political and market reforms that should yield good returns. While Europe and Japan would benefit from a trade war détente, emerging markets would benefit more. In addition to trade slowdown fears, Emerging Markets equities have also lagged due to US Dollar strength during the 2018-2019 time period. With the reversal by the Fed to lower interest rates, the Dollar is expected to stabilize. Emerging Markets currencies look undervalued given low inflation, new stimulus which should boost growth, strong balance of payments fundamentals, low debt levels and balanced budgets. Many of these countries have significant room for further rate cuts in 2020.

Alternatives

2019 was a bumper year for traditional asset classes leaving uncorrelated alternative strategies behind. However, bouts of high volatility and low expected returns on fixed income investments support our continued allocation to more stable alternative investments. Our focus within the alternatives portfolio is on stability and income generation. Market neutral strategies that sail through periods when markets fall, long term private real estate investments that consistently generate cash return without being whipsawed by retail flows, and managed futures strategies that have the opportunity to generate positive returns in a bear market continue to be key components of our alternatives strategy. We expect this portion of the portfolio to generate attractive rates of return above those available in the bond market but with similar low risk.

Conclusion

Since the market peak in 2007, the stock market has returned 189% or 8.9% annualized. While those returns look normal, much of the return has been a function of higher valuations. In fact, the stock market’s growth rate is roughly 3x the growth in corporate sales and 5x more than GDP. Despite the likelihood that the economy grows in 2020, high valuations may put a damper on stock and bond returns.

We continue to believe portfolios should be positioned to protect capital but despite our cautious outlook, we are still finding attractive areas to invest. Within our stock portfolios, defensive energy infrastructure stocks and emerging markets equities look undervalued. Our bond portfolios are tilted toward high quality and we’ve removed the riskiest corporate credit where yields are too low relative to downside. Within alternatives, we are emphasizing high quality cash return-oriented investments and further removing investments with high correlations to stocks.

4Q 2019 Performance

Stocks

- Stocks globally were up big for the quarter (↑8.74%) with strong gains in US Large Cap stocks (↑8.96%), US Mid Cap (↑6.90%), International Developed (↑7.80%), US Small Cap (↑9.02%), and Emerging Markets (↑12.11%). US Dollar strength, particularly versus emerging markets currencies, hurt non-US returns.

Bonds

- Total return for Taxable bonds were flat after a torrid first 9 months of the year (↑0.12%) as interest rates increased from September lows. The yield on the US Aggregate Bond Index is down to 2.30% after peaking at 3.66% one year ago. Municipal bonds (↑0.69%), Securitized Credit (high quality mortgages and asset-backed securities) (↑0.23%), and High Yield Corporates (junk bonds) (↑2.54%).

Alternatives

- The Alternatives portfolio was up (↑0.73%) for the quarter. Category performance was led by Real Assets (↑2.53%), Multi Strategy (↑1.90%), Market Neutral (↑1.36%) and hurt by Managed Futures (↓3.46%).

As always, contact us if would like to discuss these topics further.

Respectfully,

![]()

Royce W. Medlin, CFA, CAIA

Chief Investment Officer